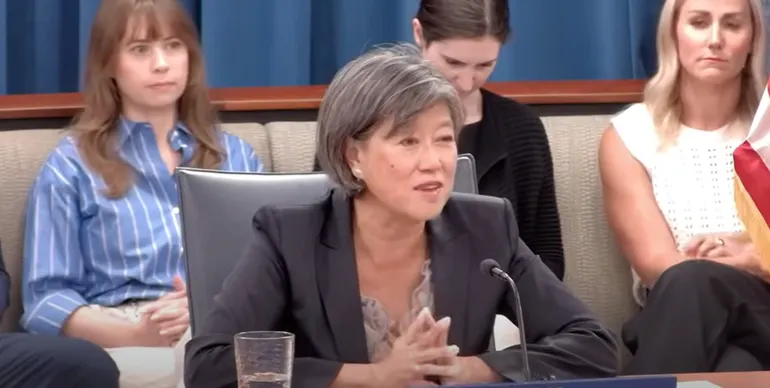

In an oil market update sent to Rigzone by the Rystad Energy team on Tuesday, Lin Ye, Rystad Energy Vice President, Oil Markets – Downstream, highlighted that “China’s stockpiling has provided a temporary price floor by mopping up excess supply”.

“China’s oil stockpiling goes against the grain as the global oil market has been in firm backwardation, where current prices are above future delivery prices, which does not support crude oil storage,” Ye said in the update, adding that, “conversely, crude inventories outside China have declined during the same period”.

“China’s stockpiling has provided a temporary price floor by mopping up excess supply, yet its efficacy is constrained by geopolitical factors, global supply changes, and Beijing’s policy redirection,” Ye noted in the update.

“It is important to note that China’s crude inventory changes are a critical buffer for the global oil market, and not a permanent solution,” Ye went on to state.

Rystad Energy’s oil market update highlighted that Brent M1 futures “have remained well above $65 per barrel for most of the last few months, even amid OPEC+’s faster unwinding production cuts since May”.

The update outlined that the reason for this is because mainland China “has put 156 million barrels of crude oil into storage since March this year, with the stock build coming in at a monthly average of 1.16 million barrels per day from March to June”.

Looking at why China is storing crude oil, the update pointed to “geopolitics”, adding that “independents [are] seiz[ing]… opportunities amid fear of tougher sanctions [and] U.S. tariffs”.

“Continued sanctions on Iran oil exports have matured the trading system, including the use of dark fleets to transport crude oil from Iran to a few Chinese ports, primarily those in Shandong,” the update noted.

“Sanctions from former U.S. President Joe Biden’s administration on Russia in early January this year added to the overall risks for crude export for Russia, Iran, and Venezuela. While China’s imports from these three countries were hit hard in January, these began to recover from February and climbed to a new high in March this year as workarounds were discovered,” it added.

“Yet, in anticipation of tougher sanctions from the west and the release of multiple rounds of sanction packages, Chinese independent refiners – who are typically seen as risk takers – along with all others along the supply chain, took advantage of the opportunity to import as much as possible and stored crude in inventories,” it continued.

The update stated that more arrivals of Iranian crude are expected in September, “as there are still many barrels awaiting discharge at Chinese ports”.

It went on to state that China has worked to divert its import origins of natural gas liquids away from the U.S. after the tariff war, “even though ethane and propane purchases from the U.S. were exempt from higher tariffs”.

“However, risks of decoupling of the world’s two largest economies remain,” the update warned.

“Imported ethane and propane have offered routes to produce ethylene and propylene alongside imported naphtha and refinery-produced light feedstocks,” it said.

“A more muted reliance on imported feedstocks intensifies the alternative feedstock demand for crude oil as China’s refining sector has highlighted the technological development – ‘from crude to chemicals’ – as a core task,” it added.

Looking at how long China’s stockpiling will last, Rystad’s update highlighted that the country’s crude building “slowed in July and August” but said “the stockpiling [is] expected to gain momentum again in September”.

“In our base case scenario, 4Q 2025 will likely see China building stocks again and in 2026, although a lower level of build is expected on average in 2026 compared to this year,” the update said.

“We also believe that the drivers of China’s crude stockpiling will remain, especially as geopolitical risks remain,” it added.

“Our unsolved balances implied, driven by the quick unwinding of production cuts from OPEC+ and non-OPEC supply growth, the 2.14 million barrels per day of crude surplus from 4Q 2025 will drag oil prices lower, providing economic incentives to stockpile,” it continued.

Rigzone has contacted the State Council the People’s Republic of China and the State Council Information Office, the International Press Center of China’s Ministry of Foreign Affairs, the White House, the Iranian Ministry of Foreign Affairs, the Department of Information and Press of the Russian Ministry of Foreign Affairs, and the Embassy of the Bolivarian Republic of Venezuela located in The Hague, Netherlands, for comment on Rystad’s oil market update. At the time of writing, none of the above have responded to Rigzone.

A statement posted on OPEC’s website on September 7 revealed that Saudi Arabia, Russia, Iraq, the UAE, Kuwait, Kazakhstan, Algeria, and Oman “decided to implement a production adjustment of 137,000 barrels per day” at a virtual meeting held that day.

“The eight OPEC+ countries, which previously announced additional voluntary adjustments in April and November 2023 … met virtually on 7 September 2025 to review global market conditions and outlook,” the statement noted.

“In view of a steady global economic outlook and current healthy market fundamentals, as reflected in the low oil inventories, the eight participating countries decided to implement a production adjustment of 137,000 barrels per day from the 1.65 million barrels per day additional voluntary adjustments announced in April 2023,” the statement added.

This adjustment will be implemented in October 2025, the statement said. A table accompanying the statement posted on OPEC’s site outlined that Saudi Arabia and Russia’s adjustment amounts to 42,000 barrels per day, each. Iraq’s comes to 17,000 barrels per day, the UAE’s is 12,000 barrels per day, Kuwait’s is 11,000 barrels per day, Kazakhstan’s is 6,000 barrels per day, Algeria’s is 4,000 barrels per day, and Oman’s is 3,000 barrels per day, the table outlined.

The table highlighted that October 2025 “required production” is 10.020 million barrels per day for Saudi Arabia, 9.491 million barrels per day for Russia, 4.237 million barrels per day for Iraq, 3.387 million barrels per day for the UAE, 2.559 million barrels per day for Kuwait, 1.556 million barrels per day for Kazakhstan, 963,000 barrels per day for Algeria, and 804,000 barrels per day for Oman.

“The 1.65 million barrels per day may be returned in part or in full subject to evolving market conditions and in a gradual manner,” the statement posted on OPEC’s site noted.

“The countries will continue to closely monitor and assess market conditions, and in their continuous efforts to support market stability, they reaffirmed the importance of adopting a cautious approach and retaining full flexibility to pause or reverse the additional voluntary production adjustments, including the previously implemented voluntary adjustments of the 2.2 million barrels per day announced in November 2023,” it added.

“The eight OPEC+ countries also noted that this measure will provide an opportunity for the participating countries to accelerate their compensation,” it continued.

To contact the author, email [email protected]