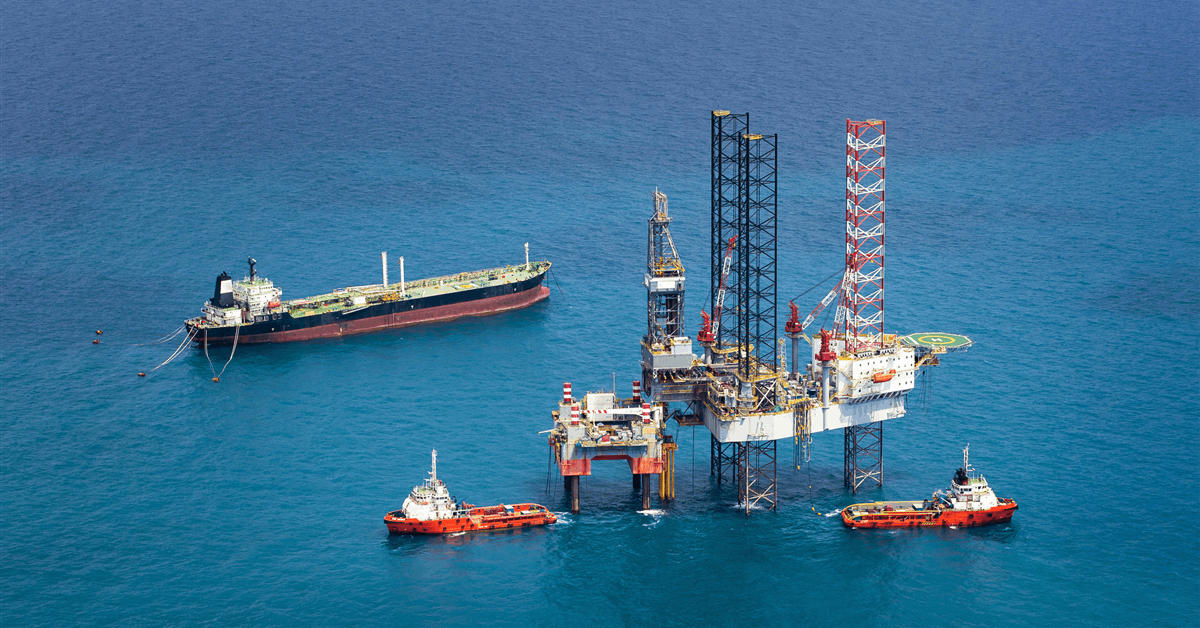

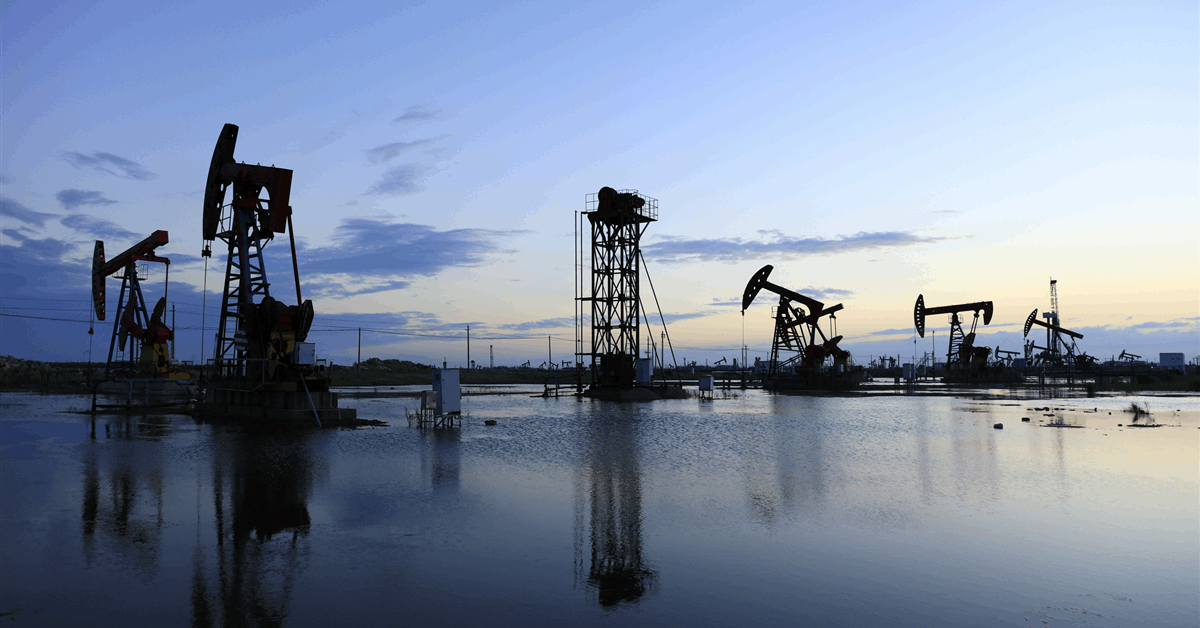

Woodside Energy Group Ltd. reported half-year production of 548 thousand barrels of oil equivalent per day (boepd), or 99.2 million barrels of oil equivalent (boe) in total, which is 11% higher compared to the comparable period last year.

