Diamondback Energy Inc. and Kinetik Holdings Inc. have signed agreements to sell each of their 27.5 percent stakes in EPIC Crude Holdings LP to Plains for around $1.57 billion.

Plains will become the majority owner with a 55 percent interest in EPIC Crude Holdings, owner of the EPIC Crude Oil Pipeline. Ares Management Corp.’s EPIC Midstream Holdings LP will retain an operating stake of 45 percent.

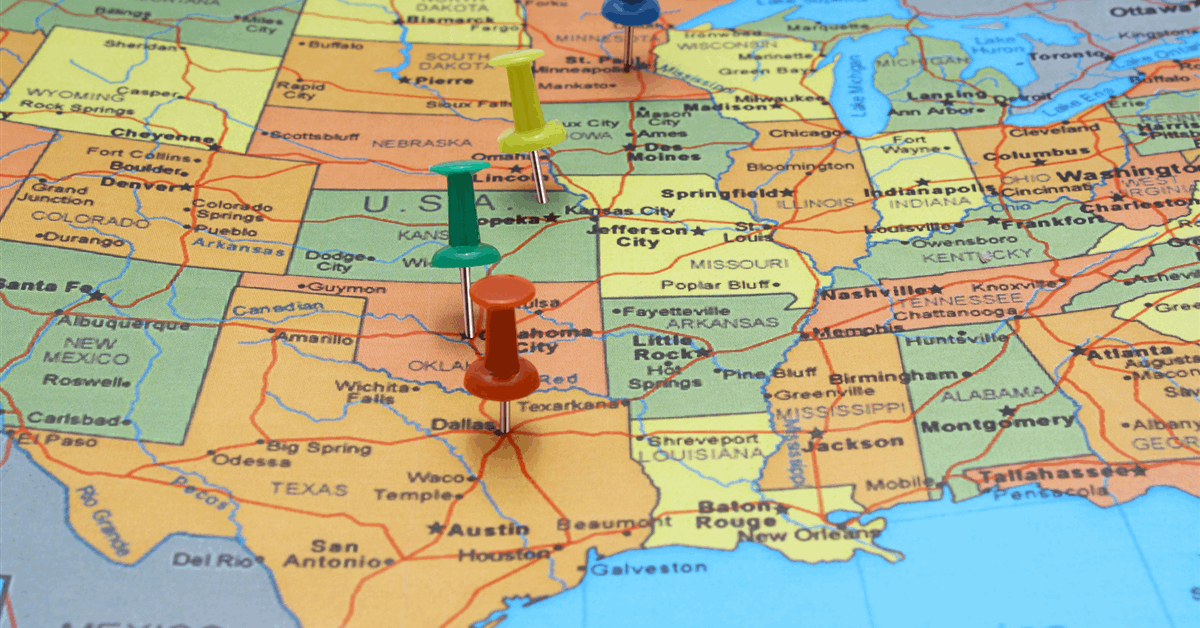

Stretching 800 miles, the pipeline system carries Delaware Basin and Midland Basin supply from locations near Crane, Midland, Orla and Wink, Texas, and Eagle Ford supply from locations near Gardendale and Hobson, Texas. The pipeline system delivers the oil to EPIC Crude Holdings’ 3.4-million-barrel Robstown Terminal near Corpus Christi, according to EPIC Midstream.

The pipeline system, which became fully operational April 2020, has a nameplate capacity of 600,000 barrels per day (bpd), expandable up to one million bpd, and nearly seven million barrels of operational storage, according to EPIC Midstream.

The assets boost Plains’ Permian wellhead to water strategy, Plains said in a statement on its website, noting the pipeline system is “underpinned by long-term minimum volume commitments from high-quality customers”.

“This transaction strengthens our position as the premier crude oil midstream provider, complements our asset footprint and enhances our customer offering”, said Plains chair, chief executive and president Willie Chiang. “The combination of our stake in EPIC Crude Holdings coupled with our existing integrated Permian and Eagle Ford assets enhances our commitment to offering a high level of connectivity and flexibility for our customers.

“By further linking our Permian and Eagle Ford gathering systems to Corpus Christi, we are enhancing market access and ensuring our customers have reliable, cost-effective routes to multiple demand centers”.

Plains agreed to pay Diamondback and Kinetik an additional $193 million should an expansion of the pipeline system to a capacity of at least 900,000 bpd be sanctioned before the end of 2027.

Diamondback and Kinetik acquired their stakes only last year.

“This is a great outcome for Diamondback, generating a meaningful return on our invested capital”, Diamondback chief executive and director Kaes Van’t Hof said in a separate statement.

“We look forward to maintaining our strong commercial relationship with the EPIC Crude and Plains teams as an anchor shipper on the EPIC Crude pipeline”.

Kinetik president and chief executive Jamie Welch said, “The transaction represents a compelling opportunity to advance our commitment to maximize long-term shareholder value by recycling proceeds from non-core asset sales to attractive growth projects and potential acceleration of shareholder returns”.

The parties expect to complete the transactions early 2026 subject to customary closing conditions including federal antitrust clearance.

Earlier this year EPIC Midstream divested its natural gas liquids pipelines, fractionation facilities and distribution systems to Phillips 66 for about $2.2 billion.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR