Oil rose to the highest level since early December as unrest in Iran raises the specter of supply disruptions from OPEC’s fourth-biggest producer, with the Wall Street Journal reporting that President Donald Trump is leaning toward striking the country.

West Texas Intermediate settled above $59 a barrel on Monday after jumping more than 6% over the past three sessions. Trump said Tehran had offered to enter negotiations with Washington over its yearslong nuclear program. But he is leaning toward authorizing military strikes against the Middle Eastern country over its treatment of protesters, the newspaper said, citing US officials familiar with the matter.

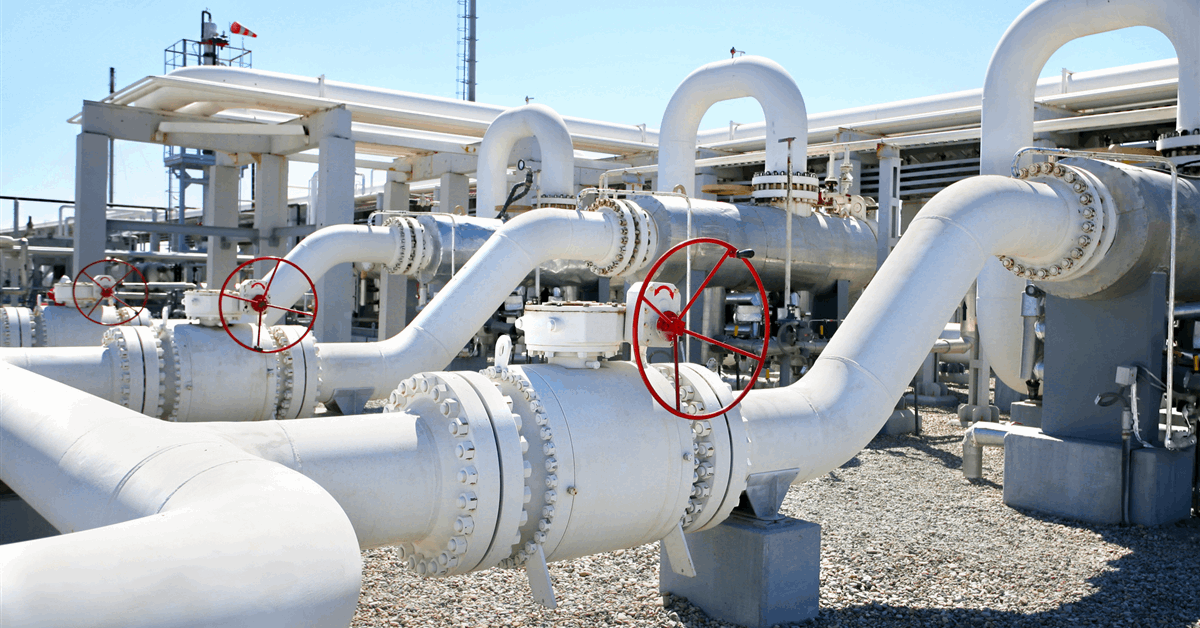

Fresh political or military unrest in Iran could threaten disruption to the country’s roughly 3.3 million barrels-per-day oil production.

Iran’s foreign minister repeated government claims that rioters and terrorists killed police and civilians, while footage was broadcast on state TV saying calm had been restored nationwide.

“Traders must now balance odds of a smooth transition to regime change, odds of a messy transition potentially impacting oil production and exports, odds of a military confrontation or miscalculation, and odds the regime change may pivot towards a deal on US terms, which would bear the most negative implications for energy markets,” said Dan Ghali, a commodity strategist at TD Securities.

The possibility of a disruption to Iran’s daily exports has tempered concerns over a global glut that caused a slump in prices and made investors increasingly bearish. The scale of risk has shown up clearest in options markets, where the skew toward bullish calls is the biggest for US crude futures since June and volatility is surging.

The two weeks of protests in the country are the most significant challenge to Supreme Leader Ayatollah Ali Khamenei since a nationwide uprising in 2022. It follows a surge in oil prices during a 12-day war between Iran and Israel in June, which quickly eased after the US intervened and brokered a peace deal.

“We see several paths for oil becoming caught in the crosshairs of the latest Iranian unrest,” RBC Capital Markets analysts including Helima Croft wrote, adding that the most obvious would be if oil workers were to join the protests and go on strike. “There is also a risk that the IRGC might target regional energy supplies to raise the cost of American intervention.”

The Iranian turmoil has also shifted the focus away from Venezuela. Trump on Saturday signed an executive order to safeguard the Latin American country’s oil revenue held in US Treasury accounts from the nation’s creditors, but broader political uncertainty could still suppress much-needed investment to revive Venezuela’s crumbling oil industry.

Trump said he is mulling excluding Exxon Mobil Corp. from his push for US oil majors to rebuild the sector, citing displeasure with CEO Darren Woods’ comments at a White House meeting last week in which Woods described Venezuela as “uninvestable.”

Meanwhile, commodity traders are scrambling to facilitate the mega sale of 50 million barrels of Venezuelan crude announced by the Trump administration last week. Trafigura Group and Vitol Group plan to move Venezuelan oil to storage facilities in the Caribbean, with offers of the South American country’s heavy crude to US Gulf Coast refiners coming at higher prices compared with oil of similar quality from Canada.

Meanwhile, Kazakh oil shipments were halted on Saturday, forcing a cessation of crude intake into the CPC pipeline system. Shipments have been intermittent since late last year with only one mooring able to operate.

Oil Prices

- WTI for February delivery rose 0.6% to settle at $59.50 a barrel in New York.

- Brent for March settlement gained 0.8% to settle at $63.87 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.