The Australian energy company said in a half-year report that it reduced unit production costs to $7.70 per boe from $8.30 per boe.

“The outstanding performance of our high-quality assets over the first half has continued to support safe, reliable operations,” Woodside CEO Meg O’Neill said. “This has been complemented by a strong focus on cost management, resulting in a reduction in our unit production costs. We have also taken a disciplined approach to future growth and reduced spend on new energy and exploration as we prioritize delivering sanctioned projects”.

Woodside reported first-half earnings of $0.69 per diluted share, down from $1.01 a year ago. Underlying net profit after tax dropped to $1.25 billion from $1.63 billion, while operating revenue rose to $6.59 billion from $6.0 billion in the same period in 2024.

“A highlight was the ongoing exceptional performance of our Senegal Project, which marked one year since first oil in June 2024. In just the first half of 2025, Sangomar has generated revenue nearing $1 billion, with gross production of 100 thousand barrels per day. Proved reserves have also been added, following positive early field performance,” O’Neill said.

“Our excellence in project delivery was further demonstrated in the first half. The Scarborough Energy Project in Western Australia is 86 percent complete and targeting first LNG [liquefied natural gas] cargo in the second half of 2026. Our Trion Project offshore Mexico is 35 percent complete and targeting first oil in 2028,” she added.

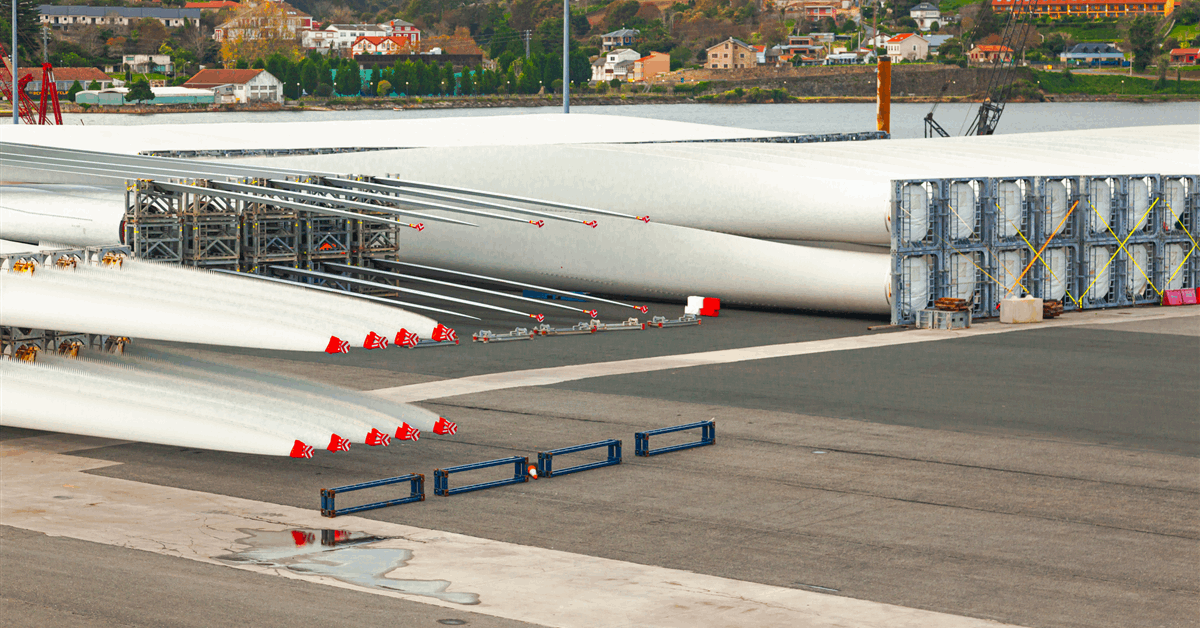

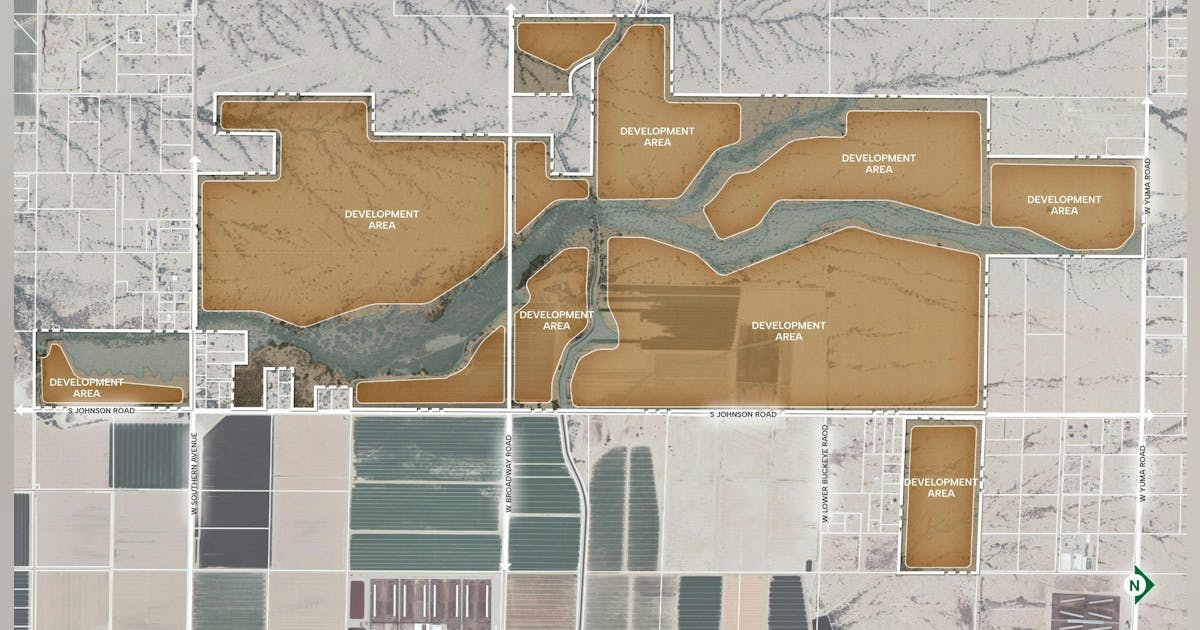

In April, Woodside made a final investment decision on Louisiana LNG in Calcasieu Parish. The FID approved phase 1, which involves three liquefaction trains with a combined capacity of 16.5 million metric tons per annum.

“The project’s compelling value proposition was reinforced with key infrastructure, offtake, and gas supply agreements signed with high-quality partners. This included completion of the sell-down of a 40 percent interest in Louisiana LNG Infrastructure LLC to Stonepeak for $5.7 billion, which will see Stonepeak contribute 75 percent of the expected project capital expenditure over both 2025 and 2026,” O’Neill said.

“We continue to receive strong interest from high-quality potential partners as we explore further sell-downs of Louisiana LNG. This highlights the distinct value Woodside offers, with our business model well positioned to deliver compelling long-term value in the US LNG market, further differentiated by our extensive LNG experience, portfolio marketing capabilities, and balance sheet strength,” she stated.

Last month, Woodside said it agreed to assume operatorship of the Bass Strait assets, unlocking potential development of additional gas resources, after an agreement with ExxonMobil Australia.

From completion, Woodside will assume operatorship of the offshore Bass Strait production assets, the Longford Gas Plant, the Long Island Point gas liquids processing facility and associated pipeline infrastructure. Woodside and ExxonMobil’s equity interests in the assets and current decommissioning plans and provisions remain unchanged, according to an earlier statement.

As operator, Woodside said it will take on responsibility for asset planning and execution activities, pursuing a value maximization strategy that targets further production and reliability improvements.

The company said it has identified four potential development wells that could deliver up to 200 petajoules of sales gas to the market. Under the agreement, Woodside can solely develop these opportunities through the Bass Strait infrastructure subject to further technical maturation and a final investment decision.

“Further strengthening our operational capabilities and subsequent to the period, we agreed to assume operatorship of the Bass Strait assets offshore Victoria from ExxonMobil. This agreement creates flexibility for future development opportunities through existing infrastructure,” O’Neill said.

The Bass Strait assets include the Gippsland Basin Joint Venture (GBJV) and the Kipper Unit Joint Venture (KUJV). Woodside and ExxonMobil Australia hold a 50 percent participating interest each in the GBJV and 32.5 percent participating interest each in the KUJV, the statement said.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR