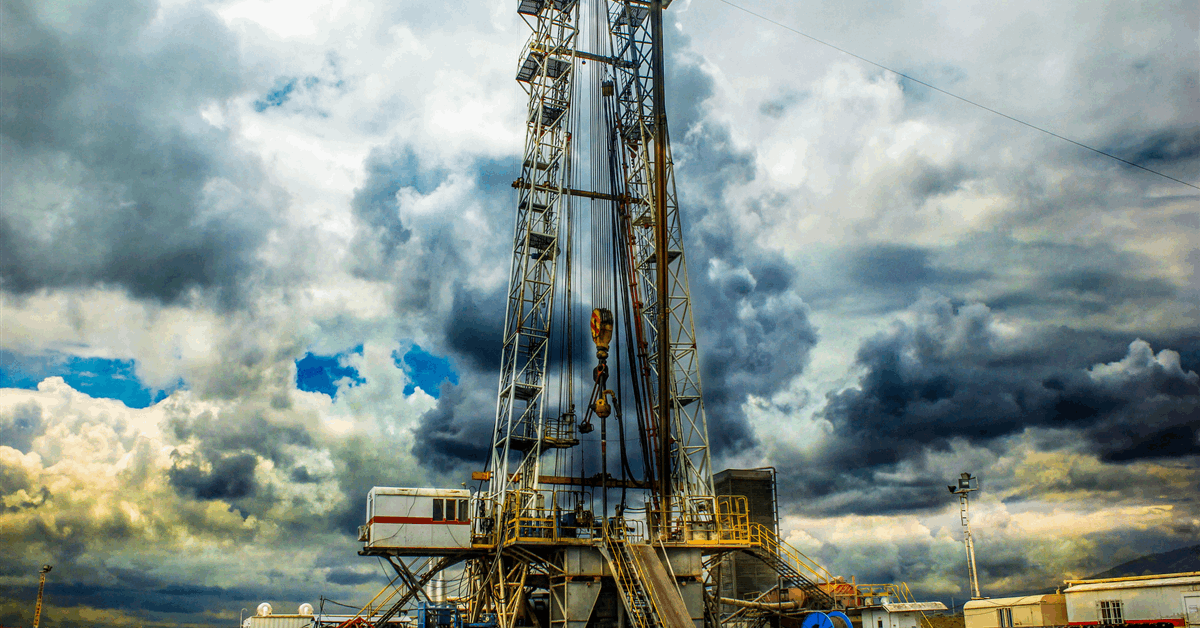

Baker Hughes said it was awarded a contract by geothermal energy firm Fervo Energy Company to design and deliver equipment for five Organic Rankine Cycle (ORC) power plants at Fervo’s Cape Station power generation project near Milford, Utah.

Once operational, the five Cape Phase II ORC plants will generate approximately 300 megawatts (MW) of power to the grid, which is the equivalent of powering about 180,000 homes, Baker Hughes said in a news release.

Financial terms of the contract were not disclosed.

The engineering and equipment scope for the project includes design and delivery of equipment for five 60-MW-electric ORC units, including the engineering, manufacturing, and supply of turboexpanders and the BRUSH Power Generation generator, according to the release.

The order, to be booked under the Industrial & Energy Technology segment of Baker Hughes, follows previous awards from Fervo Energy for subsurface drilling and production technologies from the company’s Oilfield Services & Equipment business, the release said.

Baker Hughes said its equipment is designed to operate with Fervo’s Enhanced Geothermal Systems (EGS), “resulting in a fully integrated power plant that drives scalability in sustainable baseload power generation”.

The award is for Fervo-exclusive surface power generation equipment leveraging Baker Hughes’ geothermal solutions portfolio, which covers subsurface and production technology as well as power generation solutions, the company said.

“Baker Hughes’ expertise and technology are ideal complements to the ongoing progress at Cape Station, which has been under construction and successfully meeting project milestones for almost two years,” Fervo Energy co-founder and CEO Tim Latimer said. “Fervo designed Cape Station to be a flagship development that’s scalable, repeatable, and a proof point that geothermal is ready to become a major source of reliable, carbon-free power in the U.S.”

“Geothermal power is one of several renewable energy sources expanding globally and proving to be a vital contributor to advancing sustainable energy development,” Baker Hughes Chairman and CEO Lorenzo Simonelli said. “By working with a leader like Fervo Energy and leveraging our comprehensive portfolio of technology solutions, we are supporting the scaling of lower-carbon power solutions that are integral to meet growing global energy demand”.

The Cape Station project includes Cape Station Phase I, which is poised to deliver 100 MW of baseload power to the grid beginning in 2026, as well as Cape Station Phase II, which will generate an additional 400 MW and come online by 2028. The full Cape Station development has received permitting approval for up to 2 gigawatts of reliable and renewable energy, according to the release.

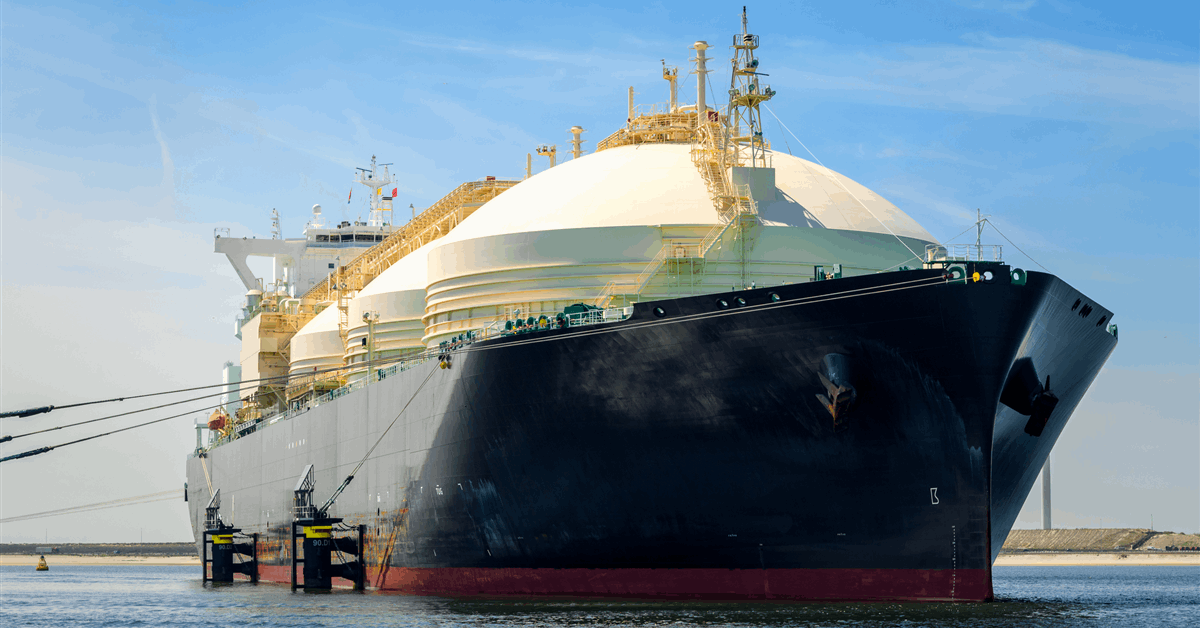

Last month, Baker Hughes won a long-term service agreement award from BP plc for its Tangguh Liquefied Natural Gas (LNG) plant in Papua Barat, Indonesia.

The 90-month agreement covers spare parts, repair services, and field service engineering support for critical turbomachinery at the facility including heavy-duty gas turbines, steam turbines, and compressors for three LNG trains, the company said in an earlier statement.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR