Indian officials have again told the Trump administration that a significant reduction in Russian oil imports by the South Asian nation’s refiners would require Washington to instead allow crude purchases from sanctioned suppliers Iran and Venezuela.

A delegation visiting the US this week reiterated the request in meetings with American officials, a person with knowledge of the discussions said, asking not to be identified as the talks are private. Indian representatives have emphasized that simultaneously cutting off Indian refiners’ supply from Russia, Iran and Venezuela – all major oil producers – could lead to a spike in global prices, people familiar with the negotiations added.

Spokespeople for the Commerce and Oil Ministries, and the US embassy in New Delhi, didn’t immediately respond to requests seeking comment.

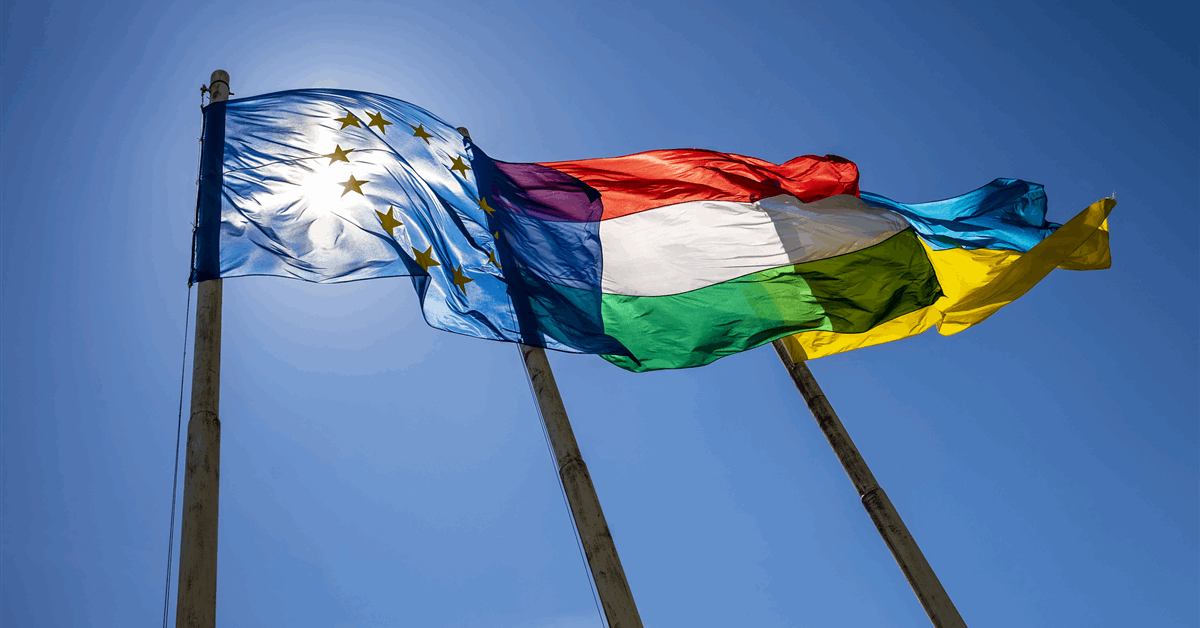

New Delhi’s representatives traveled to the US for talks after Washington imposed crushing tariffs on the country in punishment for its oil trade with Russia. Despite the levies, the South Asian nation has maintained its crude imports from the OPEC+ producer, albeit at a lower rate.

Indian Commerce Minister Piyush Goyal said this week that the country wanted to increase its purchases of American oil and gas, adding that “our energy security goals will have a very high element of US involvement.” He made the remarks in New York.

Russia was forced to discount its crude after many others shunned trade with Moscow due to the war in Ukraine. Almost 90 percent of India’s oil needs are met by imports, and cheaper Russian barrels have helped to reduce the burden on its import bill. Iranian and Venezuelan oil would also be similarly discounted.

India stopped buying Iranian oil in 2019, and the nation’s largest private refiner – Reliance Industries Ltd. – halted purchases of Venezuelan crude this year as the US tightened sanctions. Processors can shift to buying more Middle Eastern barrels, but it would come at a higher cost and inflate the overall import bill.

Oil refiners paid an average $68.90 a barrel for Russian crude in July, compared with $77.50 from Saudi Arabia and $74.20 from the US, according to data from the Commerce Ministry. India is the biggest buyer of Russian oil delivered by tanker, while China is the largest overall importer, including deliveries by pipeline.

The oil market is also on track for a large surplus next year as the OPEC+ alliance and producers from outside the group boost output, which is likely to put downward pressure on global crude prices.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.