The renewables industry begins 2025 with the Inflation Reduction Act continuing to spur record investment, and spiking load growth providing new opportunities for deployment. At the same time, interconnection queues across the country remain clogged, siting, permitting, financial and other challenges continue, and industry critic Donald Trump just began his second term as president.

“It’s an interesting moment, because there is this really rapid change, and yet we’re stuck in some really key ways,” said Heather O’Neill, president and CEO of Advanced Energy United. “The interconnection queue is one really clear example where, yes, there’s some progress — FERC’s putting out reform measures — and yet we’re not unleashing the full promise and the economic opportunity and activity that we could.”

After decades of flat load growth, U.S. electricity demand could rise 128 GW over the next five years, according to a report last month from Grid Strategies. At the same time, the number of new transmission interconnection requests has risen by 300% to 500% over the last decade, with 2.5 TW of clean energy and storage capacity currently waiting to connect to the grid, said an October report from the Department of Energy.

However, O’Neill said, the “the macro trends are incredibly positive … We are in the middle of an energy transformation.” She attributed some of her optimism to the scale of investment and growth that the industry has been seeing.

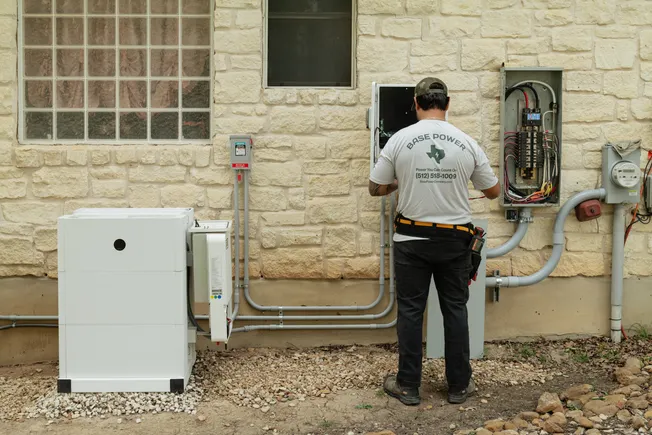

The energy storage sector is especially dynamic right now, O’Neill said: “A few years ago, [there was] very little in the way of storage capacity showing up, but with so much innovation in the technology, the cost curves are coming down. When we think about how to manage load, storage plays a key role in that.”

Global energy storage installations boomed 76% in 2024 and are projected to continue that streak in 2025, according to a November report from BloombergNEF, but BNEF noted that growth may be impacted by “uncertainties stemming from the new Trump administration.”

Trump has spoken out against electric vehicles and said he will “rescind all unspent funds under the misnamed Inflation Reduction Act.” Congress is expected to try to claw back EV tax credits from the IRA, which could impact the battery industry. Trump has also said he would end offshore wind “on day one” and embraced oil and gas generation, but vowed last month to expedite federal permits and environmental reviews for construction projects that represent an investment of $1 billion or more — a move that could benefit clean energy.

Felisa Sanchez, a partner with law firm K&L Gates’ maritime and finance practice groups, said that Trump’s goal to end offshore wind may come into conflict with his goal of boosting the U.S. economy and its domestic manufacturing.

“It’s hard to say ‘we’re going to end offshore wind’ when you’re also impacting a vast supply chain that has already been going for the last few years that has been implemented — when ports have been developed, and vessels have started to either be under construction or have come out of the yard ready to work in offshore wind,” she said.

The need to meet load growth on the electric side is not going away. And any administration – Republican, independent, Democratic – foremost in their mind is going to be a strong resilient economy. That’s going to be dependent upon a best-in-class electric distribution grid.

Paul DeCotis

Senior partner and head of East Coast energy and utilities at West Monroe

John Northington, a government affairs advisor and a member of K&L Gates’ public policy and law practice group, said he anticipates that the offshore wind industry may adapt to the new administration by shifting away from “‘steel in water is good for the environment’ as the main message.”

“Maybe for the next four years, it’s that steel in water is good for jobs, it’s money, it’s good for America,” he said. “Talking about the business benefits, rather than environmental benefits, could be a change in trend for some of these companies.”

When speaking to Utility Dive in December, Northington said he was also hopeful about the bipartisan Energy Permitting Reform Act of 2024, sponsored by Sen. Joe Manchin, I-W.Va., and Sen. John Barrasso, R-Wyo. — but the bill was not included in the continuing resolution passed later that month, “taking permitting off the table for this Congress,” said Manchin, who retired in early January.

New demands on the grid

Regardless of how Trump’s second term shapes the U.S. generation mix, his administration will be dealing with an anticipated 3% annual average load growth over the next five years — a level which hasn’t been seen since the 1980s, according to a December report from Grid Strategies.

“The need to meet load growth on the electric side is not going away. And any administration — Republican, independent, Democratic — foremost in their mind is going to be a strong resilient economy,” said Paul DeCotis, a senior partner and head of East Coast energy and utilities at West Monroe. “That’s going to be dependent upon a best-in-class electric distribution grid.”

Surging load growth is driven largely by data center demand, which a December report from Lawrence Berkeley National Laboratory found has tripled over the past decade and is projected to double or triple again by 2028. The increase in demand is also the result of industry electrification and growth in domestic manufacturing.

That growth “means continued capital investment in the [energy] industry, regardless of the administration,” DeCotis said. “I don’t think any administration is going to want to come in and all of a sudden see brownouts and blackouts and not enough capacity to meet demand, or have to stall demand and the job growth that goes with it, because they can’t meet energy needs.”

O’Neill said she believes that states will also continue to drive the clean energy transition forward, as they’re where “energy policies happen …. where the investments become real.”

State governors and commissioners “want manufacturing in their state,” she said. “They want data centers in their state. The siting reform conversation is one that I think is not a partisan conversation. It’s: how do we help unlock some of this desired economic activity? For us, the siting and building issues will be something that we’re going to work on in the states, regardless of the landscape in D.C.”

The projects that are being facilitated through [the IRA] are not isolated in blue states. For example, we’re doing projects all over the country and seeing projects work in states like Ohio and Pennsylvania that didn’t used to work.

Dan Smith

Vice president of markets at DSD Renewables

In addition to states and utilities, companies like Microsoft, Amazon and Meta are also helping to drive the demand for clean energy — investing billions in renewable energy deployment in addition to seeking nuclear and natural gas generation to handle load from their data centers.

Molly Jerrard, head of demand response at Enel North America, said she expects that in 2025, “significant load growth …. will challenge our grid’s flexibility and put the reliability of local systems to the test.”

“Combine this with aging infrastructure, congestion, and the uptick in climate-driven grid stress, utilities and grid operators will need to put a bigger focus on adoption of demand response programs and distributed energy resources to address these challenges and increase grid stability,” Jerrard said.

However, she said, “inconsistent data access standards” from utilities continue to limit the scalability of virtual power plants, a potent demand response solution.

O’Neill is excited about VPPs, she said, as she sees “a ton of innovation” flowing into the sector and expanding the ways that VPPs can offer grid flexibility.

“We’re seeing virtual power plants across different regions of the country — whether it’s coastal or Texas — where you’ve got utilities and commissions really putting virtual power plants to the test,” she said. “They’re managing the load, they’re shaving peak loads, and they don’t have to build as much [generation].”

Solar and offshore wind

In 2025, the American Clean Power Association forecasts that utility-scale U.S. solar installations will shrink 16% from 2024, due to the risk of new tariffs under a second Trump administration and concerns that he might work with Congress to repeal aspects of the IRA.

The industry’s residential segment “continued to decline” last year, driven by California, where residential solar cratered following the state’s switch from net metering to net billing in 2023, said a third quarter 2024 report from the Solar Energy Industries Association.

While solar projects in the state “definitely don’t offer the same amount of savings that they used to,” said Dan Smith, vice president of markets at DSD Renewables, “we are continuing to see California be our largest market.”

