Blockchain Technology: The Backbone Behind Bitcoin

Dec 15, 2023

In the digital age, where data is the new gold and privacy a sought-after luxury, a technology emerges from the shadows, promising a future where transparency, security, and decentralization reign supreme. This technology, known as blockchain, is the unsung hero behind Bitcoin, the digital currency that has taken the world by storm.

At its core, blockchain is a decentralized and immutable ledger that records transactions across multiple computers, creating an incorruptible chain of information. Unlike traditional centralized systems, where a single authority controls the flow of data, blockchain enables a peer-to-peer network to validate and verify transactions, ensuring transparency and eliminating the need for intermediaries.

The inception of Bitcoin in 2009 marked the debut of blockchain technology, where it served as the foundational technology for this pioneering cryptocurrency. As Bitcoin gained traction, the true potential of blockchain began to unfold, captivating the imaginations of technologists, entrepreneurs, and industries worldwide.

This article explores the profound impact of blockchain technology as the backbone behind Bitcoin. By understanding the fundamental principles and mechanics of blockchain, we can delve into its various applications, challenges, and the potential it holds.

A Brief Timeline: The Evolution of Bitcoin Blockchain

Blockchain technology was first introduced in 1991 by Stuart Haber and W. Scott Stornetta. However, it wasn't until 2008 that the technology found its first practical application with the advent of Bitcoin. A person or group known as Satoshi Nakamoto created Bitcoin to decentralize control of money, a concept that was gaining traction as centralized entities had failed the world. The Bitcoin white paper, a seminal publication, introduced a unique set of computational guidelines that defined a novel kind of distributed database known as the blockchain. This groundbreaking network was officially launched in January 2009.

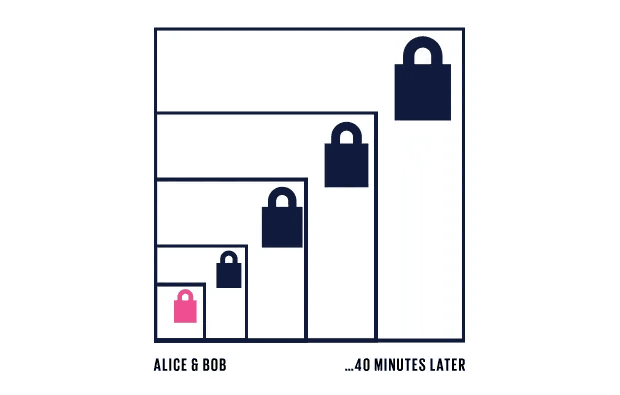

Figure 1: Bitcoin Blockchain security

The Mechanics of Blockchain

The blockchain is a digital ledger of duplicated transactions distributed across a network of computer systems. Each block in the chain contains several transactions, and whenever a new transaction occurs, a record of that transaction is added to every participant's ledger. This distributed database is managed by multiple participants using a technology called distributed ledger technology (DLT), which employs multiple cryptographic principles to secure the network. These cryptographic principles ensure the integrity and security of the Bitcoin network, making it nearly impossible to cheat the system or forge transactions.

In the context of Bitcoin, two primary cryptographic concepts are used:

Hash Functions:

Bitcoin uses the SHA-256 (Secure Hash Algorithm 2 with a 256-bit output) hash function. A hash function takes an input and returns a fixed-size string of bytes, typically a digest that is unique to each unique input. In Bitcoin, hash functions are part of the block hashing algorithm used to write new transactions into the blockchain through the mining process.

Digital Signatures:

Bitcoin uses the Elliptic Curve Digital Signature Algorithm (ECDSA) to ensure that funds can only be spent by their rightful owners. When a user wants to send bitcoins to someone else, they sign the transaction with their private key, which proves that they are the owner of the bitcoins being transferred. The network verifies the signature using the sender's public key.

Example:

When John wants to send money to Mo using Bitcoin, he uses a cryptographic key to digitally sign the transaction, proving that he owns the coins. Miners or block signers, who are part of the Bitcoin network, collect many transactions to check. They verify the digital signatures and make sure there are enough coins for each transaction. Afterward, they combine all the new transactions into a new block of data, which is added to the blockchain.

In summary, John digitally signs the transaction, miners validate and confirm it, and the transaction is added to the blockchain.

Figure 2: Bitcoin Blockchain Cryptography

The Role of Blockchain in Bitcoin

Blockchain technology plays a vital role in the functioning of Bitcoin beyond simple monetary transfers. It serves as a secure and decentralized means of storing any type of data input. By implementing a blockchain in a decentralized system, each block becomes an unchangeable part of a timeline, creating an irreversible chainline of data. Additionally, every block added to the chain is assigned an exact timestamp, ensuring an accurate record of events. The primary goal of blockchain is to enable the recording and distribution of digital information while preventing any unauthorized editing or tampering.

1. Recording and Securing Actions

In the blockchain, every action is recorded and nothing is left out by Bitcoin miners. Once an action is recorded and stored in an information block, it is time-stamped and secured. The entire record of transactions and events is available to anyone within the blockchain network. This transparency and immutability make the blockchain a reliable source of information and provide trust among network participants.

2. Bitcoin Miners and Block Signers

Bitcoin miners, also known as block signers, play a crucial role in the validation and security of the blockchain. They generate a hash, or a unique identifier, from a specific dataset. To ensure the integrity of the blockchain, the hash must start with a certain number of zeros. If it doesn't meet the criteria, the hash function is executed again with a new random number, called a nonce. This process, combined with incorporating previous blocks into each new hash, significantly increases the complexity of altering older transactions.

3. Verification and Block Rewards

High-powered computers solve complex mathematical problems to verify all transactions within the blockchain network. This verification process ensures the legitimacy of each transaction and prevents malicious actors from manipulating the system. Bitcoin miners, or block signers, dedicate their computing power to this process. As a reward for their contribution to the network's security and maintenance, miners receive newly minted Bitcoin.

Figure 3: Bitcoin miners or block signers computing and hashing to secure the Bitcoin Network.

Blockchain (Bitcoin) vs. Traditional Databases (Traditional Banking)

A blockchain is a type of database that groups data into blocks and forms a chain. It creates an unalterable sequence of data in a decentralized system. Each block is time-stamped and once added to the chain, it can't be changed. Therefore, a blockchain allows digital information to be recorded and distributed, but not edited, making it perfect for the financial sector and distinct from a typical database.

Data Structure:

Blockchain (Bitcoin) employs a chain of blocks, where each block contains a set of transactions that are linked together in an unalterable chain. Traditional databases in traditional banking use structured data stored in tables, allowing for more flexibility in editing and organizing data.

Data Editing:

Once data is added to the blockchain, it becomes immutable and cannot be altered. This feature ensures the integrity and security of the recorded transactions. In contrast, traditional databases in traditional banking allow authorized entities to edit and modify data when necessary.

Transparency:

Blockchain (Bitcoin) operates as a public ledger, making it transparent to all participants in the network. Every transaction can be accessed and verified by anyone. Traditional databases in traditional banking provide limited transparency as access to information is controlled by centralized entities.

Security:

Blockchain (Bitcoin) achieves data security through cryptographic techniques and decentralization. Transactions are cryptographically secured, making it nearly impossible to alter or forge them. Traditional databases in traditional banking rely on centralized security measures, such as firewalls and access controls, to protect data.

Transaction Speed:

The speed of transactions on the blockchain varies based on network congestion. During high activity periods, transaction processing times may increase. Traditional databases in traditional banking generally offer faster transaction speeds due to centralized processing systems and dedicated infrastructure.

Transaction Fees:

In blockchain (Bitcoin), transaction fees vary based on network conditions and data size. Users have some control over the fees they are willing to pay for faster processing. Traditional banking often applies fixed fees or service charges for various types of transactions.

Availability:

Blockchain (Bitcoin) operates 24/7, every day of the year, without dependence on specific operating hours. Traditional banking has specific operating hours, and there may be downtime for maintenance or system upgrades, limiting access during those times.

Monetary Supply Control:

Blockchain (Bitcoin) has a fixed supply of 21 million coins, making it deflationary. The monetary supply is controlled by the underlying protocol and cannot be influenced by central banks or economic policies. In traditional banking, the monetary supply is controlled by central banks, allowing for adjustments to address economic conditions.

User Empowerment:

Blockchain (Bitcoin) gives users ownership and control over their funds and data. Users hold private keys to access their accounts and authorize transactions. Traditional banking relies on centralized institutions for financial operations, reducing direct user empowerment.

Application Scope:

Blockchain technology, beyond financial transactions, offers various use cases such as supply chain management, healthcare, and voting systems. Traditional databases in traditional banking primarily focus on banking and financial operations, with limited application beyond those areas.

Future Potential:

Blockchain (Bitcoin) continues to evolve with ongoing developments for scalability, security enhancements, and innovation. This includes solutions like the Lightning Network for feeless off-chain transactions and proposals like Segregated Witness (SegWit) and Taproot to improve privacy and transaction efficiency. Traditional databases in traditional banking undergo incremental updates and modernization efforts based on industry trends.

Limitations of Bitcoin and Blockchain

Despite the numerous advantages of blockchain technology, it is important to acknowledge its limitations. One limitation is that the blockchain can experience slowdowns when there is a high volume of users on the network. This is due to the consensus method used in blockchain, which requires agreement among participants before transactions can be added to the chain. Scaling the blockchain to accommodate a growing user base can also be challenging.

