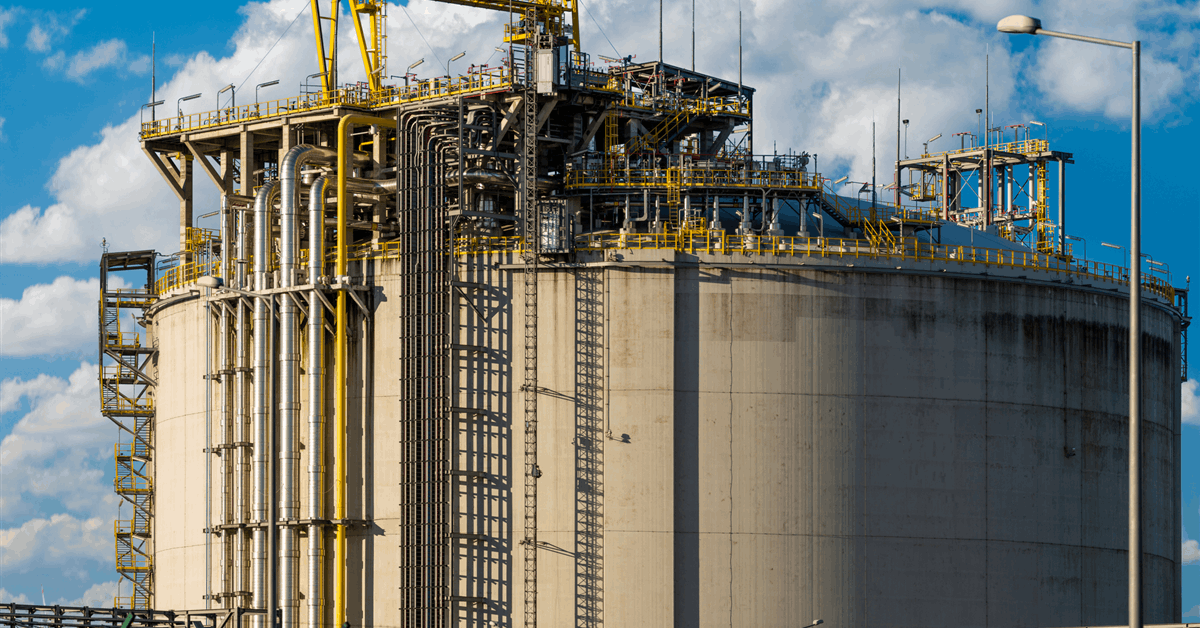

XCF Global Inc said it had completed the initial site work for its second sustainable aviation fuel (SAF) production facility, which will rise adjacent to the one it had put onstream in Storey County, Nevada, early this year.

New Rise Reno 2’s 10-acre parcel has been graded and access roads have been built, according to Houston, Texas-based XCF.

“Engineering, design and project planning are underway, positioning construction to begin in 2026”, it said in a press release.

“Located adjacent to the existing New Rise Reno facility in Nevada, the new site will benefit from integration with common facilities such as gas, water, rail and personnel offices as well as existing pre-treatment, hydrogen production and broader logistics infrastructure – reducing capital costs, lowering execution risk and accelerating time to production.

“Since inception, approximately $350 million has been invested in XCF’s flagship New Rise Reno facility. New Rise Reno 2 represents the next phase of this growth strategy, with an expected $300 million investment enabling XCF to double SAF production capacity to ~80 million gallons annually”.

XCF expects New Rise Reno 2 to start production 2028, along with two other SAF projects in the United States. All three have a planned nameplate capacity of 40 million gallons a year.

New Rise Reno began production in the first quarter. It has a nameplate capacity of 38 million gallons a year, according to XCF.

“The facility is designed and configured to produce 3,000 barrels per day of synthetic blending component for blending to make sustainable aviation fuel. All fuel is made from renewable triglyceride feedstocks (corn oil, soybean oil or other qualifying oils) that meet the Federal Renewable Fuels Standard”, according to the project website.

XCF chief executive Chris Cooper said, “This expansion exemplifies how XCF grows: intentionally, efficiently and with a platform built to meet surging global demand”.

XCF noted, “Federal targets call for three billion gallons of SAF per year by 2030 and 35 billion gallons to satisfy 100 percent of domestic demand by 2050; however, current U.S. production remains below one percent of jet fuel demand”.

“Airlines will be required to blend two percent SAF in 2025, increasing to six percent by 2030 and 20 percent by 2035, ultimately rising to 70 percent by 2050. With regional supply unable to meet these mandated volumes, Europe is expected to face structural shortages and persistently elevated SAF pricing”, it said.

