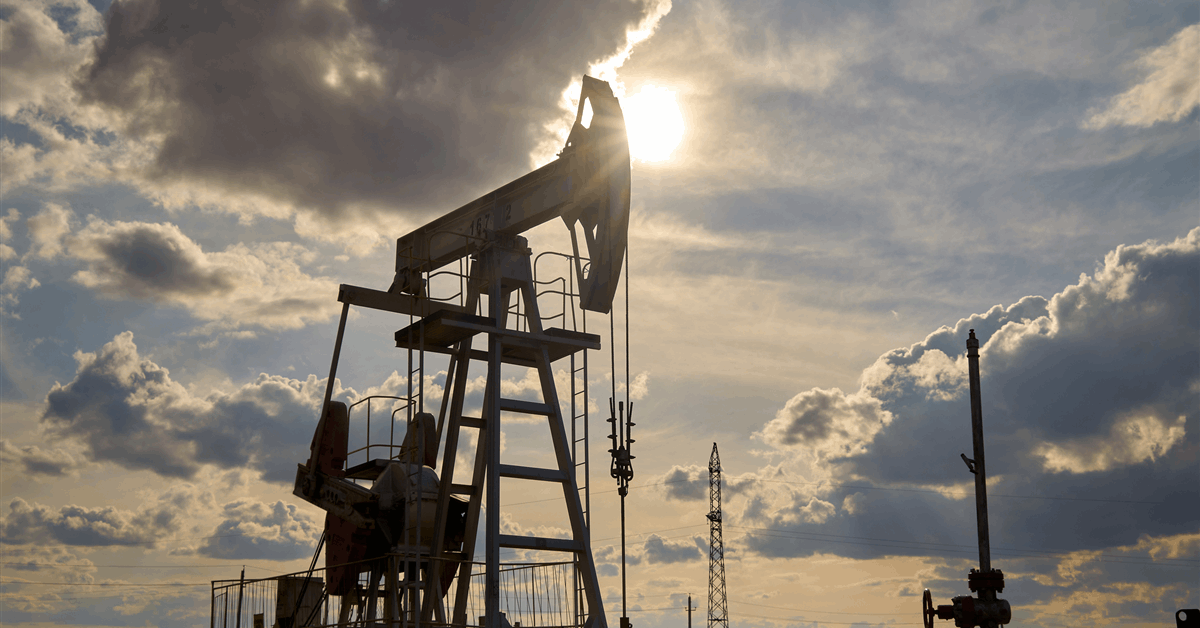

Oil rose as a key pipeline linking Kazakh fields to Russia’s Black Sea coast halted loading after one of its three moorings was damaged amid Ukrainian attacks in the region over the weekend, while traders assessed potential US military operations in Venezuela alongside expectations for oversupply.

West Texas Intermediate rose 1.3% to settle above $59 on Monday. The Caspian Pipeline Consortium carries most of Kazakhstan’s crude exports, which have averaged 1.6 million barrels a day so far this year. The mooring was severely damaged after the explosion, a person with knowledge of the matter said.

CPC said “any further operations are impossible” at the mooring, in response to questions about the damage. Ukraine hasn’t commented on the incident, although it confirmed separate attacks on an oil refinery and tankers over the weekend as it ramps up strikes on Russian oil targets amid the nearly four-year old war.

The infrastructure attacks come at a time when the global oil market is moving into what is expected to be a period of significant oversupply. Trend-following commodity trading advisers were 90% short on Monday, according to data from Bridgeton Research Group. Some shorter-term focused advisers bought on Monday as prices rose.

The extremely bearish lean from algorithmic traders leaves the market prone to bigger spikes on bullish developments as most of these traders are trend-following in nature and amplify price moves.

Oil prices are coming off a monthly drop, with futures under pressure from the prospect of a glut next year. Still, geopolitical tensions from Russia to Venezuela — where President Trump warned airspace should be considered closed over the weekend — are adding to the bullish risks for prices. The White House will hold a meeting about next steps on Venezuela on Monday evening, CNN reported.

“While the outlook for the market is bearish with expectations of a large surplus, lingering supply risks mean that it is taking longer for these bearish fundamentals to be fully reflected in prices,” said Warren Patterson, Singapore-based head of commodities strategy at ING Groep NV.

Meantime, the OPEC+ producer-group led by Saudi Arabia reiterated a three-month plan to halt output hikes in the first quarter of next year. OPEC+ again said the move reflected weaker seasonal market conditions.

Oil Prices

- WTI for January delivery gained 1.32% to settle at $59.32 in New York.

- Brent for February settlement advanced 1.27% to settle at $63.17 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.