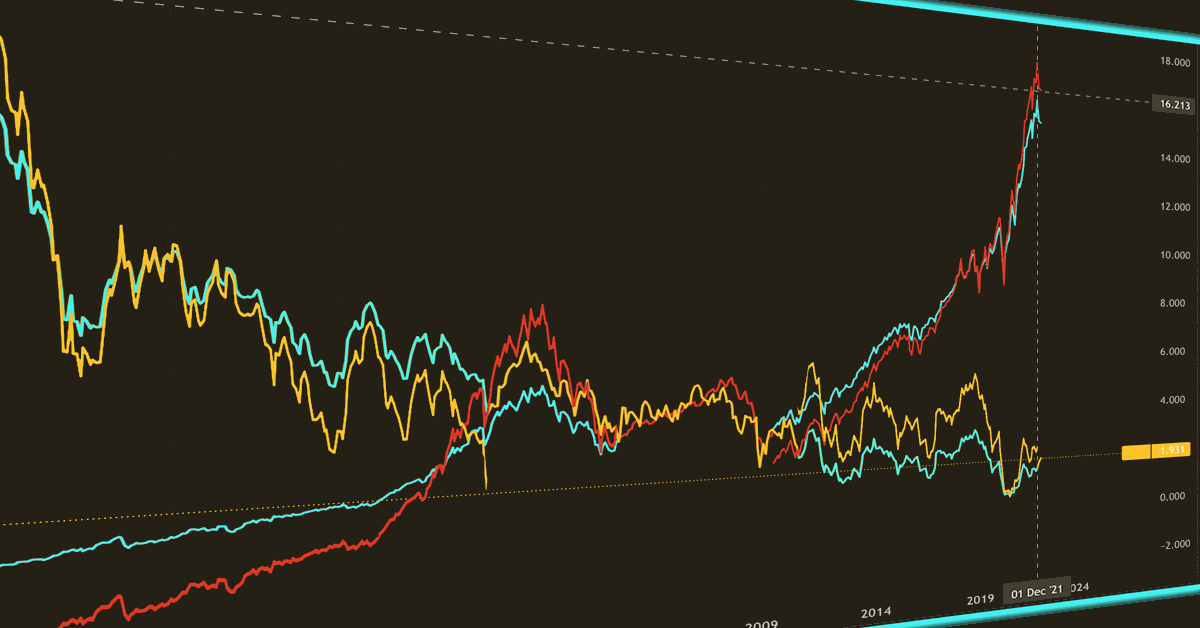

Shell Plc said its oil trading performance worsened in the fourth quarter as crude prices slumped, adding to signs that Big Oil is heading into a tougher earnings season.

Oil trading results for the year’s final three months are “expected to be significantly lower” than the previous quarter, Shell said in an update on Thursday, ahead of an earnings report due early next month. At the company’s troubled chemicals division, a “significant loss” is expected.

The update comes at a time when the oil market is lurching into an oversupply that could make for challenging trading conditions in the months ahead. The international benchmark Brent plunged 18 percent last year and has been largely unaffected by turmoil in Venezuela, where the country’s president Nicolás Maduro has been captured by US forces.

It’s a “rough end to the year” for Shell, RBC Capital Markets analyst Biraj Borkhataria said Thursday in a note. He had expected “a relatively weak quarter, and this looks worse than expected.”

Shell’s shares fell as much as 2.3 percent in early London trading.

Shell’s massive in-house trading business deals in oil, gas, fuels, chemicals and renewable power – trading both the company’s own production as well as supply from third parties. The energy major doesn’t disclose separate results for its traders, but the performance is closely watched as it can be a key driver of earnings.

A strong trading performance in the third quarter was one of the reasons Shell cited for earnings that beat estimates.

Since taking over the London-based energy giant three years ago, Chief Executive Officer Wael Sawan has sought to cut costs and offload under-performing assets to improve the company’s balance sheet. This is his first test in a lower oil-price environment that will pressure the firm’s ability to maintain its level of share buybacks.

US rival Exxon Mobil Corp. has also signaled a tougher fourth quarter, saying on Wednesday that lower oil prices and lower chemical margins impacted results.

Last year, shell’s shares were the best performer among the world’s top five oil majors in dollar terms, but the gains have fizzled since peaking in mid-November to end the year at 19 percent.

Adding to uncertainties, traders continue to weigh the wider market impact of Maduro’s ouster over the weekend. The US now says it’s controlling Venezuela’s energy industry and that American companies will invest billions in the country.

Last quarter, Shell had been preparing to resume preliminary work on a Venezuelan offshore gas field to supply neighboring Trinidad and Tobago, as the company’s confidence was growing that the Trump administration would issue a new license exempting the project from sanctions, Bloomberg News reported in October.

Overall, Shell’s oil and gas production increased slightly in the quarter, including output from its new Adura North Sea joint venture with Equinor ASA. But analysts expect higher taxes and operating spending to offset upstream earnings.

For natural gas, Shell expects trading results for the quarter to be in line with the previous period. Shell is the world’s largest liquefied natural gas trader and has bolstered its position in 2025 with a massive $29 billion terminal coming online. LNG Canada started production last summer and is continuing to ramp up. Shell’s liquefaction volumes were higher than the third quarter and in line with consensus analyst expectations.

Meanwhile, Shell in November challenged its defeat in an arbitration case against US LNG exporter Venture Global Inc. after BP Plc won a similar case. A tribunal in August ruled in favor of Venture Global in a disagreement tied to the firms’ failure to deliver LNG cargoes to Shell under long-term contracts from a plant in Louisiana. Weeks later, Venture Global lost a similar dispute with BP.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.