Oil, fundamental analysis

Crude prices were already poised for a technically-driven rebound, but across-the-board inventory draws, and new sanctions placed on Russian energy entities led to a $5.00+ rally this week. The US grade started the week as low as $56.35/bbl but pushed as high as $62.60/bbl by Friday.

Brent followed a similar pattern, hitting its low of $60.35/bbl on Monday and its weekly high of $66.80 on Friday. Both grades settled much higher week-on-week with gains exceeding $5.00/bbl. The WTI/Brent spread has widened to ($4.40).

Political risk premium entered oil markets again this week in the form of new US sanctions on Russia’s two largest oil companies, Rosneft and Lukoil, which represent about 50% of the country’s exports. The sanctions will preclude both companies from doing business with US banks and other financial institutions. The EU had imposed a new sanction package on the two last week along with some Chinese refiners.

From the start of the Russia/Ukraine war, Russia’s crude exports of about 3.0 million b/d have been the target for sanctions. Yet, to date, most sanctions have proved ineffective or have been circumvented. However, oil markets still react bullishly to such announcements.

But this time around, India’s largest refiner, Reliance, is agreeing to halt the purchases of oil from Rosneft that were taking place under a long-term agreement which will impact the physical sales of Urals.

China remains Russia’s No. 1 importer of oil. China is now also the No. 1 purchaser of Canadian bitumen, taking up to 70% of the 3.5 million b/d of the oil sands production being delivered to British Columbia ports via the expanded Trans Mountain pipeline.

The Energy Information Administration (EIA)’s Weekly Petroleum Status Report (still released despite the government shut-down) indicated that commercial crude oil and refined product inventories for last week all decreased. The Strategic Petroleum Reserve (SPR) was up 820,000 bbl to 408.5 million bbl. Total US oil production was 13.6 million b/d vs. 13.5 last year at this time. The US Department of Energy (DOE) is soliciting bids for January delivery of 1.0 million bbl for the SPR.

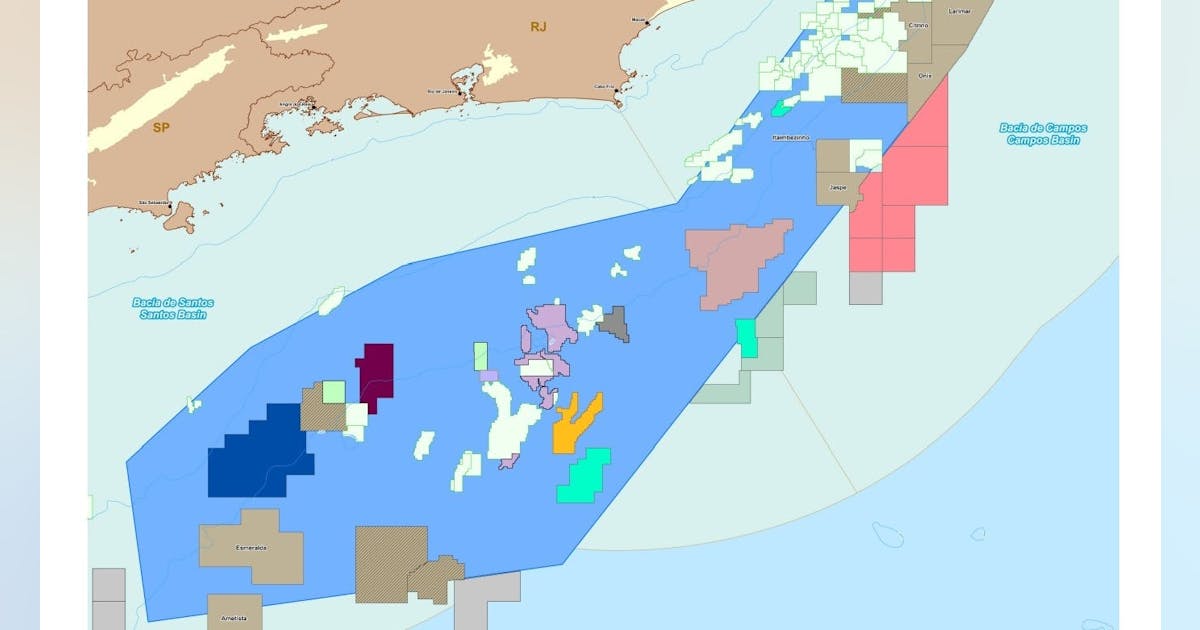

There appears to be a shift among the major exploration and production (E&P) companies back to offshore development as onshore plays have matured. About 10 years ago, these same companies had shifted from the highly expensive, mega-projects to deploying capital onshore in ‘known’ plays. With emerging discoveries in Guyana, Suriname, and Brazil, IOCs are finding solid returns again.

Inflation in September rose 3.0% year-on-year and was slightly higher than August’s +2.9%. Some key data included a 15% increase in price of beef and 19% increase for coffee. Moving away from the Fed’s 2.0% target only serves to present the agency with a dilemma. Fighting inflation by raising interest rates could stifle growth while relaxing rates could lead to more spending and a further rise in inflation. New claims for unemployment benefits rose last week to 232,000, up from the prior week’s 220,000 and above estimates of 227,000-229,000. All three US stock market indexes are up on the week as the CPI report was viewed as a moderate increase which will not stop the Fed from another rate decrease. The USD is higher also which may serve to cap crude’s rally.