“Together, the U.S. and Europe represent one of the largest and fastest-growing opportunities in the clean-energy transition, with the U.S. SAF market projected to reach nearly $7 billion by 2030 and global demand exceeding $25 billion. XCF’s scalable, modular SAF platform is built to scale directly into this opportunity”.

XCF announced July 10 an investment plan of nearly $1 billion over the next three years to build SAF production facilities, with most of its in-the-pipeline projects located in the U.S. The budget includes New Rise Reno and New Rise Reno 2.

The announcement follows the completion of the merger between XCF Global Capital Inc and Focus Impact BH3 Acquisition Co, creating what they said is the first publicly traded pureplay SAF producer in the U.S.

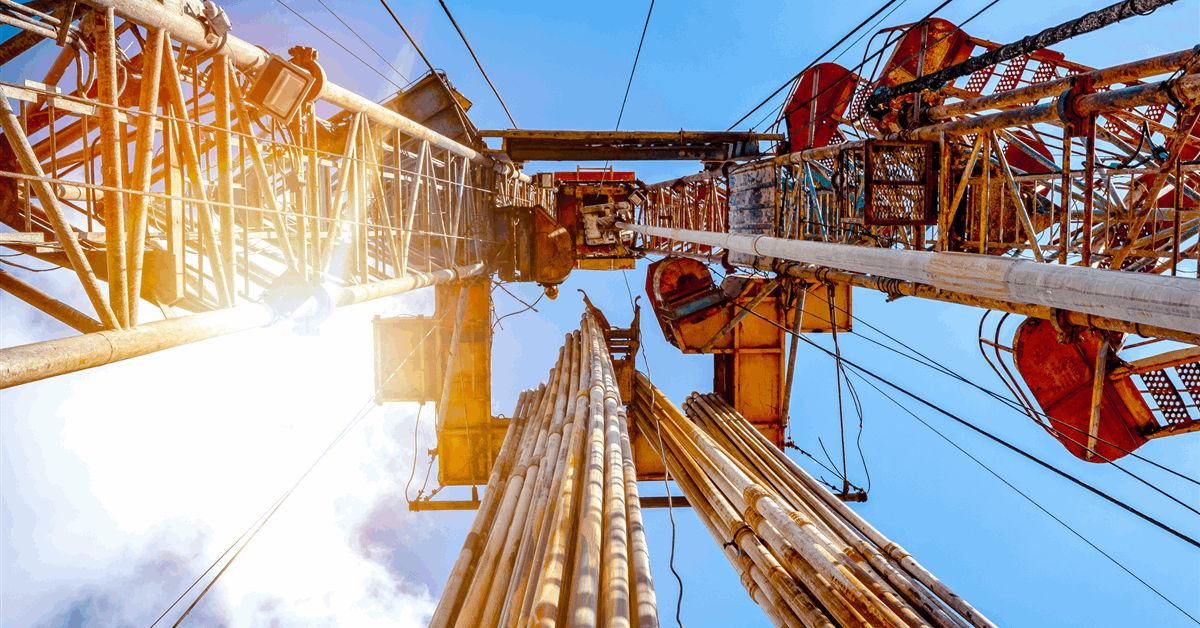

Under its U.S. expansion plan, XCF has acquired three sites “ready for development”, it said in an online statement July 10. The projects are planned to each have a nameplate capacity of 40 million gallons per annum. XCF expects to put them into operation by 2028.

Besides New Rise Reno 2, another project in Ft Myers, Florida, will be built on a site with access to port infrastructure.

The third will rise in Wilson, North Carolina, eyeing East Coast markets.

“These new sites are expected to replicate New Rise Reno’s modular, patent-pending site design and bundled technology stack, allowing for rapid deployment, flexible production and capital-efficient scaling”, XCF said.

“Each facility is expected to have the ability to produce multiple renewable fuel products, including SAF and renewable diesel, supporting a multi-product revenue strategy that maximizes plant utilization and financial performance”.

XCF is also pursuing other “high-potential” markets, according to the July statement.

On October 23 it said it had signed an initial deal with New Rise Australia Pty Ltd, its joint venture with Perth-based Continual Renewable Ventures Pty Ltd, “to accelerate the development of renewable fuel production facilities across Australia”.

“The binding term sheet grants New Rise AU an exclusive 15-year license to use the design, layout and configuration of XCF’s New Rise Reno facility to build and operate at least three SAF facilities across Australia”, XCF said.

“XCF will receive a 12.5 percent equity stake, licensing fees and one board seat in New Rise AU”.

“Building on today’s milestone, the parties intend to execute a definitive licensing agreement within 60 days, following customary diligence and regulatory review”, XCF said. “The definitive agreement will include detailed provisions for intellectual property, branding, governance, performance milestones and long-term operational coordination”.

To contact the author, email [email protected]