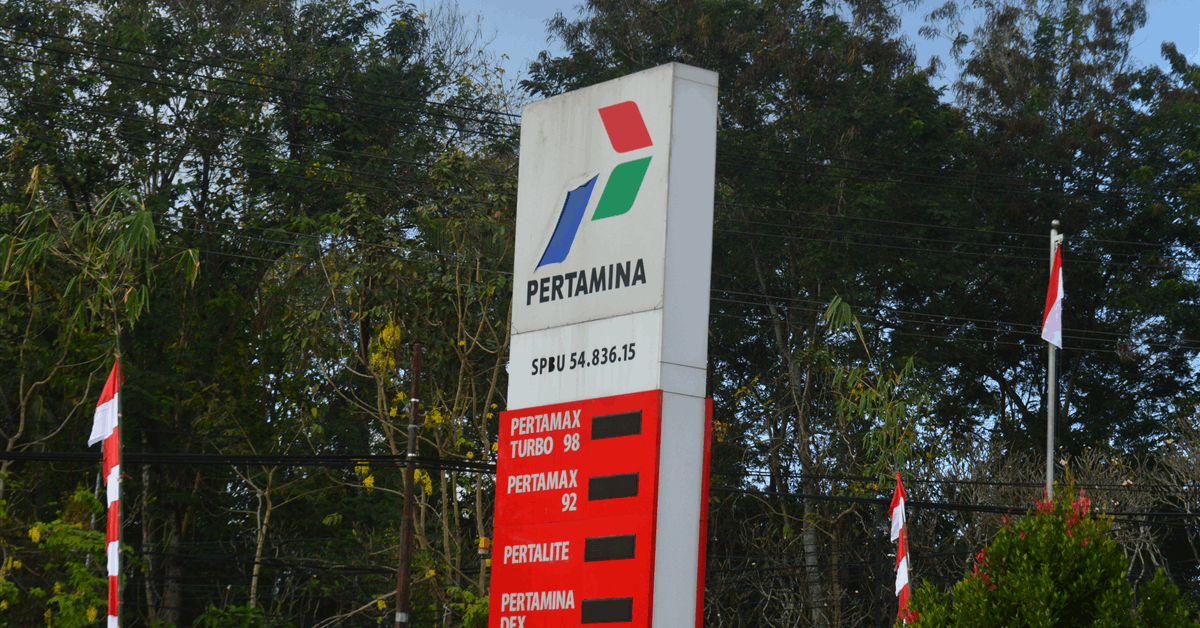

Indonesian state-owned oil and gas company PT Pertamina has signed a deal to acquire a 24.5 percent stake in the Bobara production sharing contract (PSC) off West Papua Province from Malaysian counterpart Petroliam Nasional Bhd (Petronas).

Petronas will remain operator with a 51 percent interest. Earlier this year TotalEnergies SE acquired 24.5 percent.

“This bilateral partnership brings together two leading national and international energy players, combining complementary technical strengths, deepwater expertise and a shared commitment to responsibly unlock new energy resources in support of Indonesia’s sustainable growth”, Petronas said in a press release Sunday.

Petronas won the area in Indonesia’s 2023 bidding round with an award of 8,444.49 square kilometers (3260.4 square miles).

“[T]he commitments for the first three years involve three geological and geophysical studies, including 2,000 square kilometers of 3D seismic data acquisition and processing”, Petronas said May 14 announcing the signing of the PSC.

Bobara was part of agreements in Indonesia and Malaysia that Petronas and TotalEnergies announced June 16. The agreements involve offshore blocks in different maturation stages. The blocks cover over 100,000 square kilometers, TotalEnergies said at the time.

“TotalEnergies will notably hold, alongside Petronas through its wholly-owned subsidiary Petronas Carigali Sdn Bhd, a 50 percent operated working interest in Blocks SK301b and SK313, where significant gas discoveries (more than four Tcf) were made and are expected to be developed to support gas supply to Malaysia LNG from 2030”, TotalEnergies said.

“TotalEnergies will also hold, alongside Petronas, interests in several exploration blocks offshore Malaysia. The transaction is subject to customary conditions, including regulatory approvals.

“Following the SapuraOMV’s acquisition in December 2024, this transaction strengthens TotalEnergies’ position in Southeast Asia with Malaysia as an anchor point, in partnership with Petronas”.

TotalEnergies chair and chief executive Patrick Pouyanne said the company sees Malaysia as “a strategic platform for our future low-cost, low-carbon production and cash-flow growth, underpinned by the exposure to Asian LNG market”.

“Together, we will pursue and develop advantaged barrels across Malaysia’s and Indonesia’s frontier emerging exploration blocks”, Petronas president and chief executive Muhammad Taufik said.

Separately last week Petronas announced a memorandum of understanding (MoU) with OQ Exploration and Production New Ventures LLC (OQEP), part of Oman’s state-owned OQ SAOC, for joint oil and gas exploration and production in Southeast Asia and the Middle East.

“The MoU provides a framework for collaboration that leverages Petronas’ international upstream expertise and OQEP’s regional knowledge, aiming to unlock new growth opportunities and accelerate value creation in diverse markets”, Petronas said in an online statement.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR