Whenever behemoth chipmaker NVIDIA announces its quarterly earnings, those results can have a massive influence on the stock market and its position as a key indicator for the AI industry.

After all, NVIDIA is the most valuable publicly traded company in the world, valued at $4.24 trillion—ahead of Microsoft ($3.74 trillion), Apple ($3.41 trillion), Alphabet, the parent company of Google ($2.57 trillion), and Amazon ($2.44 trillion). Due to its explosive growth in recent years, a single NVIDIA earnings report can move the entire market.

So, when NVIDIA leaders announced during their August 27 earnings call that Q2 2026 sales surged 56% to $46.74 billion, it was a record-setting performance for the company—and investors took notice.

Executive VP & CFO Colette M. Kress said the revenue exceeded leadership’s outlook as the company grew sequentially across all market platforms. She outlined a path toward substantial growth driven by AI infrastructure.

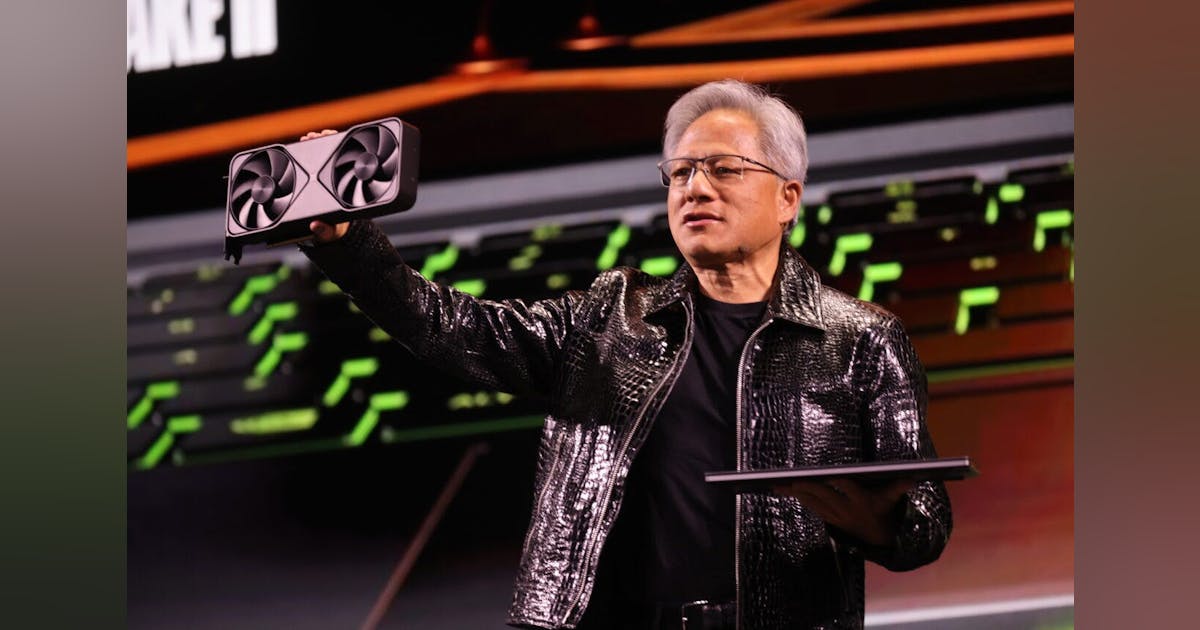

Foreseeing significant long-term growth opportunities in agentic AI and considering the scale of opportunity, CEO Jensen Huang said, “Over the next 5 years, we’re going to scale into it with Blackwell [architecture for GenAI], with Rubin [successor to Blackwell], and follow-ons to scale into effectively a $3 trillion to $4 trillion AI infrastructure opportunity.”

The chipmaker’s Q2 2026 earnings fell short of Wall Street’s lofty expectations, but they did demonstrate that its sales are still rising faster than those of most other tech companies. NVIDIA is expected to post revenue growth of at least 42% over the next four quarters, compared with an average of about 10% for firms in the technology-heavy Nasdaq 100 Index, according to data compiled by Bloomberg Intelligence.

On August 29, two days after announcing their earnings, NVIDIA stocks slid 3% and other chip stocks also declined. This came amid a broader sell-off after server-maker Dell, a customer of those chipmakers, gave a 3Q earnings outlook below Wall Street’s estimates, while a new report said Chinese tech giant Alibaba is testing a new chip to compete with NVIDIA and Advanced Micro Devices (AMD) in China.

Uncertainty About China

Data center revenue grew 56% Y-o-Y, despite the $4 billion decline in H20 chip revenue. In April, the Trump administration blocked NVIDIA from selling the H20, which is designed specifically for the China market.

Huang estimated the China market to have about $50 billion of opportunity for NVIDIA in 2026 if the firm was able to address it with competitive products.

In August, Huang struck a deal with the President to restart sales to China by agreeing to give 15% of the region’s sales to the U.S. government. That deal hasn’t been finalized.

“In late July, the U.S. government began reviewing licenses for sales of H20 to China customers,” Kress noted. “While a select number of our China-based customers have received licenses over the past few weeks, we have not shipped any H20 based on those licenses.”

Looking Ahead: Q3 Guidance and Strategic Levers

NVIDIA is projecting fiscal Q3 revenue of $54 billion, plus or minus 2%, implying sequential growth of about 16% driven by continued strength in data center demand. Importantly, this guidance assumes no shipments of the H20 chip into China, reflecting ongoing export-control restrictions. CFO Colette Kress noted that, should the geopolitical landscape shift, NVIDIA could unlock an additional $2 billion to $5 billion in H20 revenue during the quarter.

The company also expects GAAP and non-GAAP gross margins of approximately 73.3% and 73.5%, respectively, with a range of plus or minus 50 basis points. Operating expenses are forecast to grow in the high-30% range for the full year, signaling sustained investment in R&D and AI infrastructure capacity.

Huang emphasized that adoption of the new Blackwell architecture is already fueling growth, with sequential gains of 17% in Blackwell-related data center revenue. However, the company also revealed that just two hyperscale customers accounted for 39% of Q2 revenue: a reminder of both NVIDIA’s dominance and its reliance on a handful of mega-buyers.

Meanwhile, NVIDIA continues to return capital to shareholders, with $24.3 billion distributed in the first half of fiscal 2026 through share repurchases and dividends. The board has authorized an additional $60 billion buyback program, underscoring confidence in the company’s trajectory.

Key Guidance Highlights:

-

Q3 revenue outlook: $54 billion ±2%.

-

Gross margins: ~73.3% GAAP, ~73.5% non-GAAP.

-

Potential $2–$5 billion upside from H20 shipments if licenses resume.

-

Operating expenses expected to grow in the high-30% range.

-

Shareholder returns: $24.3 billion YTD, with $60 billion new buyback authorization.