Qatar Gas Transport Co. is seeking a $1 billion syndicated loan, according to a person familiar with the matter, adding to the flurry of Middle East borrowers that have tapped Asian lenders recently.

Mizuho Bank Ltd. is the sole mandated lead arranger and bookrunner of the five-year deal, the person said, who asked not to be identified discussing private matters. The deal carries a greenshoe option, which allows the size to increase by an additional $330 million, the person said.

The loan, which is being syndicated to the broader market, pays an interest margin of 82 basis points over the benchmark Secured Overnight Financing Rate, the person said, adding that the proceeds are for general corporate purposes.

Qatar Gas didn’t immediately respond to a request for comment.

Qatar Gas joins a slew of Middle East borrowers, notably from the Gulf States, keen to tap banks in Asia to diversify fundraising beyond their domestic capital markets. Saudi Investment Bank, for example, just launched a syndicated loan of as much as $750 million, while Saudi Electricity Co. is in the market with a $1 billion facility.

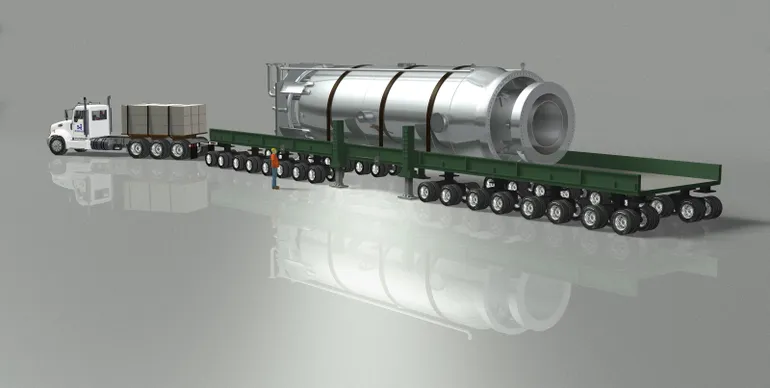

Qatar Gas, more commonly known as Nakilat, is expanding its liquefied natural gas fleet as the nation seeks to reinforce its position as a leading global supplier of clean energy, according to local media. The borrower last month launched its first financing package with the Export-Import Bank of Korea to build 25 conventional Korean-built LNG vessels.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.