Immutability and Wallet Maintenance Challenges

Immutability, a key feature of blockchain, can be a double-edged sword. While it ensures the integrity and security of transactions, it can also pose challenges for users. Maintaining hardware wallets, which store the private keys needed to access and manage cryptocurrencies, may be seen as cumbersome by some. Additionally, there have been instances where users have lost access to their wallets, resulting in the permanent loss of their digital assets.

Volatility and Perception Challenges

The historical volatility of cryptocurrencies, including Bitcoin, and their false association with cybercrime can deter individuals from fully embracing the technology. Price fluctuations and market instability can create uncertainty for users and investors. Overcoming the perception that cryptocurrencies are primarily used for illicit activities is an ongoing challenge for the industry.

The Future of Bitcoin and Blockchain

Many applications have already been built on top of the Bitcoin blockchain, leveraging its unmatched security. These applications range from decentralized finance (DeFi) platforms to tokenization of real-world assets. Such advancements demonstrate the potential of blockchain technology beyond its initial use case of cryptocurrencies. Ongoing developments and upgrades in the blockchain space continue to expand the possibilities for its application in various industries, paving the way for a future where blockchain technology plays a vital role in reshaping digital transactions and beyond.

1. Lightning Network: Feeless Off-Chain Transactions

The Lightning Network is a solution that enables feeless off-chain transactions on the Bitcoin network. It allows users to conduct transactions without relying solely on the blockchain, improving scalability and reducing transaction fees. However, concerns exist regarding the security of off-chain transactions as the Lightning Network grows in popularity.

2. Segregated Witness (SegWit): Enhanced Scalability and Efficiency

Segregated Witness (SegWit) is a development that addresses scalability and malleability issues in the Bitcoin blockchain. By separating transaction signatures, SegWit increases transaction speed and efficiency. It optimizes block space utilization and opens the door for future upgrades and improvements.

3. Taproot: Privacy, Simpler Smart Contracts, and Efficiency

Taproot is a proposed soft fork upgrade for the Bitcoin blockchain. It aims to enhance privacy, enable simpler smart contracts, and improve scalability and transaction efficiency. Taproot utilizes Schnorr signatures, a more efficient signature scheme, to optimize block space and improve the functionality of Bitcoin's scripting capabilities.

Blockchain Technology & Bitcoin: Bottom Line

In conclusion, blockchain technology, as the backbone behind Bitcoin, has revolutionized the financial world. Its transparency, security, and decentralization have paved the way for various applications beyond cryptocurrencies. While acknowledging its limitations, ongoing developments and upgrades show promise for addressing scalability, privacy, and efficiency concerns. As we continue to explore the potential of blockchain, it has the potential to redefine the future of digital transactions and revolutionize various industries.

FAQ About Blockchain Technology

What is blockchain technology

Blockchain technology is a secure and transparent digital ledger system that records data and tracks transactions across distributed networks. It stores data in blocks, which are connected using cryptographic principles and each block holds a timestamp and a link to the previous block. The blockchain technology provides immutability, decentralization, privacy, security and transparency.

How does blockchain technology work

Blockchain technology works by creating a distributed network of computers that run algorithms to validate transactions. Every block in the chain stores information, such as transaction time-stamps and data about the sender and receiver. The blocks are linked together into chains, forming an immutable ledger where every transaction is stored securely in chronological order, enabling users to access accurate information while keeping it secure from tampering.

What is blockchain technology in simple terms

Blockchain technology is a digital ledger system that securely records data and tracks transactions across multiple distributed networks. It uses cryptographic principles to link each block, which stores timestamps and data about sender and receiver, enabling users to access accurate information while keeping it secure from tampering.

When was blockchain technology invented

The idea of a secured chain of blocks was first created in 1991 by Stuart Haber and W Scott Stornetta. Hal Finney improved upon this in 2004 creating Reusable Proof Of Work(RPoW). In 2008 Satosi Nakamoto conceptualized the theory of distributed blockchains with his creation of Bitcoin.

Distributed ledger technology vs blockchain

Distributed ledger technology (DLT) is a broader term for digitally storing and managing data across distributed networks while blockchain refers specifically to decentralized, immutable ledgers secured through cryptography that can be used as an application platform. Blockchain provides increased security and trust compared to other DLTs.

Uses of blockchain Technology

It can be used for many applications such as banking, finance, supply chain management and more. Its decentralized nature makes it an attractive solution for businesses all over the world.

Benefits of blockchain technology

The biggest benefit of blockchain technology is its ability to provide secure and immutable data storage, allowing for accurate tracking of transactions that can be accessed by all involved parties. Additionally, its decentralized nature makes it attractive to businesses as it eliminates the need for a centralized authority and increases trust between all stakeholders.