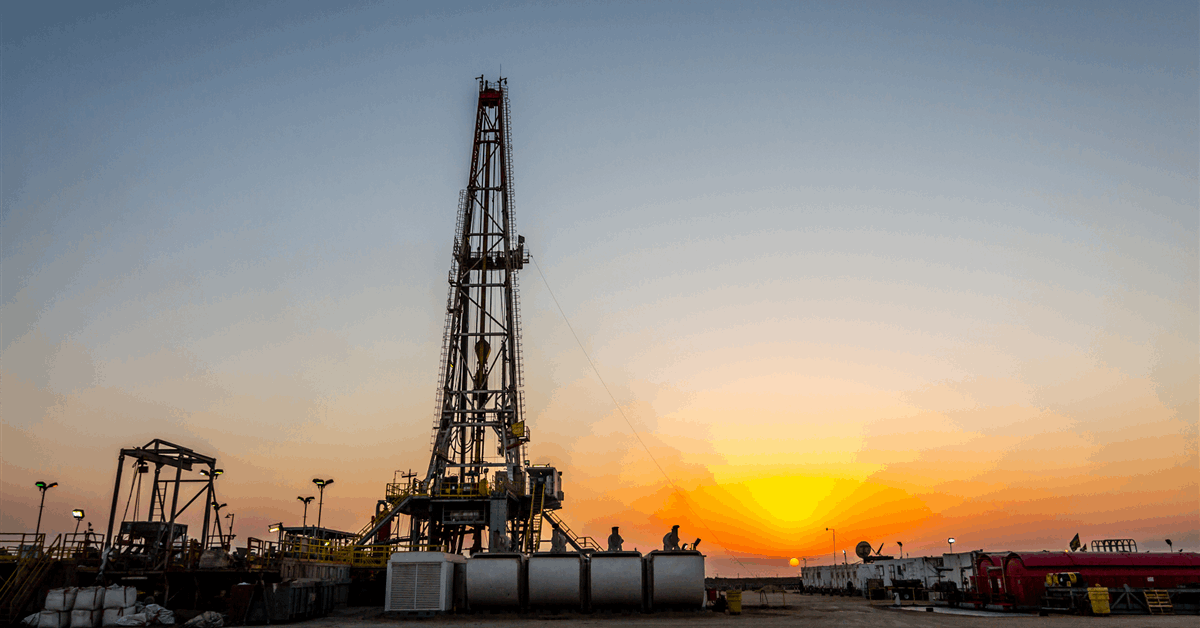

Nigeria’s crude losses from theft and metering issues dropped to their lowest in nearly 16 years at 9,600 barrels per day (bpd), the West African country’s upstream regulator has reported.

Representing the one year to July, the figure is the lowest daily average since 2009, according to the Nigerian Upstream Petroleum Regulatory Commission (NUPRC).

“So far in 2025, only 2.04 million barrels have been lost, which is a reduction of 35.56 million barrels compared to the 37.6 million barrels lost in 2021, underscoring the scale of progress made in just four years”, the NUPRC said in a statement on its website.

“Crude oil losses in 2021 were the highest recorded in nearly 23 years, making it the peak year between 2002 and July 2025”.

In 2022 yearly losses dropped to 20.9 million barrels or 57,200 bpd. The daily average fell to 11,900 bpd in 2023 and 11,300 bpd in 2024, the NUPRC said.

“Remarkably, in just the first seven months of 2025, losses were cut by 50.2 percent, with only 2.04 million barrels lost over the period”, it said.

“Since the implementation of the Petroleum Industry Act (PIA) in 2021, Nigeria has recorded steady progress in reducing crude oil losses”, the NUPRC said.

“The commission has adopted a balanced mix of kinetic and non-kinetic strategies in tackling oil losses”, it added. “On the kinetic front, the commission has continued to collaborate closely with security agencies, operators and communities.

“On the non-kinetic front, NUPRC has implemented strategic regulatory measures to close systemic loopholes. One key initiative is the metering audit across upstream facilities to ensure accurate measurement of production and exports”.

It said it has also approved 37 new crude evacuation routes to counter oil theft.

Monthly Production Growth

Meanwhile July 2025 liquids production grew 9.9 percent compared to July 2024, the NUPRC reported earlier. July 2025 output averaged 1.71 million bpd (MMbpd), consisting of about 1.51 MMbpd of oil and around 205,000 bpd of condensate. Month-on-month, July 2025 production rose 0.89 percent.

“On the monthly performance of Nigeria’s crude oil terminals, Forcados recorded the highest output in July 2025 with 9.04 million barrels, representing a 2.1 percent increase from 8.85 million barrels in June”, the NUPRC said August 25.

Decommissioning Liabilities

In other achievements, the NUPRC said Nigeria secured over $400 million in decommissioning liabilities in 2024, as well as applied stricter rules in recent asset transfers.

Nigeria recently saw a spate of divestments by international energy majors, including Shell PLC.

Shell said March 13 it had completed the sale of its subsidiary in the Niger Delta, where it had frequently reported oil theft and sabotage. The NUPRC had held back the $1.3 billion divestment of Shell Petroleum Development Company of Nigeria Ltd to assess environmental liabilities, according to a statement by the commission April 29, 2024.

Across the Nigerian upstream sector last year, more than $400 million in “pre-sale decommissioning and abandonment liabilities have been secured through Letters of Credit and escrow accounts”, NUPRC chief executive Gbenga Komolafe was quoted as saying in an NUPRC press release September 9, 2025.

“Since April 2023, we have approved 94 decommissioning and abandonment plans, in strict alignment with the PIA”, Komolafe said. “These approvals represent total liabilities of $4.424 billion, arising from all field development plans submitted within this period, and will be remitted progressively over the production life of the respective fields into designated escrow accounts”.

Komolafe added, “In addition to divestments, the Commission has been working together with operators, particularly members of OPTS [Oil Producers Trade Section], on life extension projects, ranging from facility integrity audits to subsea upgrades and enhanced reservoir management measures that sustain safe production, delay decommissioning, reduce environmental risks and secure resilience across our mature fields”.

To contact the author, email [email protected]