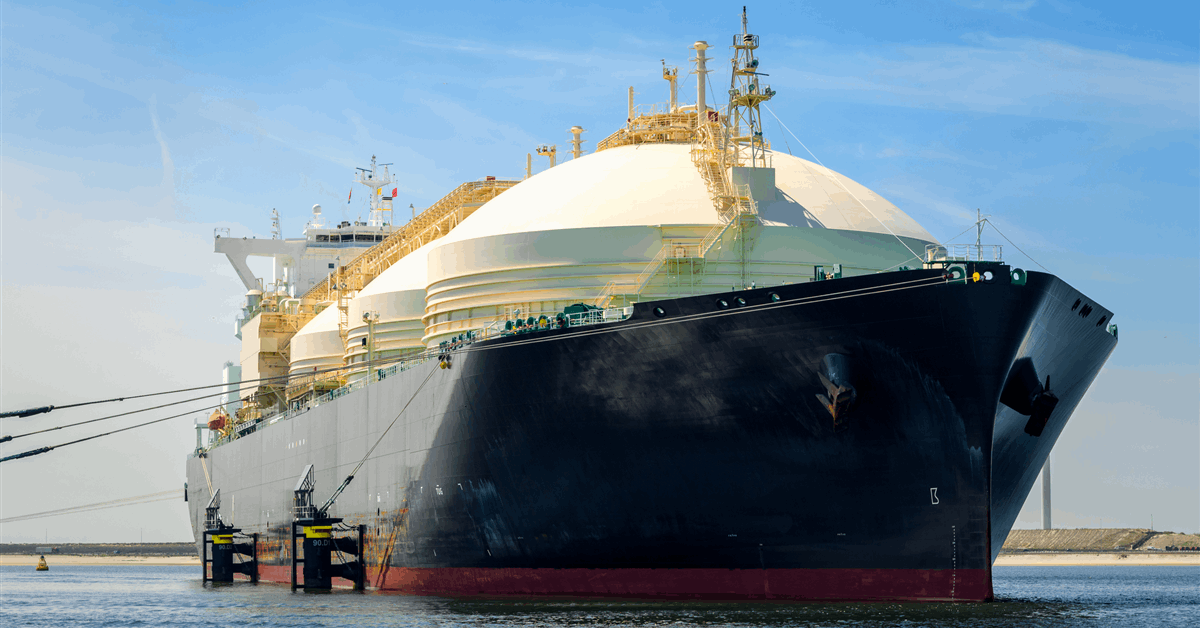

JERA Co Inc and Glenfarne Group LLC announced Wednesday a letter of intent for the Japanese utility’s offtake of one million metric tons per annum (MMtpa) of liquefied natural gas (LNG) from Glenfarne’s Alaska LNG project.

The potential purchase will be for 20 years on a free-on-board basis, a joint statement said.

“Since becoming the 75 percent shareholder and lead developer of the Alaska LNG project in March of 2025, Glenfarne has secured preliminary commercial agreements for more than half of Alaska LNG’s available third-party LNG offtake capacity, including agreements with CPC in Taiwan and PTT in Thailand”, the statement said. “Negotiations to advance these agreements to binding contracts are underway.

“Glenfarne is in discussions with potential customers for LNG volumes exceeding Alaska LNG’s total capacity”.

Alaska LNG holds a Department of Energy (DOE) permit to export a cumulative 20 million metric tons per annum (MMtpa) to both FTA and non-FTA countries. The project secured the authorization November 2014 for the portion for countries with a free trade agreement (FTA) with the United States and August 2020 for the non-FTA portion.

In May 2020 Alaska LNG obtained Federal Energy Regulatory Commission approval for siting, construction and operation to deliver natural gas from the state’s North Slope to both domestic and global markets. The approved proposal includes a 42-inch diameter pipeline about 807 miles long and capable of transporting up to 3.9 billion cubic feet of gas per day to Alaska LNG’s liquefaction facilities.

Alaska LNG is the only federally permitted LNG project on the U.S. Pacific Coast, according to the developers.

Glenfarne Alaska LNG LLC president Adam Prestidge said in Wednesday’s announcement, “Alaska LNG’s economic and strategic competitive advantages, including the shortest U.S. shipping proximity to Asia and abundant, low-volatility North Slope gas reserves, are propelling our commercial progress”.

U.S. Energy Secretary Chris Wright was quoted in the statement as saying, “Alaska LNG will not only be one of the greatest energy infrastructure projects in our nation’s history, but also provides enormous energy security to the United States and our allies”.

Glenfarne and co-owner Alaska Gasline Development Corp (25 percent) plan to develop the portion for the domestic market first, for which they expect to make a FID (final investment decision) by year-end.

On June 3 Glenfarne said the first round of partner selection saw expressions of interest totaling over $115 billion of contract value, “including equipment and material supply, services, investment, and customer agreements”.

On May 27 Glenfarne said it has brought in Worley Ltd to complete engineering works and update the cost estimate for Alaska LNG.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR