Oil rose as a push to end the US government shutdown buoyed wider markets, with crude traders also looking toward a data-heavy week that will yield insights into whether a long-awaited global surplus is forming.

West Texas Intermediate rose around 0.6% to settle above $60 a barrel after two weekly declines, while Brent closed around $64. In the US, the White House expressed support for a bipartisan deal to reopen the US government after its longest-ever shutdown. Markets took the progress as a breakthrough, with tech shares driving the equities rally.

Crude has dropped in five of the past six weeks as jitters over surplus supply gained greater traction. The Organization of the Petroleum Exporting Countries and its allies have been loosening output curbs in an apparent effort to gain market share, while drillers from outside the alliance, including the US, have also been adding barrels.

OPEC is due to release its monthly analysis on Wednesday, with the International Energy Agency issuing an annual energy outlook the same day, followed by its regular monthly snapshot on Thursday.

US sanctions also remain in focus after the Trump administration last month targeted Russia’s Rosneft PJSC and Lukoil PJSC in a bid to raise pressure on the Kremlin to end its war in Ukraine.

Governments across Europe and the Middle East are rushing to ensure Lukoil’s sprawling oil operations can keep running after the US sanctions and a quashed bid by energy merchant Gunvor Group for its assets last week.

Iraq is said to have transferred operations at Lukoil’s West Qurna 2 field to two state firms in an effort to ensure production continues. Earlier in the day Lukoil declared force majeure, allowing it to exercise the right to skip contractual obligations on the field, according to a person familiar with the matter.

Lukoil’s moves are lending mild support to futures, said Rebecca Babin, a senior energy trader at CIBC Private Wealth Group. “Still, fundamentals remain soft — Dubai spreads continue to weaken, Asian demand is well supplied, and both Saudi Arabia and Iraq have reduced official selling prices,” she added.

And in Moscow’s view, the sanctions haven’t curbed all oil flows. India has continued buying Russian crude, Russian Deputy Foreign Minister Andrei Rudenko said, according to Russian news agency Interfax. That contrasted with President Donald Trump’s comments last week praising India for “largely” reducing its purchases from Russia.

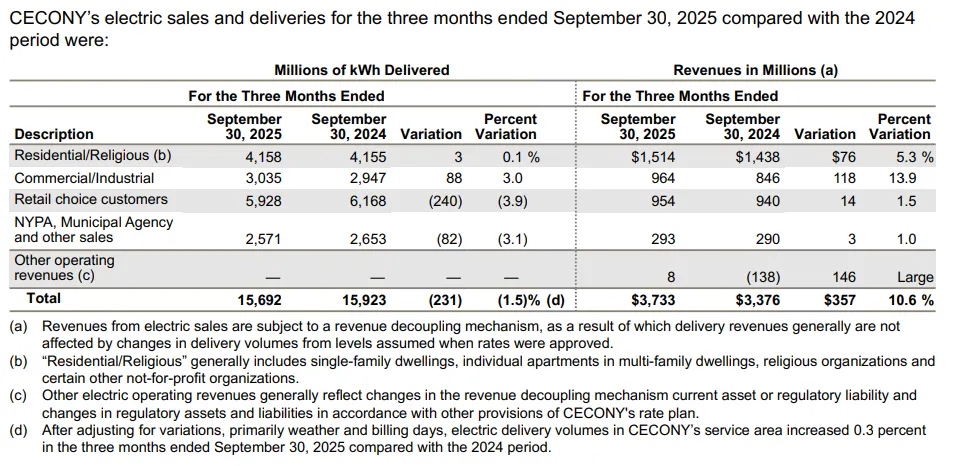

Oil Prices

- WTI for December delivery rose 0.6% to settle at $60.13 a barrel in New York.

- Brent for January settlement climbed 0.7% to settle at $64.06 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.