Oil closed unchanged after a choppy session as investors assessed whether a prospective deal by the US and Russia to halt the war in Ukraine would receive international support and materially affect Russian crude flows.

West Texas Intermediate swung in a roughly $1.80 range before ending the day flat below $64 a barrel, narrowly breaking a six-session losing streak. The US and Russia are aiming to reach a deal that would lock in Russia’s occupation of territory seized during its invasion, according to people familiar with the matter. Washington is working to get buy-in from Ukraine and its European allies on the agreement, which is far from certain.

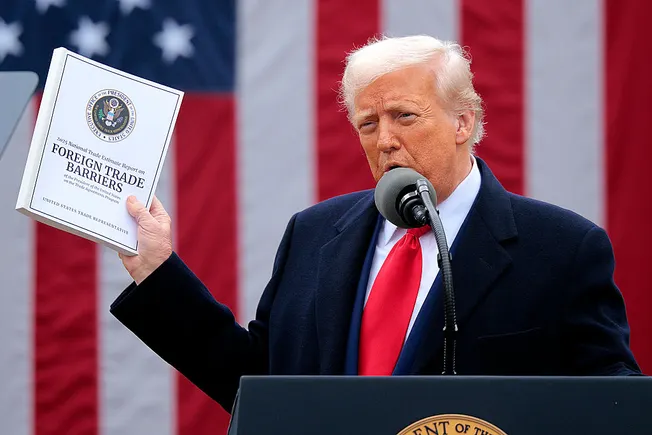

The US and the European Union have targeted Russia’s oil revenues in response to its invasion of Ukraine, with President Donald Trump just this week doubling levies on all Indian imports to 50% as a penalty for the nation taking Russian crude and threatening similar measures against China.

Though investors remain skeptical that Europe would support a deal representing a major victory for Russian President Vladimir Putin, the renewed collaboration between Washington and Moscow has lifted expectations that the nation’s crude will continue to flow freely to its two biggest buyers. Still, the market’s focus has shifted to whether US sanctions on Russia — which have crimped Russia’s ability to sell oil and replenish the Kremlin’s war chest in recent months — will remain in place.

“A possible truce would be only modestly bearish crude — assuming there is no lifting of EU and US sanctions against Russian energy — since the market does not currently price in much disruption risk,” said Bob McNally, founder of the Rapidan Energy Group and a former White House official. The proposed deal resembles a ceasefire, not a full-fledged peace agreement, he added.

At the same time, oil traders, producers and users have proved adept in recent years at responding to supply challenges, whether they stem from conflict, geopolitical risks, or administrative hurdles such as sanctions and tariffs. Among signs of that flexibility this week were Russian Urals cargoes — from the nation’s west — being offered to Chinese buyers who don’t typically take such grades.

Russian President Vladimir Putin is demanding that Ukraine cede its eastern Donbas area to Russia, as well as Crimea, which his forces illegally annexed in 2014. That would require Ukrainian President Volodymyr Zelenskiy to order a withdrawal of troops from parts of the Luhansk and Donetsk regions still held by Kyiv.

Deteriorating Outlook

The development compounded general bearishness as peak summer demand season comes to an end, with oil slumping more than 7% in August following three months of gains. Investors are braced for a potential glut later this year after OPEC+ followed through on a campaign to relax output curbs. At the same time, crude futures have been weighed down by signs of slower growth in the world’s largest economy as Trump’s wider tariffs take a toll on activity, posing a risk to energy demand.

In another sign of deteriorating conditions, commodity trading advisers, which tend to accelerate price moves, flipped to net-short on Friday for the first time since early June, according to data from Bridgeton Research Group. The algorithmic-based traders are now sitting 36% short in WTI, compared with 18% just a day earlier, Bridgeton said. Global benchmark Brent is positioned at 27% short, compared with 9% long on Thursday, the firm said.

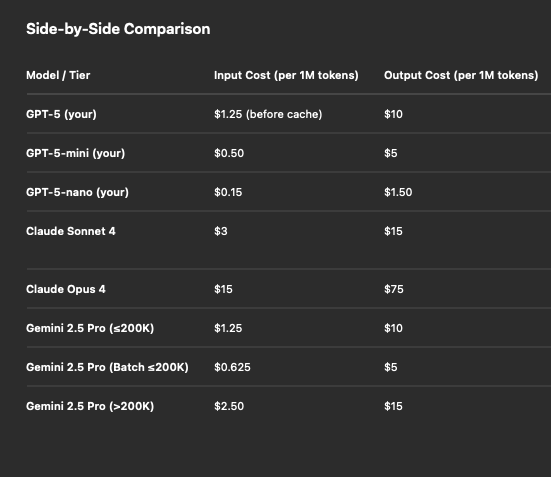

Oil Prices

- West Texas Intermediate for September delivery settled unchanged at $63.88 a barrel in New York.

- Brent for October settlement advanced 16 cents to $66.59 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.