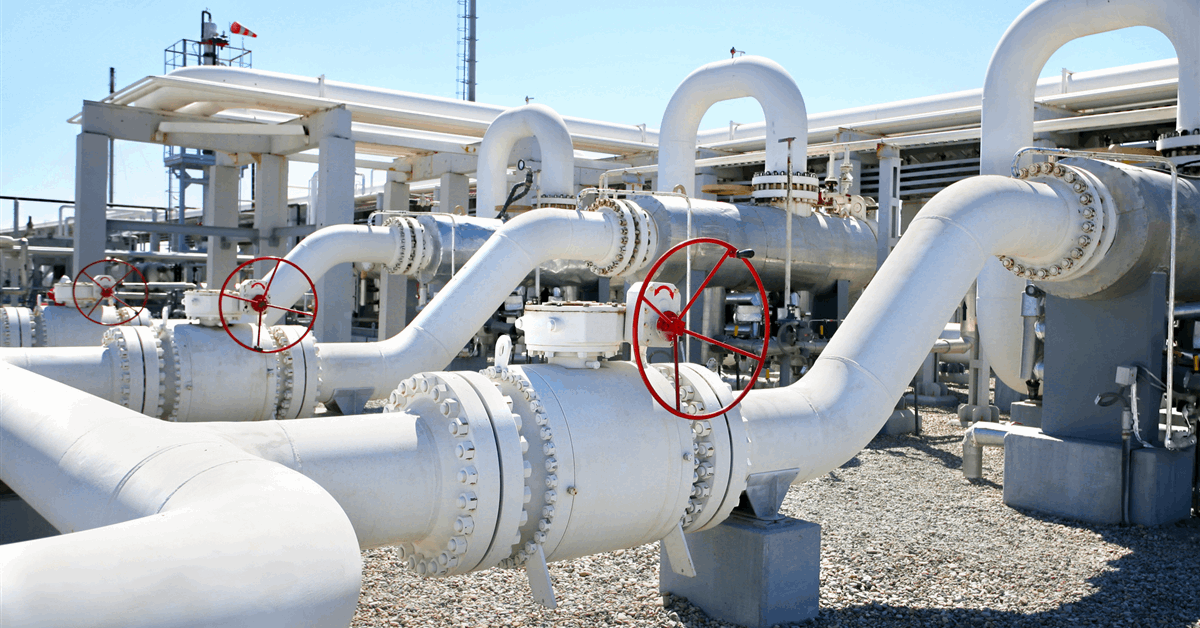

In an insight report released recently, analysts at Wood Mackenzie outlined that U.S. tight oil production “will shrink without a crash event for the first time” in 2026.

“Holding oil production flat in the U.S. today requires over two million barrels per day of new supply,” the analysts said in the report.

“We expect output to fall by 200,000 barrels per day in 2026 with WTI prices 20 percent lower than 2025,” they added.

“This signal could change market mentality and bolster international conventional investment plans. But caution is still needed. That 2026 tight oil deficit is filled by Guyana alone, and U.S. liquids will return to growth in 2028,” the Wood Mackenzie analysts continued.

In its latest short term energy outlook (STEO) at the time of writing, which was released back in December 2025, the U.S. Energy Information Administration (EIA) showed that Lower 48 States crude oil production, including lease condensate and excluding the Gulf of America, would drop from an average of 11.29 million barrels per day in 2025 to an average of 11.11 million barrels per day in 2026. This production came in at 11.03 million barrels per day in 2024, the EIA’s December STEO highlighted.

Total U.S. crude oil production, including lease condensate, was projected to drop from an average of 13.61 million barrels per day in 2025 to an average of 13.53 million barrels per day in 2026 in that STEO. Total U.S. crude oil output, including lease condensate, averaged 13.23 million barrels per day in 2024, the EIA’s latest STEO at the time of writing showed. The EIA’s next STEO is scheduled to be released on January 13.

In the Wood Mackenzie report, the analysts also predicted a shale gas “renaissance” in the U.S. this year.

“As LNG FIDs have come thick and fast, there are concerns the Haynesville and Permian aren’t big enough to meet next decade demand. Rising data center power demand adds weight to the argument,” the analysts said in the report.

“Nimble E&Ps will therefore revisit the gas basins of yesteryear – particularly in the Rockies – to unlock resource with low entry costs,” they added.

“Exploration will gain momentum, boosted by results in the Western Haynesville … Renewed interest in deep gas in a variety of basins is also possible,” they continued.

The Wood Mackenzie analysts also predicted in the report that gas will overtake tight oil deal spend in the U.S. in 2026.

“Many of the biggest oil deals have already happened (e.g. Pioneer, Endeavor, CrownRock, and Marathon),” the analysts noted in the report.

“Focus will shift to consolidation in fragmented basins and gas will be top of the list. There are three main drivers,” they added.

“Firstly, LNG equity holders and those with large offtake deals will add upstream gas as a Henry Hub price hedge. Secondly, participants across the value chain (and beyond) will see arbitrage between current and future Henry Hub prices and discern a value play,” they continued.

“Thirdly, some governments seeking to rebalance cross-border trade to mitigate tariffs may see the gas value chain as a good way to deploy capital in the United States,” the analysts went on to state.

Rigzone has contacted the American Petroleum Institute (API), the U.S. Department of Energy (DOE), and the White House for comment on the Wood Mackenzie report. At the time of writing, none of the above have responded to Rigzone.

Wood Mackenzie describes itself on its website as a global leader in analytics, insights, and proprietary data across the entire energy and natural resources landscape. The EIA describes itself as the statistical and analytical agency within the DOE in its December STEO.

To contact the author, email [email protected]