Your Gateway to Power, Energy, Datacenters, Bitcoin and AI

Dive into the latest industry updates, our exclusive Paperboy Newsletter, and curated insights designed to keep you informed. Stay ahead with minimal time spent.

Discover What Matters Most to You

AI

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Bitcoin:

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Datacenter:

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Energy:

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Discover What Matter Most to You

Featured Articles

Angola Raises Diesel Price by 33 Pct, Third Increase This Year

Angola raised the diesel price by 33%, the third increase this year as authorities press ahead with fuel-subsidy cuts that have been encouraged by the International Monetary Fund. The price will rise to 400 kwanzas ($0.43) per liter on Friday from 300 kwanza previously, the Petroleum Derivatives Regulatory Institute said in a statement late Thursday. The increase is part of a “gradual adjustment of fuel prices,” it said. Previous hikes were announced in March and April. The IRDP said prices of other fuels, including gasoline and liquefied-petroleum gas, will remain unchanged in Angola, Africa’s third-largest oil producer. The IMF said in February that Angola should do more to eliminate subsidies that cost about $3 billion last year — similar to the amount the government spent on health and education last year. The latest hike follows an IMF-World Bank review of Angola’s financial system that ended last month. WHAT DO YOU THINK? Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

OPEC+ Moves Meeting to Saturday as Group Weighs Another Hike

Key OPEC+ members brought forward to Saturday an online meeting where they’re set to consider a fourth bumper oil production increase, delegates said. Saudi Arabia and its partners have been discussing another output hike of 411,000 barrels a day for August as their base-case scenario as they seek to recoup lost market share. The video-conference was moved one day earlier because of scheduling issues, said the officials, who asked not to be identified since the change isn’t yet public. The Organization of the Petroleum Exporting Countries has roiled markets in recent months by speeding up the return of halted output, despite faltering demand and an impending surplus. Their strategy shift is dragging crude prices lower, offering relief to consumers and playing into calls from US President Donald Trump for cheaper fuel. Eight major OPEC+ members have already agreed to restart 411,000 barrels a day in May, June and July, triple the rate they initially scheduled. Officials have said that Riyadh is eager to revive more idle production as quickly as possible to regain market share ceded to US shale drillers and other rivals. The kingdom’s pivot away from years of supply restraint aimed at shoring up crude prices has upended traders’ assumptions about what role the OPEC+ alliance will continue to play in world oil markets. Brent crude futures traded near $68 a barrel in London on Friday. The international benchmark plunged 12% last week as a tentative truce between Israel and Iran allayed fears over the threat to Middle East energy exports. Further OPEC+ increases threaten to create a glut. Global oil inventories have been building at a brisk clip of around 1 million barrels a day in recent months as demand cools in China and supplies continue to swell across the Americas. Markets are headed for a substantial surplus later this year,

Methane Emission Tracking Satellite Lost in Space, EDF Says

Methane emissions tracking satellite MethaneSAT lost contact with mission operations, and it is “likely not recoverable,” the Environmental Defense Fund (EDF) said in a statement. “After pursuing all options to restore communications, we learned this morning that the satellite has lost power,” the EDF said. “The engineering team is conducting a thorough investigation into the loss of communication. This is expected to take time. We will share what we learn,” the nonprofit organization added. Launched in March 2024, MethaneSAT had been collecting methane emissions data over the past year. It was one of the most advanced methane tracking satellites in space, measuring methane emissions in oil and gas producing regions across the world, according to the statement. “The mission has been a remarkable success in terms of scientific and technological accomplishment, and for its lasting influence on both industry and regulators worldwide,” the EDF said. “Thanks to MethaneSAT, we have gained critical insight about the distribution and volume of methane being released from oil and gas production areas. We have also developed an unprecedented capability to interpret the measurements from space and translate them into volumes of methane released. This capacity will be valuable to other missions,” the organization continued. MethaneSAT had the ability to monitor both high-emitting methane sources and small sources spread over a wide area, according to the release. It is designed to measure regions at intervals under seven days, regularly monitoring roughly 50 major regions accounting for more than 80 percent of global oil and gas production, according to an earlier statement. “The advanced spectrometers developed specifically for MethaneSAT met or exceeded all expectations throughout the mission. In combination with the mission algorithms and software, we showed that the highly sensitive instrument could see total methane emissions, even at low levels, over wide areas, including both

How Has USA Energy Use Changed Since 1776?

A new analysis piece published on the U.S. Energy Information Administration (EIA) website recently, which was penned by Mickey Francis, Program Manager and Lead Economist for the EIA’s State Energy Data System, has outlined how U.S. energy use has changed since the Declaration of Independence was signed in 1776. The piece highlighted that, according to the EIA’s monthly energy review, in 2024, the U.S. consumed about 94 quadrillion British thermal units (quads) of energy. Fossil fuels – namely petroleum, natural gas, and coal – made up 82 percent of total U.S. energy consumption last year, the piece pointed out, adding that non-fossil fuel energy accounted for the other 18 percent. Petroleum remained the most-consumed fuel in the United States, the piece stated, outlining that this has been the case for the past 75 years. It also highlighted that, last year, nuclear energy consumption exceeded coal consumption for the first time ever. The analysis piece went on to note that, when the Declaration of Independence was signed in 1776, wood was the largest source of energy in the United States. “Used for heating, cooking, and lighting, wood remained the largest U.S. energy source until the late 1800s, when coal consumption became more common,” it added. “Wood energy is still consumed, mainly by industrial lumber and paper plants that burn excess wood waste to generate electricity,” it continued. The piece went on to highlight that coal was the largest source of U.S. energy for about 65 years, from 1885 until 1950. “Early uses of coal included many purposes that are no longer common, such as in stoves for home heating and in engines for trains and ships. Since the 1960s, nearly all coal consumed in the United States has been for electricity generation,” the piece said. The analysis piece went on to state that petroleum has

Ocean Installer Awarded EPCI Contract for Var Energi’s Balder Project

Subsea services firm Ocean Installer has been awarded a fast-track engineering, procurement, construction and installation (EPCI) contract by Var Energi for further development of the Balder Phase VI project for the further development of the Balder area in the North Sea. This project is part of Var Energi’s hub development strategy in the Balder area, which is centered around the newly installed Jotun floating production storage and offloading vessel (FPSO), Ocean Installer said in a news release. Ocean Installer said it will execute subsea umbilicals, risers, and flowlines (SURF) activities including the fabrication and installation of flexible flowlines and umbilicals. Financial details of the contract were not disclosed. The project is scheduled to deliver first oil by the end of 2026, reinforcing both companies’ shared commitment to efficient development of subsea tie-backs on the Norwegian Continental Shelf (NCS), according to the release. “Var Energi is a key customer for Ocean Installer and the wider Moreld group. It’s exciting to see that Ocean Installer signs a new contract within the same week that the Jotun FPSO starts producing first oil as part of the Balder Future project, in which Ocean Installer has played a key role,” Moreld CEO Geir Austigard said. The contract is called off under the strategic partnership contract entered into with Vår Energi in June 2022. It is also a continuation of a multi-year collaboration between Vår Energi and Ocean Installer in the Balder area, where Ocean Installer has been engaged since 2019, the release said. “We are happy that Vår Energi continues to place their trust in us. Subsea tiebacks have been the core of our business for 14 years, and as the NCS transitions to more marginal fields, our expertise is valuable in enabling faster and more cost-efficient developments. Working together with Vår Energi to utilize

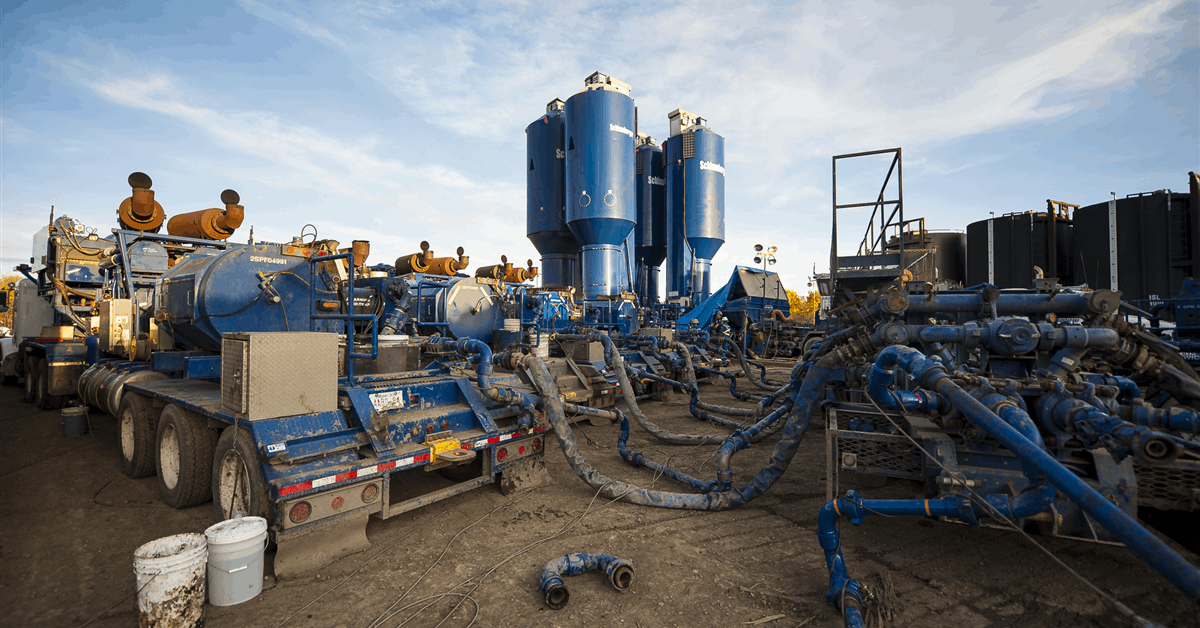

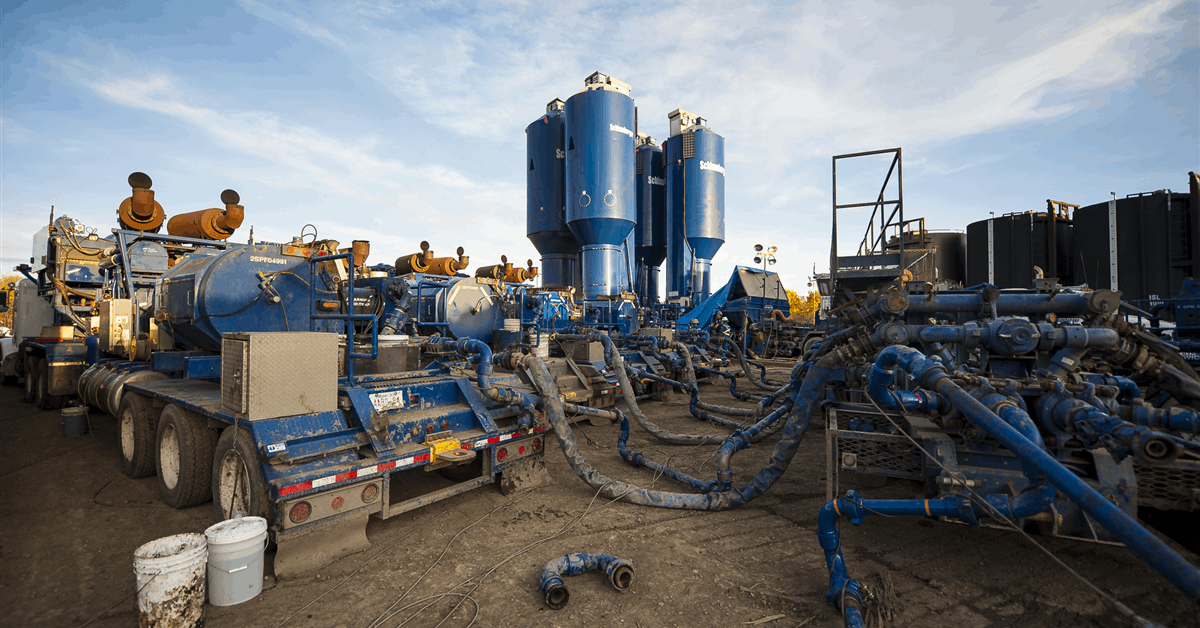

ADNOC Drilling Wins $800MM Contract for Fracking Services

ADNOC Drilling Company said it was awarded a contract valued at up to $800 million by ADNOC Onshore for the provision of integrated hydraulic fracturing services for conventional and tight reservoirs. The five-year agreement is set to begin in the third quarter, ADNOC Drilling said in a news release. The contract’s scope of work supports ADNOC’s strategic goal to accelerate the development of conventional and tight reservoirs across the United Arab Emirates (UAE) and includes the design, execution, and evaluation of multistage hydraulic fracturing treatments, which will be deployed across a wide range of assets in Abu Dhabi, according to the release. Fracturing services for conventional and tight reservoirs are used to enhance the flow of oil or gas through existing natural pathways and optimize production by improving flow rates, the company said. ADNOC Drilling said it plans to “deploy advanced technologies throughout the project to maximize efficiency and performance”. Proprietary fracturing simulation software will be used to optimize every stage of the operation, increasing flow rates and overall hydrocarbon recovery. Intelligent fluid systems will adapt dynamically in real-time to reservoir conditions, improving fracture efficiency and reducing environmental impact, while automated pumping units and blending systems will enhance safety, streamline operations and reduce the need for on-site manpower, the company stated. ADNOC Drilling’s new CEO, Abdulla Ateya Al Messabi, said, “This significant contract is a powerful endorsement of ADNOC Drilling’s expanding capabilities and our trusted partnership with ADNOC Onshore. It reflects our ability to deliver high-impact, technologically advanced fracturing services that will help unlock the UAE’s energy potential. As we continue our transformation, we are proud to support the nation’s strategic energy goals and reinforce our position as a leader in integrated drilling and completion solutions”. The award “further reinforces ADNOC Drilling’s leadership in high-tech oilfield services, combining next-generation equipment,

Angola Raises Diesel Price by 33 Pct, Third Increase This Year

Angola raised the diesel price by 33%, the third increase this year as authorities press ahead with fuel-subsidy cuts that have been encouraged by the International Monetary Fund. The price will rise to 400 kwanzas ($0.43) per liter on Friday from 300 kwanza previously, the Petroleum Derivatives Regulatory Institute said in a statement late Thursday. The increase is part of a “gradual adjustment of fuel prices,” it said. Previous hikes were announced in March and April. The IRDP said prices of other fuels, including gasoline and liquefied-petroleum gas, will remain unchanged in Angola, Africa’s third-largest oil producer. The IMF said in February that Angola should do more to eliminate subsidies that cost about $3 billion last year — similar to the amount the government spent on health and education last year. The latest hike follows an IMF-World Bank review of Angola’s financial system that ended last month. WHAT DO YOU THINK? Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

OPEC+ Moves Meeting to Saturday as Group Weighs Another Hike

Key OPEC+ members brought forward to Saturday an online meeting where they’re set to consider a fourth bumper oil production increase, delegates said. Saudi Arabia and its partners have been discussing another output hike of 411,000 barrels a day for August as their base-case scenario as they seek to recoup lost market share. The video-conference was moved one day earlier because of scheduling issues, said the officials, who asked not to be identified since the change isn’t yet public. The Organization of the Petroleum Exporting Countries has roiled markets in recent months by speeding up the return of halted output, despite faltering demand and an impending surplus. Their strategy shift is dragging crude prices lower, offering relief to consumers and playing into calls from US President Donald Trump for cheaper fuel. Eight major OPEC+ members have already agreed to restart 411,000 barrels a day in May, June and July, triple the rate they initially scheduled. Officials have said that Riyadh is eager to revive more idle production as quickly as possible to regain market share ceded to US shale drillers and other rivals. The kingdom’s pivot away from years of supply restraint aimed at shoring up crude prices has upended traders’ assumptions about what role the OPEC+ alliance will continue to play in world oil markets. Brent crude futures traded near $68 a barrel in London on Friday. The international benchmark plunged 12% last week as a tentative truce between Israel and Iran allayed fears over the threat to Middle East energy exports. Further OPEC+ increases threaten to create a glut. Global oil inventories have been building at a brisk clip of around 1 million barrels a day in recent months as demand cools in China and supplies continue to swell across the Americas. Markets are headed for a substantial surplus later this year,

Methane Emission Tracking Satellite Lost in Space, EDF Says

Methane emissions tracking satellite MethaneSAT lost contact with mission operations, and it is “likely not recoverable,” the Environmental Defense Fund (EDF) said in a statement. “After pursuing all options to restore communications, we learned this morning that the satellite has lost power,” the EDF said. “The engineering team is conducting a thorough investigation into the loss of communication. This is expected to take time. We will share what we learn,” the nonprofit organization added. Launched in March 2024, MethaneSAT had been collecting methane emissions data over the past year. It was one of the most advanced methane tracking satellites in space, measuring methane emissions in oil and gas producing regions across the world, according to the statement. “The mission has been a remarkable success in terms of scientific and technological accomplishment, and for its lasting influence on both industry and regulators worldwide,” the EDF said. “Thanks to MethaneSAT, we have gained critical insight about the distribution and volume of methane being released from oil and gas production areas. We have also developed an unprecedented capability to interpret the measurements from space and translate them into volumes of methane released. This capacity will be valuable to other missions,” the organization continued. MethaneSAT had the ability to monitor both high-emitting methane sources and small sources spread over a wide area, according to the release. It is designed to measure regions at intervals under seven days, regularly monitoring roughly 50 major regions accounting for more than 80 percent of global oil and gas production, according to an earlier statement. “The advanced spectrometers developed specifically for MethaneSAT met or exceeded all expectations throughout the mission. In combination with the mission algorithms and software, we showed that the highly sensitive instrument could see total methane emissions, even at low levels, over wide areas, including both

How Has USA Energy Use Changed Since 1776?

A new analysis piece published on the U.S. Energy Information Administration (EIA) website recently, which was penned by Mickey Francis, Program Manager and Lead Economist for the EIA’s State Energy Data System, has outlined how U.S. energy use has changed since the Declaration of Independence was signed in 1776. The piece highlighted that, according to the EIA’s monthly energy review, in 2024, the U.S. consumed about 94 quadrillion British thermal units (quads) of energy. Fossil fuels – namely petroleum, natural gas, and coal – made up 82 percent of total U.S. energy consumption last year, the piece pointed out, adding that non-fossil fuel energy accounted for the other 18 percent. Petroleum remained the most-consumed fuel in the United States, the piece stated, outlining that this has been the case for the past 75 years. It also highlighted that, last year, nuclear energy consumption exceeded coal consumption for the first time ever. The analysis piece went on to note that, when the Declaration of Independence was signed in 1776, wood was the largest source of energy in the United States. “Used for heating, cooking, and lighting, wood remained the largest U.S. energy source until the late 1800s, when coal consumption became more common,” it added. “Wood energy is still consumed, mainly by industrial lumber and paper plants that burn excess wood waste to generate electricity,” it continued. The piece went on to highlight that coal was the largest source of U.S. energy for about 65 years, from 1885 until 1950. “Early uses of coal included many purposes that are no longer common, such as in stoves for home heating and in engines for trains and ships. Since the 1960s, nearly all coal consumed in the United States has been for electricity generation,” the piece said. The analysis piece went on to state that petroleum has

Ocean Installer Awarded EPCI Contract for Var Energi’s Balder Project

Subsea services firm Ocean Installer has been awarded a fast-track engineering, procurement, construction and installation (EPCI) contract by Var Energi for further development of the Balder Phase VI project for the further development of the Balder area in the North Sea. This project is part of Var Energi’s hub development strategy in the Balder area, which is centered around the newly installed Jotun floating production storage and offloading vessel (FPSO), Ocean Installer said in a news release. Ocean Installer said it will execute subsea umbilicals, risers, and flowlines (SURF) activities including the fabrication and installation of flexible flowlines and umbilicals. Financial details of the contract were not disclosed. The project is scheduled to deliver first oil by the end of 2026, reinforcing both companies’ shared commitment to efficient development of subsea tie-backs on the Norwegian Continental Shelf (NCS), according to the release. “Var Energi is a key customer for Ocean Installer and the wider Moreld group. It’s exciting to see that Ocean Installer signs a new contract within the same week that the Jotun FPSO starts producing first oil as part of the Balder Future project, in which Ocean Installer has played a key role,” Moreld CEO Geir Austigard said. The contract is called off under the strategic partnership contract entered into with Vår Energi in June 2022. It is also a continuation of a multi-year collaboration between Vår Energi and Ocean Installer in the Balder area, where Ocean Installer has been engaged since 2019, the release said. “We are happy that Vår Energi continues to place their trust in us. Subsea tiebacks have been the core of our business for 14 years, and as the NCS transitions to more marginal fields, our expertise is valuable in enabling faster and more cost-efficient developments. Working together with Vår Energi to utilize

ADNOC Drilling Wins $800MM Contract for Fracking Services

ADNOC Drilling Company said it was awarded a contract valued at up to $800 million by ADNOC Onshore for the provision of integrated hydraulic fracturing services for conventional and tight reservoirs. The five-year agreement is set to begin in the third quarter, ADNOC Drilling said in a news release. The contract’s scope of work supports ADNOC’s strategic goal to accelerate the development of conventional and tight reservoirs across the United Arab Emirates (UAE) and includes the design, execution, and evaluation of multistage hydraulic fracturing treatments, which will be deployed across a wide range of assets in Abu Dhabi, according to the release. Fracturing services for conventional and tight reservoirs are used to enhance the flow of oil or gas through existing natural pathways and optimize production by improving flow rates, the company said. ADNOC Drilling said it plans to “deploy advanced technologies throughout the project to maximize efficiency and performance”. Proprietary fracturing simulation software will be used to optimize every stage of the operation, increasing flow rates and overall hydrocarbon recovery. Intelligent fluid systems will adapt dynamically in real-time to reservoir conditions, improving fracture efficiency and reducing environmental impact, while automated pumping units and blending systems will enhance safety, streamline operations and reduce the need for on-site manpower, the company stated. ADNOC Drilling’s new CEO, Abdulla Ateya Al Messabi, said, “This significant contract is a powerful endorsement of ADNOC Drilling’s expanding capabilities and our trusted partnership with ADNOC Onshore. It reflects our ability to deliver high-impact, technologically advanced fracturing services that will help unlock the UAE’s energy potential. As we continue our transformation, we are proud to support the nation’s strategic energy goals and reinforce our position as a leader in integrated drilling and completion solutions”. The award “further reinforces ADNOC Drilling’s leadership in high-tech oilfield services, combining next-generation equipment,

Angola Raises Diesel Price by 33 Pct, Third Increase This Year

Angola raised the diesel price by 33%, the third increase this year as authorities press ahead with fuel-subsidy cuts that have been encouraged by the International Monetary Fund. The price will rise to 400 kwanzas ($0.43) per liter on Friday from 300 kwanza previously, the Petroleum Derivatives Regulatory Institute said in a statement late Thursday. The increase is part of a “gradual adjustment of fuel prices,” it said. Previous hikes were announced in March and April. The IRDP said prices of other fuels, including gasoline and liquefied-petroleum gas, will remain unchanged in Angola, Africa’s third-largest oil producer. The IMF said in February that Angola should do more to eliminate subsidies that cost about $3 billion last year — similar to the amount the government spent on health and education last year. The latest hike follows an IMF-World Bank review of Angola’s financial system that ended last month. WHAT DO YOU THINK? Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

OPEC+ Moves Meeting to Saturday as Group Weighs Another Hike

Key OPEC+ members brought forward to Saturday an online meeting where they’re set to consider a fourth bumper oil production increase, delegates said. Saudi Arabia and its partners have been discussing another output hike of 411,000 barrels a day for August as their base-case scenario as they seek to recoup lost market share. The video-conference was moved one day earlier because of scheduling issues, said the officials, who asked not to be identified since the change isn’t yet public. The Organization of the Petroleum Exporting Countries has roiled markets in recent months by speeding up the return of halted output, despite faltering demand and an impending surplus. Their strategy shift is dragging crude prices lower, offering relief to consumers and playing into calls from US President Donald Trump for cheaper fuel. Eight major OPEC+ members have already agreed to restart 411,000 barrels a day in May, June and July, triple the rate they initially scheduled. Officials have said that Riyadh is eager to revive more idle production as quickly as possible to regain market share ceded to US shale drillers and other rivals. The kingdom’s pivot away from years of supply restraint aimed at shoring up crude prices has upended traders’ assumptions about what role the OPEC+ alliance will continue to play in world oil markets. Brent crude futures traded near $68 a barrel in London on Friday. The international benchmark plunged 12% last week as a tentative truce between Israel and Iran allayed fears over the threat to Middle East energy exports. Further OPEC+ increases threaten to create a glut. Global oil inventories have been building at a brisk clip of around 1 million barrels a day in recent months as demand cools in China and supplies continue to swell across the Americas. Markets are headed for a substantial surplus later this year,

Methane Emission Tracking Satellite Lost in Space, EDF Says

Methane emissions tracking satellite MethaneSAT lost contact with mission operations, and it is “likely not recoverable,” the Environmental Defense Fund (EDF) said in a statement. “After pursuing all options to restore communications, we learned this morning that the satellite has lost power,” the EDF said. “The engineering team is conducting a thorough investigation into the loss of communication. This is expected to take time. We will share what we learn,” the nonprofit organization added. Launched in March 2024, MethaneSAT had been collecting methane emissions data over the past year. It was one of the most advanced methane tracking satellites in space, measuring methane emissions in oil and gas producing regions across the world, according to the statement. “The mission has been a remarkable success in terms of scientific and technological accomplishment, and for its lasting influence on both industry and regulators worldwide,” the EDF said. “Thanks to MethaneSAT, we have gained critical insight about the distribution and volume of methane being released from oil and gas production areas. We have also developed an unprecedented capability to interpret the measurements from space and translate them into volumes of methane released. This capacity will be valuable to other missions,” the organization continued. MethaneSAT had the ability to monitor both high-emitting methane sources and small sources spread over a wide area, according to the release. It is designed to measure regions at intervals under seven days, regularly monitoring roughly 50 major regions accounting for more than 80 percent of global oil and gas production, according to an earlier statement. “The advanced spectrometers developed specifically for MethaneSAT met or exceeded all expectations throughout the mission. In combination with the mission algorithms and software, we showed that the highly sensitive instrument could see total methane emissions, even at low levels, over wide areas, including both

How Has USA Energy Use Changed Since 1776?

A new analysis piece published on the U.S. Energy Information Administration (EIA) website recently, which was penned by Mickey Francis, Program Manager and Lead Economist for the EIA’s State Energy Data System, has outlined how U.S. energy use has changed since the Declaration of Independence was signed in 1776. The piece highlighted that, according to the EIA’s monthly energy review, in 2024, the U.S. consumed about 94 quadrillion British thermal units (quads) of energy. Fossil fuels – namely petroleum, natural gas, and coal – made up 82 percent of total U.S. energy consumption last year, the piece pointed out, adding that non-fossil fuel energy accounted for the other 18 percent. Petroleum remained the most-consumed fuel in the United States, the piece stated, outlining that this has been the case for the past 75 years. It also highlighted that, last year, nuclear energy consumption exceeded coal consumption for the first time ever. The analysis piece went on to note that, when the Declaration of Independence was signed in 1776, wood was the largest source of energy in the United States. “Used for heating, cooking, and lighting, wood remained the largest U.S. energy source until the late 1800s, when coal consumption became more common,” it added. “Wood energy is still consumed, mainly by industrial lumber and paper plants that burn excess wood waste to generate electricity,” it continued. The piece went on to highlight that coal was the largest source of U.S. energy for about 65 years, from 1885 until 1950. “Early uses of coal included many purposes that are no longer common, such as in stoves for home heating and in engines for trains and ships. Since the 1960s, nearly all coal consumed in the United States has been for electricity generation,” the piece said. The analysis piece went on to state that petroleum has

Ocean Installer Awarded EPCI Contract for Var Energi’s Balder Project

Subsea services firm Ocean Installer has been awarded a fast-track engineering, procurement, construction and installation (EPCI) contract by Var Energi for further development of the Balder Phase VI project for the further development of the Balder area in the North Sea. This project is part of Var Energi’s hub development strategy in the Balder area, which is centered around the newly installed Jotun floating production storage and offloading vessel (FPSO), Ocean Installer said in a news release. Ocean Installer said it will execute subsea umbilicals, risers, and flowlines (SURF) activities including the fabrication and installation of flexible flowlines and umbilicals. Financial details of the contract were not disclosed. The project is scheduled to deliver first oil by the end of 2026, reinforcing both companies’ shared commitment to efficient development of subsea tie-backs on the Norwegian Continental Shelf (NCS), according to the release. “Var Energi is a key customer for Ocean Installer and the wider Moreld group. It’s exciting to see that Ocean Installer signs a new contract within the same week that the Jotun FPSO starts producing first oil as part of the Balder Future project, in which Ocean Installer has played a key role,” Moreld CEO Geir Austigard said. The contract is called off under the strategic partnership contract entered into with Vår Energi in June 2022. It is also a continuation of a multi-year collaboration between Vår Energi and Ocean Installer in the Balder area, where Ocean Installer has been engaged since 2019, the release said. “We are happy that Vår Energi continues to place their trust in us. Subsea tiebacks have been the core of our business for 14 years, and as the NCS transitions to more marginal fields, our expertise is valuable in enabling faster and more cost-efficient developments. Working together with Vår Energi to utilize

ADNOC Drilling Wins $800MM Contract for Fracking Services

ADNOC Drilling Company said it was awarded a contract valued at up to $800 million by ADNOC Onshore for the provision of integrated hydraulic fracturing services for conventional and tight reservoirs. The five-year agreement is set to begin in the third quarter, ADNOC Drilling said in a news release. The contract’s scope of work supports ADNOC’s strategic goal to accelerate the development of conventional and tight reservoirs across the United Arab Emirates (UAE) and includes the design, execution, and evaluation of multistage hydraulic fracturing treatments, which will be deployed across a wide range of assets in Abu Dhabi, according to the release. Fracturing services for conventional and tight reservoirs are used to enhance the flow of oil or gas through existing natural pathways and optimize production by improving flow rates, the company said. ADNOC Drilling said it plans to “deploy advanced technologies throughout the project to maximize efficiency and performance”. Proprietary fracturing simulation software will be used to optimize every stage of the operation, increasing flow rates and overall hydrocarbon recovery. Intelligent fluid systems will adapt dynamically in real-time to reservoir conditions, improving fracture efficiency and reducing environmental impact, while automated pumping units and blending systems will enhance safety, streamline operations and reduce the need for on-site manpower, the company stated. ADNOC Drilling’s new CEO, Abdulla Ateya Al Messabi, said, “This significant contract is a powerful endorsement of ADNOC Drilling’s expanding capabilities and our trusted partnership with ADNOC Onshore. It reflects our ability to deliver high-impact, technologically advanced fracturing services that will help unlock the UAE’s energy potential. As we continue our transformation, we are proud to support the nation’s strategic energy goals and reinforce our position as a leader in integrated drilling and completion solutions”. The award “further reinforces ADNOC Drilling’s leadership in high-tech oilfield services, combining next-generation equipment,

Microsoft will invest $80B in AI data centers in fiscal 2025

And Microsoft isn’t the only one that is ramping up its investments into AI-enabled data centers. Rival cloud service providers are all investing in either upgrading or opening new data centers to capture a larger chunk of business from developers and users of large language models (LLMs). In a report published in October 2024, Bloomberg Intelligence estimated that demand for generative AI would push Microsoft, AWS, Google, Oracle, Meta, and Apple would between them devote $200 billion to capex in 2025, up from $110 billion in 2023. Microsoft is one of the biggest spenders, followed closely by Google and AWS, Bloomberg Intelligence said. Its estimate of Microsoft’s capital spending on AI, at $62.4 billion for calendar 2025, is lower than Smith’s claim that the company will invest $80 billion in the fiscal year to June 30, 2025. Both figures, though, are way higher than Microsoft’s 2020 capital expenditure of “just” $17.6 billion. The majority of the increased spending is tied to cloud services and the expansion of AI infrastructure needed to provide compute capacity for OpenAI workloads. Separately, last October Amazon CEO Andy Jassy said his company planned total capex spend of $75 billion in 2024 and even more in 2025, with much of it going to AWS, its cloud computing division.

John Deere unveils more autonomous farm machines to address skill labor shortage

Join our daily and weekly newsletters for the latest updates and exclusive content on industry-leading AI coverage. Learn More Self-driving tractors might be the path to self-driving cars. John Deere has revealed a new line of autonomous machines and tech across agriculture, construction and commercial landscaping. The Moline, Illinois-based John Deere has been in business for 187 years, yet it’s been a regular as a non-tech company showing off technology at the big tech trade show in Las Vegas and is back at CES 2025 with more autonomous tractors and other vehicles. This is not something we usually cover, but John Deere has a lot of data that is interesting in the big picture of tech. The message from the company is that there aren’t enough skilled farm laborers to do the work that its customers need. It’s been a challenge for most of the last two decades, said Jahmy Hindman, CTO at John Deere, in a briefing. Much of the tech will come this fall and after that. He noted that the average farmer in the U.S. is over 58 and works 12 to 18 hours a day to grow food for us. And he said the American Farm Bureau Federation estimates there are roughly 2.4 million farm jobs that need to be filled annually; and the agricultural work force continues to shrink. (This is my hint to the anti-immigration crowd). John Deere’s autonomous 9RX Tractor. Farmers can oversee it using an app. While each of these industries experiences their own set of challenges, a commonality across all is skilled labor availability. In construction, about 80% percent of contractors struggle to find skilled labor. And in commercial landscaping, 86% of landscaping business owners can’t find labor to fill open positions, he said. “They have to figure out how to do

2025 playbook for enterprise AI success, from agents to evals

Join our daily and weekly newsletters for the latest updates and exclusive content on industry-leading AI coverage. Learn More 2025 is poised to be a pivotal year for enterprise AI. The past year has seen rapid innovation, and this year will see the same. This has made it more critical than ever to revisit your AI strategy to stay competitive and create value for your customers. From scaling AI agents to optimizing costs, here are the five critical areas enterprises should prioritize for their AI strategy this year. 1. Agents: the next generation of automation AI agents are no longer theoretical. In 2025, they’re indispensable tools for enterprises looking to streamline operations and enhance customer interactions. Unlike traditional software, agents powered by large language models (LLMs) can make nuanced decisions, navigate complex multi-step tasks, and integrate seamlessly with tools and APIs. At the start of 2024, agents were not ready for prime time, making frustrating mistakes like hallucinating URLs. They started getting better as frontier large language models themselves improved. “Let me put it this way,” said Sam Witteveen, cofounder of Red Dragon, a company that develops agents for companies, and that recently reviewed the 48 agents it built last year. “Interestingly, the ones that we built at the start of the year, a lot of those worked way better at the end of the year just because the models got better.” Witteveen shared this in the video podcast we filmed to discuss these five big trends in detail. Models are getting better and hallucinating less, and they’re also being trained to do agentic tasks. Another feature that the model providers are researching is a way to use the LLM as a judge, and as models get cheaper (something we’ll cover below), companies can use three or more models to

OpenAI’s red teaming innovations define new essentials for security leaders in the AI era

Join our daily and weekly newsletters for the latest updates and exclusive content on industry-leading AI coverage. Learn More OpenAI has taken a more aggressive approach to red teaming than its AI competitors, demonstrating its security teams’ advanced capabilities in two areas: multi-step reinforcement and external red teaming. OpenAI recently released two papers that set a new competitive standard for improving the quality, reliability and safety of AI models in these two techniques and more. The first paper, “OpenAI’s Approach to External Red Teaming for AI Models and Systems,” reports that specialized teams outside the company have proven effective in uncovering vulnerabilities that might otherwise have made it into a released model because in-house testing techniques may have missed them. In the second paper, “Diverse and Effective Red Teaming with Auto-Generated Rewards and Multi-Step Reinforcement Learning,” OpenAI introduces an automated framework that relies on iterative reinforcement learning to generate a broad spectrum of novel, wide-ranging attacks. Going all-in on red teaming pays practical, competitive dividends It’s encouraging to see competitive intensity in red teaming growing among AI companies. When Anthropic released its AI red team guidelines in June of last year, it joined AI providers including Google, Microsoft, Nvidia, OpenAI, and even the U.S.’s National Institute of Standards and Technology (NIST), which all had released red teaming frameworks. Investing heavily in red teaming yields tangible benefits for security leaders in any organization. OpenAI’s paper on external red teaming provides a detailed analysis of how the company strives to create specialized external teams that include cybersecurity and subject matter experts. The goal is to see if knowledgeable external teams can defeat models’ security perimeters and find gaps in their security, biases and controls that prompt-based testing couldn’t find. What makes OpenAI’s recent papers noteworthy is how well they define using human-in-the-middle

Three Aberdeen oil company headquarters sell for £45m

Three Aberdeen oil company headquarters have been sold in a deal worth £45 million. The CNOOC, Apache and Taqa buildings at the Prime Four business park in Kingswells have been acquired by EEH Ventures. The trio of buildings, totalling 275,000 sq ft, were previously owned by Canadian firm BMO. The financial services powerhouse first bought the buildings in 2014 but took the decision to sell the buildings as part of a “long-standing strategy to reduce their office exposure across the UK”. The deal was the largest to take place throughout Scotland during the last quarter of 2024. Trio of buildings snapped up London headquartered EEH Ventures was founded in 2013 and owns a number of residential, offices, shopping centres and hotels throughout the UK. All three Kingswells-based buildings were pre-let, designed and constructed by Aberdeen property developer Drum in 2012 on a 15-year lease. © Supplied by CBREThe Aberdeen headquarters of Taqa. Image: CBRE The North Sea headquarters of Middle-East oil firm Taqa has previously been described as “an amazing success story in the Granite City”. Taqa announced in 2023 that it intends to cease production from all of its UK North Sea platforms by the end of 2027. Meanwhile, Apache revealed at the end of last year it is planning to exit the North Sea by the end of 2029 blaming the windfall tax. The US firm first entered the North Sea in 2003 but will wrap up all of its UK operations by 2030. Aberdeen big deals The Prime Four acquisition wasn’t the biggest Granite City commercial property sale of 2024. American private equity firm Lone Star bought Union Square shopping centre from Hammerson for £111m. © ShutterstockAberdeen city centre. Hammerson, who also built the property, had originally been seeking £150m. BP’s North Sea headquarters in Stoneywood, Aberdeen, was also sold. Manchester-based

2025 ransomware predictions, trends, and how to prepare

Zscaler ThreatLabz research team has revealed critical insights and predictions on ransomware trends for 2025. The latest Ransomware Report uncovered a surge in sophisticated tactics and extortion attacks. As ransomware remains a key concern for CISOs and CIOs, the report sheds light on actionable strategies to mitigate risks. Top Ransomware Predictions for 2025: ● AI-Powered Social Engineering: In 2025, GenAI will fuel voice phishing (vishing) attacks. With the proliferation of GenAI-based tooling, initial access broker groups will increasingly leverage AI-generated voices; which sound more and more realistic by adopting local accents and dialects to enhance credibility and success rates. ● The Trifecta of Social Engineering Attacks: Vishing, Ransomware and Data Exfiltration. Additionally, sophisticated ransomware groups, like the Dark Angels, will continue the trend of low-volume, high-impact attacks; preferring to focus on an individual company, stealing vast amounts of data without encrypting files, and evading media and law enforcement scrutiny. ● Targeted Industries Under Siege: Manufacturing, healthcare, education, energy will remain primary targets, with no slowdown in attacks expected. ● New SEC Regulations Drive Increased Transparency: 2025 will see an uptick in reported ransomware attacks and payouts due to new, tighter SEC requirements mandating that public companies report material incidents within four business days. ● Ransomware Payouts Are on the Rise: In 2025 ransom demands will most likely increase due to an evolving ecosystem of cybercrime groups, specializing in designated attack tactics, and collaboration by these groups that have entered a sophisticated profit sharing model using Ransomware-as-a-Service. To combat damaging ransomware attacks, Zscaler ThreatLabz recommends the following strategies. ● Fighting AI with AI: As threat actors use AI to identify vulnerabilities, organizations must counter with AI-powered zero trust security systems that detect and mitigate new threats. ● Advantages of adopting a Zero Trust architecture: A Zero Trust cloud security platform stops

The Download: India’s AI independence, and predicting future epidemics

This is today’s edition of The Download, our weekday newsletter that provides a daily dose of what’s going on in the world of technology. Inside India’s scramble for AI independence Despite its status as a global tech hub, India lags far behind the likes of the US and China when it comes to homegrown AI.That gap has opened largely because India has chronically underinvested in R&D, institutions, and invention. Meanwhile, since no one native language is spoken by the majority of the population, training language models is far more complicated than it is elsewhere. So when the open-source foundation model DeepSeek-R1 suddenly outperformed many global peers, it struck a nerve. This launch by a Chinese startup prompted Indian policymakers to confront just how far behind the country was in AI infrastructure—and how urgently it needed to respond. Read the full story.

—Shadma Shaikh

Job titles of the future: Pandemic oracle Officially, Conor Browne is a biorisk consultant. Based in Belfast, Northern Ireland, he has advanced degrees in security studies and medical and business ethics, along with United Nations certifications in counterterrorism and conflict resolution.Early in the emergence of SARS-CoV-2, international energy conglomerates seeking expert guidance on navigating the potential turmoil in markets and transportation became his main clients. Having studied the 2002 SARS outbreak, he predicted the exponential spread of the new airborne virus. In fact, he forecast the epidemic’s broadscale impact and its implications for business so accurately that he has come to be seen as a pandemic oracle. Read the full story. —Britta Shoot This story is from the most recent print edition of MIT Technology Review, which explores power—who has it, and who wants it. Subscribe here to receive future copies once they drop. The must-reads I’ve combed the internet to find you today’s most fun/important/scary/fascinating stories about technology.

1 Donald Trump’s ‘big beautiful bill’ has passed Which is terrible news for the clean energy industry. (Vox)+ An energy-affordability crisis is looming in the US. (The Atlantic $)+ The President struck deals with House Republican holdouts to get it over the line. (WSJ $)+ The Trump administration has shut down more than 100 climate studies. (MIT Technology Review) 2 Daniel Gross is joining Meta’s superintelligence lab He’s jumping ship from the startup he co-founded with Ilya Sutskever. (Bloomberg $)+ Sutskever is stepping into the CEO role in his absence. (TechCrunch)+ Here’s what we can infer from Meta’s recent hires. (Semafor)3 AI’s energy demands could destabilize the global supplyThat’s according to the head of the world’s largest transformer maker. (FT $)+ We did the math on AI’s energy footprint. Here’s the story you haven’t heard. (MIT Technology Review)4 Elon Musk is threatening to start his own political partyWould anyone vote for him, though? (WP $)+ You’d think his bruising experience in the White House would have put him off. (NY Mag $) 5 The US has lifted exports on chip design software to ChinaIt suggests that frosty relations between the nations may be thawing. (Reuters) 6 Trump officials are going after this ICE warning appBut lawyers say there’s nothing illegal about it. (Wired $)+ Downloads of ICEBlock are rising. (NBC News) 7 Wildfires are making it harder to monitor air pollutantsCurrent tracking technology isn’t built to accommodate shifting smoke. (Undark)+ How AI can help spot wildfires. (MIT Technology Review) 8 Apple’s iOS 26 software can detect nudity on FaceTime callsThe feature will pause the call and ask if you want to continue. (Gizmodo) 9 Threads has finally launched DMsBut users are arguing there should be a way to opt out of them entirely. (TechCrunch)

10 You can hire a robot to write a handwritten note 🖊️🤖Or, y’know, pick up a pen and write it yourself. (Insider $)

Quote of the day “It’s almost like we never even spoke.” Richard Wilson, an online dater who is convinced his most recent love interest used a chatbot to converse with him online before they awkwardly met in person, tells the Washington Post about his disappointment. One more thing Deepfakes of your dead loved ones are a booming Chinese businessOnce a week, Sun Kai has a video call with his mother, and they discuss his day-to-day life. But Sun’s mother died five years ago, and the person he’s talking to isn’t actually a person, but a digital replica he made of her.There are plenty of people like Sun who want to use AI to preserve, animate, and interact with lost loved ones as they mourn and try to heal. The market is particularly strong in China, where at least half a dozen companies are now offering such technologies and thousands of people have already paid for them.But some question whether interacting with AI replicas of the dead is truly a healthy way to process grief, and it’s not entirely clear what the legal and ethical implications of this technology may be. Read the full story.

—Zeyi Yang We can still have nice things A place for comfort, fun and distraction to brighten up your day. (Got any ideas? Drop me a line or skeet ’em at me.)+ There’s nothing cooler than wooden interiors right now.+ Talented artist Ian Robinson creates beautiful paintings of people’s vinyl collections.+ You’ll find me in every one of Europe’s top wine destinations this summer.+ Here’s everything you need to remember before Stranger Things returns this fall.

Inside India’s scramble for AI independence

In Bengaluru, India, Adithya Kolavi felt a mix of excitement and validation as he watched DeepSeek unleash its disruptive language model on the world earlier this year. The Chinese technology rivaled the best of the West in terms of benchmarks, but it had been built with far less capital in far less time. “I thought: ‘This is how we disrupt with less,’” says Kolavi, the 20-year-old founder of the Indian AI startup CognitiveLab. “If DeepSeek could do it, why not us?” But for Abhishek Upperwal, founder of Soket AI Labs and architect of one of India’s earliest efforts to develop a foundation model, the moment felt more bittersweet. Upperwal’s model, called Pragna-1B, had struggled to stay afloat with tiny grants while he watched global peers raise millions. The multilingual model had a relatively modest 1.25 billion parameters and was designed to reduce the “language tax,” the extra costs that arise because India—unlike the US or even China—has a multitude of languages to support. His team had trained it, but limited resources meant it couldn’t scale. As a result, he says, the project became a proof of concept rather than a product.

“If we had been funded two years ago, there’s a good chance we’d be the ones building what DeepSeek just released,” he says. Kolavi’s enthusiasm and Upperwal’s dismay reflect the spectrum of emotions among India’s AI builders. Despite its status as a global tech hub, the country lags far behind the likes of the US and China when it comes to homegrown AI. That gap has opened largely because India has chronically underinvested in R&D, institutions, and invention. Meanwhile, since no one native language is spoken by the majority of the population, training language models is far more complicated than it is elsewhere.

Historically known as the global back office for the software industry, India has a tech ecosystem that evolved with a services-first mindset. Giants like Infosys and TCS built their success on efficient software delivery, but invention was neither prioritized nor rewarded. Meanwhile, India’s R&D spending hovered at just 0.65% of GDP ($25.4 billion) in 2024, far behind China’s 2.68% ($476.2 billion) and the US’s 3.5% ($962.3 billion). The muscle to invent and commercialize deep tech, from algorithms to chips, was just never built. Isolated pockets of world-class research do exist within government agencies like the DRDO (Defense Research & Development Organization) and ISRO (Indian Space Research Organization), but their breakthroughs rarely spill into civilian or commercial use. India lacks the bridges to connect risk-taking research to commercial pathways, the way DARPA does in the US. Meanwhile, much of India’s top talent migrates abroad, drawn to ecosystems that better understand and, crucially, fund deep tech.So when the open-source foundation model DeepSeek-R1 suddenly outperformed many global peers, it struck a nerve. This launch by a Chinese startup prompted Indian policymakers to confront just how far behind the country was in AI infrastructure, and how urgently it needed to respond. India responds In January 2025, 10 days after DeepSeek-R1’s launch, the Ministry of Electronics and Information Technology (MeitY) solicited proposals for India’s own foundation models, which are large AI models that can be adapted to a wide range of tasks. Its public tender invited private-sector cloud and data‑center companies to reserve GPU compute capacity for government‑led AI research. Providers including Jio, Yotta, E2E Networks, Tata, AWS partners, and CDAC responded. Through this arrangement, MeitY suddenly had access to nearly 19,000 GPUs at subsidized rates, repurposed from private infrastructure and allocated specifically to foundational AI projects. This triggered a surge of proposals from companies wanting to build their own models. Within two weeks, it had 67 proposals in hand. That number tripled by mid-March. In April, the government announced plans to develop six large-scale models by the end of 2025, plus 18 additional AI applications targeting sectors like agriculture, education, and climate action. Most notably, it tapped Sarvam AI to build a 70-billion-parameter model optimized for Indian languages and needs. For a nation long restricted by limited research infrastructure, things moved at record speed, marking a rare convergence of ambition, talent, and political will. “India could do a Mangalyaan in AI,” said Gautam Shroff of IIIT-Delhi, referencing the country’s cost-effective, and successful, Mars orbiter mission.

Jaspreet Bindra, cofounder of AI&Beyond, an organization focused on teaching AI literacy, captured the urgency: “DeepSeek is probably the best thing that happened to India. It gave us a kick in the backside to stop talking and start doing something.” The language problem One of the most fundamental challenges in building foundational AI models for India is the country’s sheer linguistic diversity. With 22 official languages, hundreds of dialects, and millions of people who are multilingual, India poses a problem that few existing LLMs are equipped to handle. Whereas a massive amount of high-quality web data is available in English, Indian languages collectively make up less than 1% of online content. The lack of digitized, labeled, and cleaned data in languages like Bhojpuri and Kannada makes it difficult to train LLMs that understand how Indians actually speak or search. Global tokenizers, which break text into units a model can process, also perform poorly on many Indian scripts, misinterpreting characters or skipping some altogether. As a result, even when Indian languages are included in multilingual models, they’re often poorly understood and inaccurately generated. And unlike OpenAI and DeepSeek, which achieved scale using structured English-language data, Indian teams often begin with fragmented and low-quality data sets encompassing dozens of Indian languages. This makes the early steps of training foundation models far more complex. Nonetheless, a small but determined group of Indian builders is starting to shape the country’s AI future. For example, Sarvam AI has created OpenHathi-Hi-v0.1, an open-source Hindi language model that shows the Indian AI field’s growing ability to address the country’s vast linguistic diversity. The model, built on Meta’s Llama 2 architecture, was trained on 40 billion tokens of Hindi and related Indian-language content, making it one of the largest open-source Hindi models available to date. Pragna-1B, the multilingual model from Upperwal, is more evidence that India could solve for its own linguistic complexity. Trained on 300 billion tokens for just $250,000, it introduced a technique called “balanced tokenization” to address a unique challenge in Indian AI, enabling a 1.25-billion-parameter model to behave like a much larger one.The issue is that Indian languages use complex scripts and agglutinative grammar, where words are formed by stringing together many smaller units of meaning using prefixes and suffixes. Unlike English, which separates words with spaces and follows relatively simple structures, Indian languages like Hindi, Tamil, and Kannada often lack clear word boundaries and pack a lot of information into single words. Standard tokenizers struggle with such inputs. They end up breaking Indian words into too many tokens, which bloats the input and makes it harder for models to understand the meaning efficiently or respond accurately.

With the new technique, however, “a billion-parameter model was equivalent to a 7 billion one like Llama 2,” Upperwal says. This performance was particularly marked in Hindi and Gujarati, where global models often underperform because of limited multilingual training data. It was a reminder that with smart engineering, small teams could still push boundaries.Upperwal eventually repurposed his core tech to build speech APIs for 22 Indian languages, a more immediate solution better suited to rural users who are often left out of English-first AI experiences. “If the path to AGI is a hundred-step process, training a language model is just step one,” he says.

At the other end of the spectrum are startups with more audacious aims. Krutrim-2, for instance, is a 12-billion-parameter multilingual language model optimized for English and 22 Indian languages. Krutrim-2 is attempting to solve India’s specific problems of linguistic diversity, low-quality data, and cost constraints. The team built a custom Indic tokenizer, optimized training infrastructure, and designed models for multimodal and voice-first use cases from the start, crucial in a country where text interfaces can be a problem. Krutrim’s bet is that its approach will not only enable Indian AI sovereignty but also offer a model for AI that works across the Global South. Besides public funding and compute infrastructure, India also needs the institutional support of talent, the research depth, and the long-horizon capital that produce globally competitive science. While venture capital still hesitates to bet on research, new experiments are emerging. Paras Chopra, an entrepreneur who previously built and sold the software-as-a-service company Wingify, is now personally funding Lossfunk, a Bell Labs–style AI residency program designed to attract independent researchers with a taste for open-source science. “We don’t have role models in academia or industry,” says Chopra. “So we’re creating a space where top researchers can learn from each other and have startup-style equity upside.”

Government-backed bet on sovereign AI The clearest marker of India’s AI ambitions came when the government selected Sarvam AI to develop a model focused on Indian languages and voice fluency. The idea is that it would not only help Indian companies compete in the global AI arms race but benefit the wider population as well. “If it becomes part of the India stack, you can educate hundreds of millions through conversational interfaces,” says Bindra. Sarvam was given access to 4,096 Nvidia H100 GPUs for training a 70-billion-parameter Indian language model over six months. (The company previously released a 2-billion-parameter model trained in 10 Indian languages, called Sarvam-1.) Sarvam’s project and others are part of a larger strategy called the IndiaAI Mission, a $1.25 billion national initiative launched in March 2024 to build out India’s core AI infrastructure and make advanced tools more widely accessible. Led by MeitY, the mission is focused on supporting AI startups, particularly those developing foundation models in Indian languages and applying AI to key sectors such as health care, education, and agriculture.

Under its compute program, the government is deploying more than 18,000 GPUs, including nearly 13,000 high-end H100 chips, to a select group of Indian startups that currently includes Sarvam, Upperwal’s Soket Labs, Gnani AI, and Gan AI. The mission also includes plans to launch a national multilingual data set repository, establish AI labs in smaller cities, and fund deep-tech R&D. The broader goal is to equip Indian developers with the infrastructure needed to build globally competitive AI and ensure that the results are grounded in the linguistic and cultural realities of India and the Global South.According to Abhishek Singh, CEO of IndiaAI and an officer with MeitY, India’s broader push into deep tech is expected to raise around $12 billion in research and development investment over the next five years. This includes approximately $162 million through the IndiaAI Mission, with about $32 million earmarked for direct startup funding. The National Quantum Mission is contributing another $730 million to support India’s ambitions in quantum research. In addition to this, the national budget document for 2025-26 announced a $1.2 billion Deep Tech Fund of Funds aimed at catalyzing early-stage innovation in the private sector. The rest, nearly $9.9 billion, is expected to come from private and international sources including corporate R&D, venture capital firms, high-net-worth individuals, philanthropists, and global technology leaders such as Microsoft. IndiaAI has now received more than 500 applications from startups proposing use cases in sectors like health, governance, and agriculture. “We’ve already announced support for Sarvam, and 10 to 12 more startups will be funded solely for foundational models,” says Singh. Selection criteria include access to training data, talent depth, sector fit, and scalability. Open or closed? The IndiaAI program, however, is not without controversy. Sarvam is being built as a closed model, not open-source, despite its public tech roots. That has sparked debate about the proper balance between private enterprise and the public good. “True sovereignty should be rooted in openness and transparency,” says Amlan Mohanty, an AI policy specialist. He points to DeepSeek-R1, which despite its 236-billion parameter size was made freely available for commercial use. Its release allowed developers around the world to fine-tune it on low-cost GPUs, creating faster variants and extending its capabilities to non-English applications. “Releasing an open-weight model with efficient inference can democratize AI,” says Hancheng Cao, an assistant professor of information systems and operations management at Emory University. “It makes it usable by developers who don’t have massive infrastructure.” IndiaAI, however, has taken a neutral stance on whether publicly funded models should be open-source. “We didn’t want to dictate business models,” says Singh. “India has always supported open standards and open source, but it’s up to the teams. The goal is strong Indian models, whatever the route.” There are other challenges as well. In late May, Sarvam AI unveiled Sarvam‑M, a 24-billion-parameter multilingual LLM fine-tuned for 10 Indian languages and built on top of Mistral Small, an efficient model developed by the French company Mistral AI. Sarvam’s cofounder Vivek Raghavan called the model “an important stepping stone on our journey to build sovereign AI for India.” But its download numbers were underwhelming, with only 300 in the first two days. The venture capitalist Deedy Das called the launch “embarrassing.”And the issues go beyond the lukewarm early reception. Many developers in India still lack easy access to GPUs and the broader ecosystem for Indian-language AI applications is still nascent. The compute question Compute scarcity is emerging as one of the most significant bottlenecks in generative AI, not just in India but across the globe. For countries still heavily reliant on imported GPUs and lacking domestic fabrication capacity, the cost of building and running large models is often prohibitive. India still imports most of its chips rather than producing them domestically, and training large models remains expensive. That’s why startups and researchers alike are focusing on software-level efficiencies that involve smaller models, better inference, and fine-tuning frameworks that optimize for performance on fewer GPUs. “The absence of infrastructure doesn’t mean the absence of innovation,” says Cao. “Supporting optimization science is a smart way to work within constraints.” Yet Singh of IndiaAI argues that the tide is turning on the infrastructure challenge thanks to the new government programs and private-public partnerships. “I believe that within the next three months, we will no longer face the kind of compute bottlenecks we saw last year,” he says. India also has a cost advantage.According to Gupta, building a hyperscale data center in India costs about $5 million, roughly half what it would cost in markets like the US, Europe, or Singapore. That’s thanks to affordable land, lower construction and labor costs, and a large pool of skilled engineers. For now, India’s AI ambitions seem less about leapfrogging OpenAI or DeepSeek and more about strategic self-determination. Whether its approach takes the form of smaller sovereign models, open ecosystems, or public-private hybrids, the country is betting that it can chart its own course. While some experts argue that the government’s action, or reaction (to DeepSeek), is performative and aligned with its nationalistic agenda, many startup founders are energized. They see the growing collaboration between the state and the private sector as a real opportunity to overcome India’s long-standing structural challenges in tech innovation. At a Meta summit held in Bengaluru last year, Nandan Nilekani, the chairman of Infosys, urged India to resist chasing a me-too AI dream. “Let the big boys in the Valley do it,” he said of building LLMs. “We will use it to create synthetic data, build small language models quickly, and train them using appropriate data.” His view that India should prioritize strength over spectacle had a divided reception. But it reflects a broader growing consensus on whether India should play a different game altogether. “Trying to dominate every layer of the stack isn’t realistic, even for China,” says Bharath Reddy, a researcher at the Takshashila Institution, an Indian public policy nonprofit. “Dominate one layer, like applications, services, or talent, so you remain indispensable.”

Dust hits $6M ARR helping enterprises build AI agents that actually do stuff instead of just talking

Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now Dust, a two-year-old artificial intelligence platform that helps enterprises build AI agents capable of completing entire business workflows, has reached $6 million in annual revenue — a six-fold increase from $1 million just one year ago. The company’s rapid growth signals a shift in enterprise AI adoption from simple chatbots toward sophisticated systems that can take concrete actions across business applications. The San Francisco-based startup announced Thursday that it has been selected as part of Anthropic’s “Powered by Claude” ecosystem, highlighting a new category of AI companies building specialized enterprise tools on top of frontier language models rather than developing their own AI systems from scratch. “Users want more than just conversational interfaces,” said Gabriel Hubert, CEO and co-founder of Dust, in an interview with VentureBeat. “Instead of generating a draft, they want to create the actual document automatically. Rather than getting meeting summaries, they need CRM records updated without manual intervention.” Dust’s platform goes far beyond the chatbot-style AI tools that dominated early enterprise adoption. Instead of simply answering questions, Dust’s AI agents can automatically create GitHub issues, schedule calendar meetings, update customer records, and even push code reviews based on internal coding standards–all while maintaining enterprise-grade security protocols. How AI agents turn sales calls into automated GitHub tickets and CRM updates The company’s approach becomes clear through a concrete example Hubert described: a business-to-business sales company using multiple Dust agents to process sales call transcripts. One agent analyzes which sales arguments resonated with prospects and automatically updates battle cards in Salesforce. Simultaneously, another agent identifies customer feature requests, maps them to the product roadmap, and in some cases, automatically generates GitHub tickets

Research Note: Our scheming precursor evals had limited predictive power for our in-context scheming evals

This is a linkpost for https://www.apolloresearch.ai/blog/research-note-our-scheming-precursor-evals-had-limited-predictive-power-for-our-in-context-scheming-evals

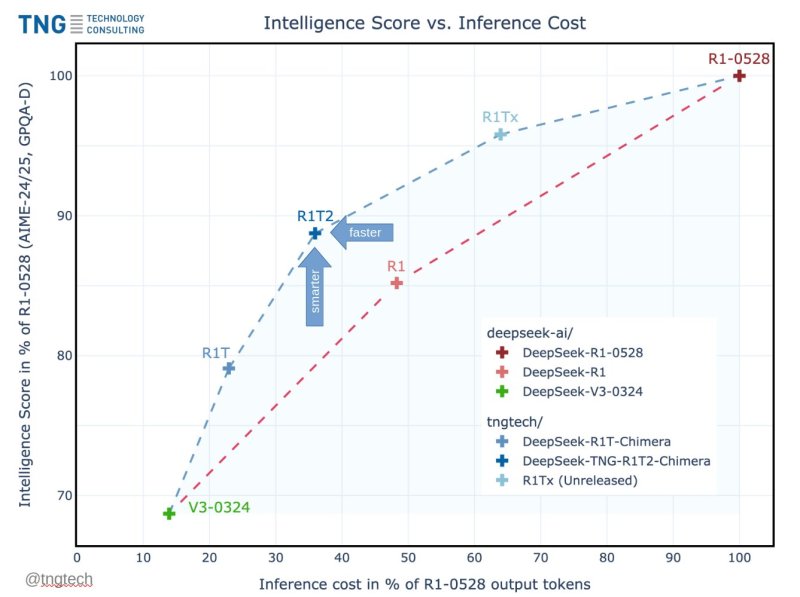

HOLY SMOKES! A new, 200% faster DeepSeek R1-0528 variant appears from German lab TNG Technology Consulting GmbH

Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now It’s been a little more than a month since Chinese AI startup DeepSeek, an offshoot of Hong Kong-based High-Flyer Capital Management, released the latest version of its hit open source model DeepSeek, R1-0528. Like its predecessor, DeepSeek-R1 — which rocked the AI and global business communities with how cheaply it was trained and how well it performed on reasoning tasks, all available to developers and enterprises for free — R1-0528 is already being adapted and remixed by other AI labs and developers, thanks in large part to its permissive Apache 2.0 license. This week, the 24-year-old German firm TNG Technology Consulting GmbH released one such adaptation: DeepSeek-TNG R1T2 Chimera, the latest model in its Chimera large language model (LLM) family. R1T2 delivers a notable boost in efficiency and speed, scoring at upwards of 90% of R1-0528’s intelligence benchmark scores, while generating answers with less than 40% of R1-0528’s output token count. That means it produces shorter responses, translating directly into faster inference and lower compute costs. On the model card TNG released for its new R1T2 on the AI code sharing community Hugging Face, the company states that it is “about 20% faster than the regular R1” (the one released back in January) “and more than twice as fast as R1-0528” (the May official update from DeepSeek). Already, the response has been incredibly positive from the AI developer community. “DAMN! DeepSeek R1T2 – 200% faster than R1-0528 & 20% faster than R1,” wrote Vaibhav (VB) Srivastav, a senior leader at Hugging Face, on X. “Significantly better than R1 on GPQA & AIME 24, made via Assembly of Experts with DS V3, R1 & R1-0528

The Download: AI agents hype, and Google’s electricity plans

This is today’s edition of The Download, our weekday newsletter that provides a daily dose of what’s going on in the world of technology. Don’t let hype about AI agents get ahead of reality —Yoav Shoham is a professor emeritus at Stanford University and cofounder of AI21 Labs. At Google’s I/O 2025 event in May, the company showed off a digital assistant that didn’t just answer questions; it helped work on a bicycle repair by finding a matching user manual, locating a YouTube tutorial, and even calling a local store to ask about a part, all with minimal human nudging. Such capabilities could soon extend far outside the Google ecosystem.The vision is exciting: Intelligent software agents that act like digital coworkers, booking your flights, rescheduling meetings, filing expenses, and talking to each other behind the scenes to get things done.But if we’re not careful, we’re going to derail the whole idea before it has a chance to deliver real benefits. As with many tech trends, there’s a risk of hype racing ahead of reality. And when expectations get out of hand, a backlash isn’t far behind. Read the full story.

Google’s electricity demand is skyrocketing

We got two big pieces of energy news from Google this week. The company announced that it’s signed an agreement to purchase electricity from a fusion company’s forthcoming first power plant. Google also released its latest environmental report, which shows that its energy use from data centers has doubled since 2020. Taken together, these two bits of news offer a fascinating look at just how desperately big tech companies are hunting for clean electricity to power their data centers as energy demand and emissions balloon in the age of AI. Of course, we don’t know exactly how much of this pollution is attributable to AI because Google doesn’t break that out. (Also a problem!) So, what’s next and what does this all mean? —Casey Crownhart This article is from The Spark, MIT Technology Review’s weekly climate newsletter. To receive it in your inbox every Wednesday, sign up here.+ To read more about whether nuclear energy is really a viable way to power the AI boom, check out Casey’s recent article, which is part of Power Hungry: AI and our energy future—our new series shining a light on the energy demands and carbon costs of the artificial intelligence revolution. You can take a look at the rest of the package here. The must-reads I’ve combed the internet to find you today’s most fun/important/scary/fascinating stories about technology. 1 Meta’s climate tool was ‘trained using faulty data’Scientists claim it raised false hopes about the feasibility of removing carbon dioxide from the atmosphere. (FT $)+ xAI’s gas turbines have been greenlit, despite community backlash. (Wired $)+ Why we need to shoot carbon dioxide thousands of feet underground. (MIT Technology Review)

2 We don’t know whether US insurers will cover vaccines for kidsMajor insurers haven’t confirmed whether they’ll keep covering the costs of shots. (Wired $)+ What’s next for the Gates Foundation’s global health initiatives? (Undark)+ How measuring vaccine hesitancy could help health professionals tackle it. (MIT Technology Review) 3 The Trump administration wants to gut Biden’s climate lawThe Inflation Reduction Act’s green energy tax incentives are hanging in the balance. (WP $)+ It’s bad news for one of the US economy’s biggest growth sectors. (Vox)+ How are we going to feed the world without making climate change worse? (New Yorker $)+ The President threatened to unravel the landmark law long before he was elected. (MIT Technology Review) 4 There are certain tells a scientific study abstract has been written by AIUse of hundreds of words has shot up since ChatGPT was made public. (NYT $)+ Beware over-reliance on AI-text detection tools, though. (MIT Technology Review) 5 Elon Musk doesn’t care about cars any moreWhich is terrible news for Tesla and its investors. (WSJ $)+ Things aren’t looking too hot for Rivian, either. (Insider $) 6 America’s weather forecasting is getting worseJust a year ago, US storm forecasting was the best it had ever been. Now, its accuracy is rapidly declining. (The Atlantic $) 7 Brazil has sustainable data center ambitionsEnvironmentalists aren’t convinced, however. (Rest of World) 8 A mysterious object has been spotted passing through the solar systemAnd we’ve got good reason to believe it originated outside our system. (Ars Technica) 9 A rising band on Spotify is probably AI-generatedBut no one seems able to say for sure. (Vice)

10 The homes float in flood waterIt’s one solution to building homes on known flood plains. (Fast Company $)+ How to stop a state from sinking. (MIT Technology Review)

Quote of the day “AI doesn’t know what an orgasm sounds like.” —Annabelle Tudor, an audiobook narrator, tells the Guardian why she’s not convinced by the industry’s plans to have AI narrate audiobooks. One more thing Who gets to decide who receives experimental medical treatments?

There has been a trend toward lowering the bar for new medicines, and it is becoming easier for people to access treatments that might not help them—and could even harm them. Anecdotes appear to be overpowering evidence in decisions on drug approval. As a result, we’re ending up with some drugs that don’t work. We urgently need to question how these decisions are made. Who should have access to experimental therapies? And who should get to decide? Such questions are especially pressing considering how quickly biotechnology is advancing. We’re not just improving on existing classes of treatments—we’re creating entirely new ones. Read the full story. —Jessica Hamzelou

We can still have nice things A place for comfort, fun and distraction to brighten up your day. (Got any ideas? Drop me a line or skeet ’em at me.) + These aerial shots of Glastonbury festival are crazy.+ Our oceans really are amazing places—take a moment to appreciate them.+ How to be truly cool, according to science.+ Happy 62nd birthday to Tracey Emin, still an enfant terrible after all these years.

Angola Raises Diesel Price by 33 Pct, Third Increase This Year