This is due in part to utility rates “[continuing] to escalate at really extreme levels in California,” he said. “So while we’re experiencing [NEM 3.0] adversely, as utility rates increase, that increases our customers’ savings. So that’s making up a bit of that gap.”

Smith said that DSD Renewables is entering 2025 apprehensive about any potential repeal or reforms to the IRA’s solar tax credits, but hopeful that the Trump administration and Congress will see their value.

“The projects that are being facilitated through that are not isolated in blue states,” he said. “For example, we’re doing projects all over the country and seeing projects work in states like Ohio and Pennsylvania that didn’t used to work.”

Smith said that if the domestic content adder in the IRA remains in place, and domestic solar supply continues to come online, he won’t be as concerned about potential tariffs.

“But that’s the question that I think the whole industry has right now — do those suppliers continue to make investments in their domestic factories?” he said. “There are many factories either under construction or planned, and the big question on many of our minds right now is, will any of that federal policy change in such a way that it causes those companies to pull back on those commitments?”

The offshore wind industry also contains a lot of people “holding their breath,” Sanchez said, “waiting to see what happens when [Trump] does come into power at the end of January.”

The stock prices for offshore wind companies like Ørsted and Vestas fell following the election and have yet to recover. Sanchez said she sees this as a “temporary signal” that will depend on what actions Trump takes on offshore wind.

“There’s been a tremendous level of investment, and that has continued this year, even with the more cautious approach that the industry has taken,” Sanchez said. “And I do see that going forward. But again, I think everyone at this moment is in a pause waiting to see what happens over the next couple of months, to see whether it’s worth continuing additional investment.”

On his first day in office, Trump issued an executive order pausing offshore wind lease sales in federal waters and the issuance of approvals, permits and loans for onshore and offshore wind projects. The pauses don’t have a set expiration date, according to the order, but will remain in effect until revoked.

We don’t expect, and I think lots of people out there don’t expect, the IRA to completely be blown up and be obliterated.

Marlene Motyka

Deloitte’s U.S. renewable energy leader

Northington said he finds it promising that Trump’s pick to head the Department of the Interior, former North Dakota governor Doug Burgum, has overseen the development of onshore wind in his state.

“I think that the Trump energy policies are, yes, anti-wind, but when it comes to getting something done, it’s more pro-oil and gas,” he said. “At the end of the day, to dismantle something requires effort and energy, and to ignore something takes much less energy.”

However, Northington said he’s concerned that the high bureaucratic turnover of Trump’s first administration may continue in his second, and civil servants at agencies like the Bureau of Ocean Energy Management may decide to retire. People might say, “‘Okay. I stuck through round one — am I going to stick through round two?’” he said. “I think that can have a certain deleterious effect on things like getting permits through, or holding lease sales.”

Both solar and offshore wind continue to advance technologically, with promising innovations on the horizon. There are still “a lot of discussions going on about the future of offshore wind, about floating wind, about the development of the technology and the infrastructure needed on the West Coast to support floating wind,” Sanchez said.

The solar industry benefits each year from “continued improvements in efficiency of solar modules,” Smith said. “Now we’re using almost exclusively bifacial solar modules, which increase the energy yield.”

Marlene Motyka, Deloitte’s U.S. renewable energy leader, said she’s hopeful that solar cell technology will continue to advance with further innovations in materials like silicon and perovskite, and she’s excited about a December report from SEIA and Wood Mackenzie that said U.S. solar module factories are now equipped to meet nearly all domestic demand.

Motyka said Deloitte expects “good momentum” for the industry in 2025: “We don’t expect, and I think lots of people out there don’t expect, the IRA to completely be blown up and be obliterated.”

“There are a lot of things that have been coming together over time, and that’s not going to be stopped on a dime,” she said. “I’ve been involved in renewable energy for 17 years, and all of it is kind of coming together now. I think it’s still an exciting time.”