Oil eased after a three-session advance as traders assessed fresh US stockpile data and a Federal Reserve interest-rate cut.

West Texas Intermediate fell 0.7% to settle above $64 a barrel after the Federal Reserve lowered its benchmark interest rate by a quarter percentage point and penciled in two more reductions this year. Although lower rates typically boost energy demand, investors focused on policymakers’ warnings of mounting labor market weakness.

Traders had also mostly priced in a 25 basis-point cut ahead of the decision, leading some to unwind hedges against a bigger-than-expected reduction. The dollar strengthened, making commodities priced in the currency less attractive.

“There is a somewhat counterintuitive reaction to the Fed’s cut, but the dovish pivot cements their shift to protect the labor side of their mandate,” said Frank Monkam, head of macro trading at Buffalo Bayou Commodities. The shift suggests “an admission that growth risks to the economy are becoming more apparent and concerning.”

The Fed move compounded an earlier slide as traders discounted the most recent US stockpile data, which showed crude inventories fell 9.29 million barrels amid a sizable increase in exports. However, the adjustment factor ballooned and distillate inventories rose to the highest since January, adding a bearish tilt to the report.

“Traders like to see domestic demand pulling the inventories,” as opposed to exports, said Dennis Kissler, senior vice president for trading at BOK Financial Securities.

The distillate buildup also stunted a rally following Ukraine’s attack on the Saratov refinery in its latest strike on Russian energy facilities — which have helped cut the OPEC+ member’s production to its lowest post-pandemic level, according to Goldman Sachs Group Inc.

Still, the strikes haven’t been enough to push oil out of the $5 band it has been in for most of the past month-and-a-half, buffeted between geopolitical tensions and bearish fundamentals. The accelerated return of OPEC+ supply has boosted predictions of a looming glut later in the year, while growth-sapping tariffs imposed by US President Donald Trump threaten to destabilize the US economy.

Brent’s second-month implied volatility was subdued after it fell to the lowest in more than three weeks on Monday, as outright prices remain firmly stuck within the narrow range seen since early August.

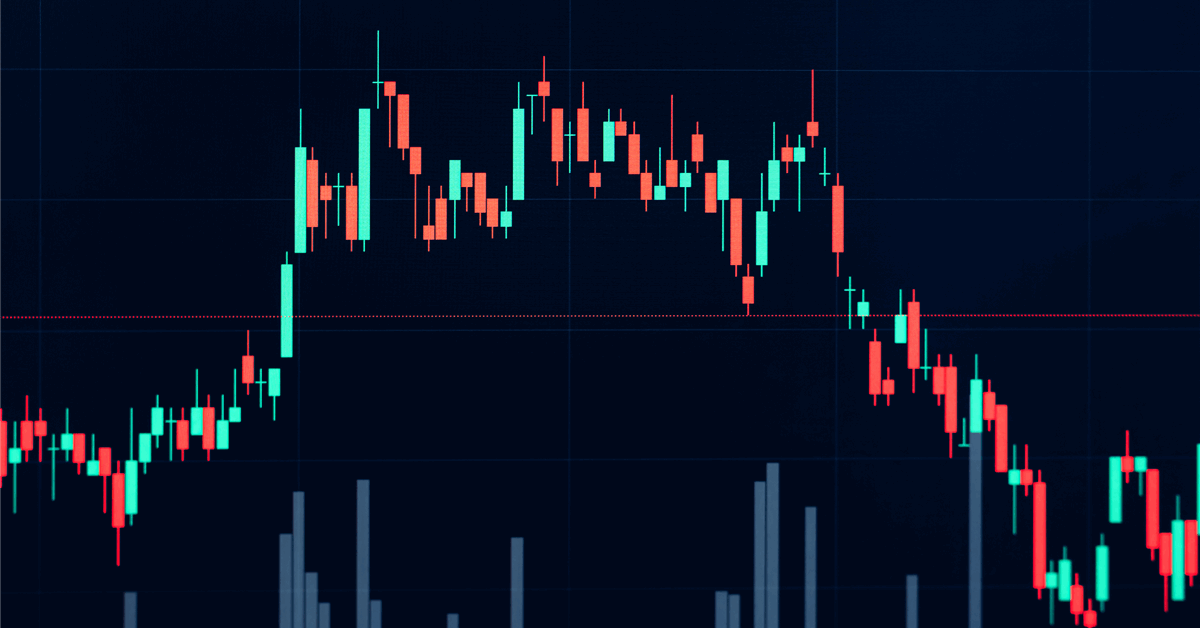

Oil Prices

- WTI for October delivery slipped 0.7% to settle at $64.05 a barrel in New York.

- Brent for November settlement shed 0.8% to $67.95 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.