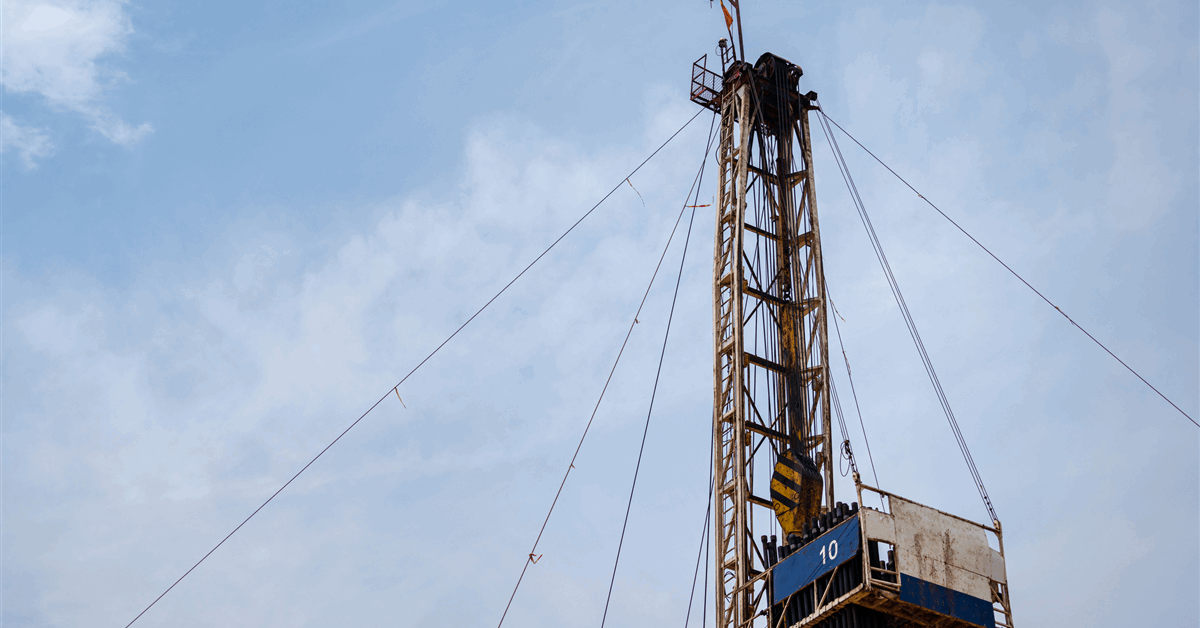

The European Union is planning measures to accelerate the bloc’s phaseout of Russian liquefied natural gas, just days after US President Donald Trump called on the EU to do more to curb Moscow’s energy trade.

The European Commission, the bloc’s executive arm, is considering including a provision in its new sanctions package to phase out imports of all Russian LNG earlier than the end of 2027, which was the EU’s initial plan, according to people familiar with the matter. The EU will propose its new sanctions as early as Friday, Bloomberg reported earlier.

The EU is also weighing an option to push forward the elimination of Russian LNG imports through an amendment to the so-called RePowerEU plan to end reliance on energy from Moscow, said the people, who spoke on the condition of anonymity.

“Since we presented the RePowerEU plan in 2022, we’ve been saying that a phaseout of Russian energy is better sooner rather than later,” Commission Spokeswoman Anna-Kaisa Itkonen said.

The Trump administration has called on Europe to accelerate its wind-down of Russian fuel imports at a faster rate and has pressured allies to impose tariffs as high as 100 percent on India and China for their purchases of Russian oil.

Trump has been calling on Europe to do more to target Russia’s energy revenue as a condition for ramping up its own pressure on Moscow.

Many EU countries are reluctant to hit India and China with tariffs, so the commission’s focus is turning to targeting Russian LNG, according to the people.

The global gas market is expected to start shifting into a surplus in the second half of next year, reducing the risk that the phaseout of Russian gas could put pressure on European supplies and lead to price spikes. This will be a key factor for the EU to determine a new phaseout date.

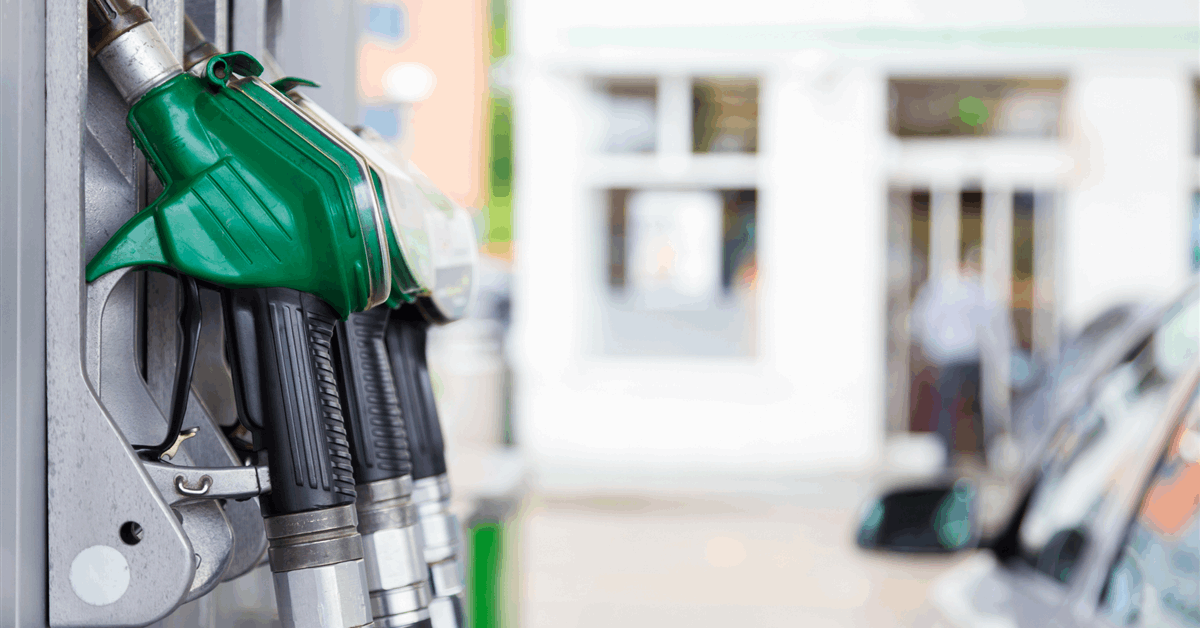

The US has repeatedly indicated its interest in supplying more LNG to Europe, especially as more production facilities are expected to come online in the next few years. The EU has imported around 50 billion cubic meters of LNG annually from the US in recent years, with LNG infrastructure in place in around a dozen EU countries.

A commitment to buy more US LNG was a central plank of the EU’s pledge to purchase $750 billion worth of US energy over the next three years under the recently agreed EU-US trade deal.

Russian gas flows to Europe dropped sharply in the wake of the full-scale invasion of Ukraine in 2022, but supplies through a pipeline via Turkey and shipments of liquefied natural gas still accounted for nearly 19 percent of total EU imports in 2024.

Spain, Belgium and France are among the biggest importers of Russian LNG.

While including a commitment on LNG in the EU’s next sanctions package requires unanimous support, the proposals covered by the RePowerEU plan are subject to a qualified majority vote.

A draft regulation proposed earlier this year to halt Russian LNG imports by the end of 2027 is currently being discussed by the European Parliament member states in the EU Council, with each of the institutions entitled to propose amendments.

Another distinction is that measures to accelerate the phaseout of Russian LNG through RePowerEU would be permanent, whereas measures included in the sanctions package could be removed if sanctions on Russia are lifted in the future.

“Europe has made huge efforts and been very successful in reducing our reliance on Russian energy and Russian gas,” Paschal Donohoe, who leads the meetings of euro-area finance chiefs, told Bloomberg Television in Copenhagen on Friday. “The Commission have indicated that they want to bring forward the proposal to further accelerate the reduced reliance we would have on Russian energy, and I know that efforts will be made to do that.”

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.