Helmerich & Payne Inc (H&P) on Monday reported $57.36 million, or $0.58 per share, in net loss for the fiscal fourth quarter (July-September).

That was an improvement from a net loss of $162.76 million for the prior three months, when the Tulsa, Oklahoma-based drilling rig operator logged $128 million in goodwill impairment from its acquisition of KCA Deutag International Ltd, completed early 2025.

For fiscal Q4 Helmerich & Payne booked $18.93 million in asset impairment charges and $7.45 million in restructuring charges.

Net loss adjusted for nonrecurring items was $1 million, or -$0.01 per share – beating the Zacks Consensus Estimate of -$0.26. Impact from nonrecurring charges totaled $56 million.

Drilling services revenue totaled $1.01 billion, down from $1.04 billion for fiscal Q3. H&P recorded an operating loss of $1.46 million, improving from -$128.27 million for fiscal Q3.

Its North America Solutions (NAS) segment registered $118.16 million in operating income, down from $157.65 million for fiscal Q3. “NAS realized direct margins of $242 million during the quarter, yielding an associated margin per day of $18,620 and profitability continuing to lead all North American land drillers”, the company said.

The International Solutions Segment had an operating loss of $75.72 million, better than -$166.51 million for fiscal Q3. “International Solutions again exceeded guidance midpoint expectations with direct margins of approximately $30 million”, H&P said.

Offshore Gulf of Mexico generated $20.29 million in operating income, up from $8.77 million for fiscal Q3.

H&P paid $25 million in dividends in fiscal Q4.

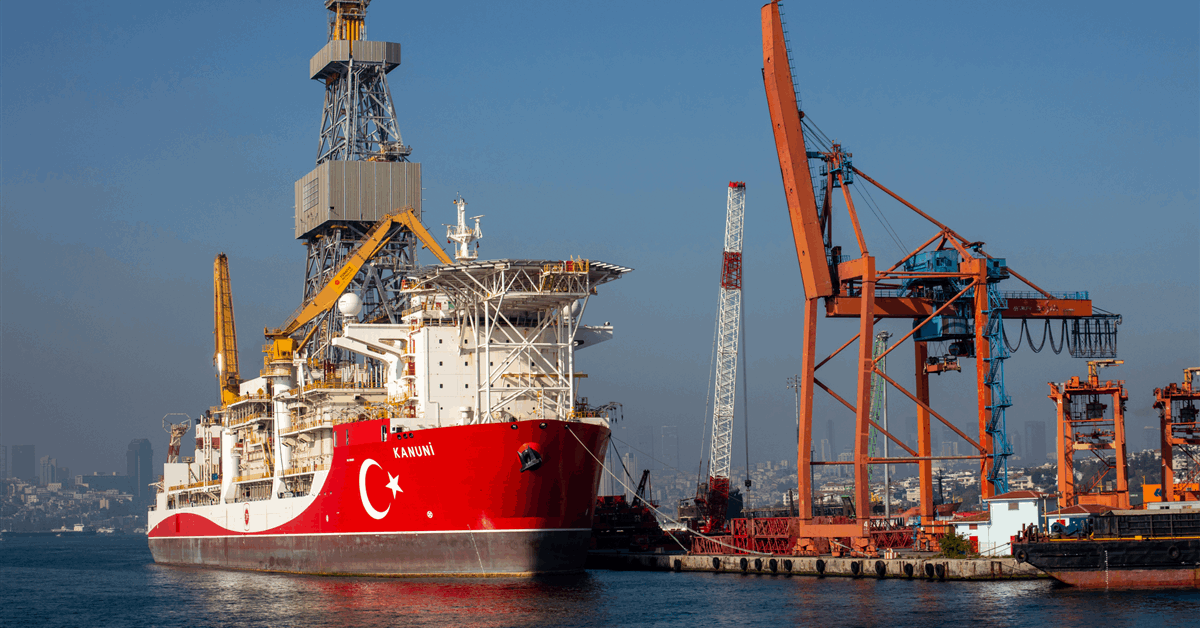

“Fiscal 2025 was a historic year for H&P, as we grew our global drilling footprint to over 200 operating rigs, surpassed over $1 billion of direct margins in our North American Solutions business, welcomed the talented team from KCA Deutag and established new relationships with a diverse set of global customers”, commented chief executive John Lindsay.

“Assuming current commodity prices, we continue to expect stable activity trends in the Lower 48 throughout 2026 and remain committed to financial discipline while continuing to deliver mutually beneficial outcomes with our customers”, Lindsay added.

“For our International Solutions segment, fiscal 2025 was particularly meaningful. We started operations for our eight FlexRigs in Saudi Arabia, completed the acquisition of KCA Deutag and continued to grow our global presence, with operations now spanning six continents”.

H&P ended fiscal 2025 with $196.85 million in cash and cash equivalents, while current assets totaled $1.47 billion.

Current liabilities stood at $814.84 million including a $6.86 million current portion of long-term net debt.

In 2026 H&P expects an average rig count of 132-148 in the NAS segment and 58-68 for International Solutions.

Also on Monday it said it had received notification to restart operations for seven rigs onshore Saudi Arabia. “The reactivations will occur in stages throughout the first half of calendar year 2026. In accordance with the terms of the drilling contracts, all days accrued during each rig’s suspension period will be added to its remaining contract”, it said.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR