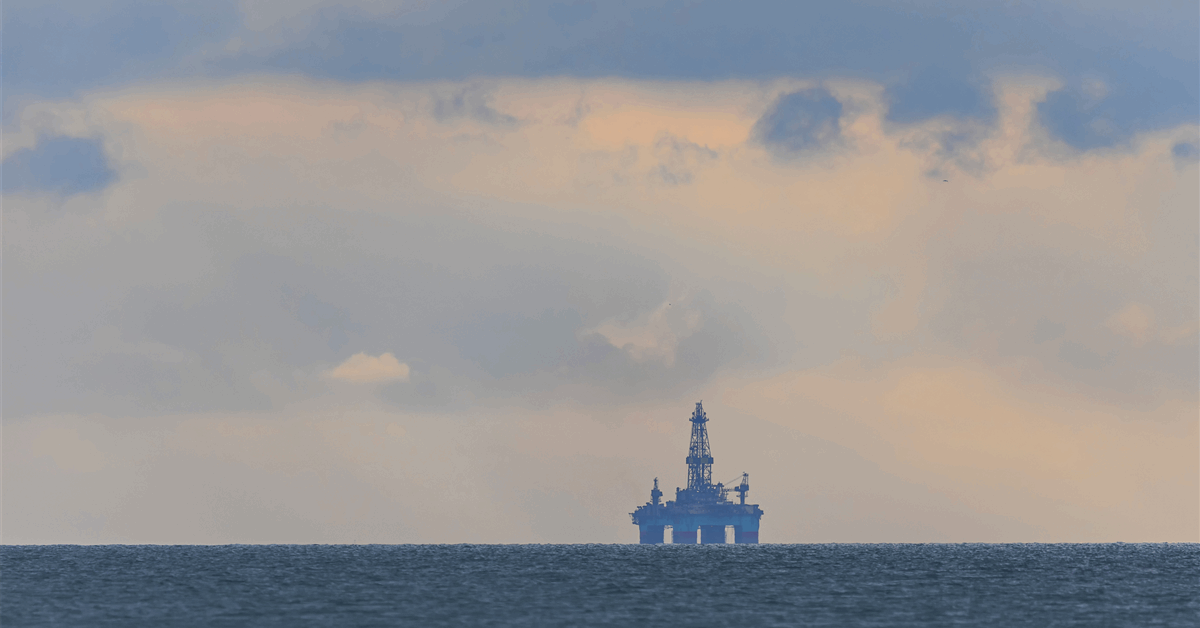

An appraisal well has confirmed Vår Energi ASA’ Zagato oil discovery in the Goliat area on Norway’s side of the North Sea, with preliminary estimated recoverable resources of 21-25 million barrels of oil equivalent (MMboe), the Norwegian Offshore Directorate (NOD) said.

That is equivalent to 3.3-11.9 million standard cubic meters of oil equivalent (MMscmoe), up from the previous estimate of 2.8-10.1 MMscmoe before appraisal well 7122/8-3 A was drilled, the upstream regulator said in a press release.

The latest target represents the 14th exploration well drilled in production license 229, awarded under the Barents Sea Project in 1997, the NOD noted.

Var Energi said separately, “The latest well tested two intervals with each showing maximum flow rates of more than 4,000 barrels of oil per day, confirming reservoir quality”.

“The production tests confirmed good quality reservoirs and oil quality similar to the Goliat field”, Vår Energi said. Goliat, discovered 2000, started producing 2016 and expanded with the startup of the Snadd and Goliat West accumulations in 2017 and 2021 respectively, according to field information on government website Norskpetroleum.no.

Operator Vår Energi (65 percent) and partner Equinor ASA (35 percent) have now drilled five wells in the Goliat Ridge, Vår Energi noted. “Including the latest well, the Goliat Ridge is estimated to contain gross discovered recoverable resources of 35-138 MMboe, and with additional prospective resources taking the total gross potential to over 200 MMboe”, it said.

“A tie-back to the nearby Goliat FPSO [floating production, storage and offloading vessel] is being planned, targeting first production in 2019.

“Vår Energi was recently awarded an adjacent license to the Goliat field in the 2025 Awards in Predefined Areas, which offers additional prospectivity on trend with the Goliat Ridge discovery”.

Norskpetroleum.no says plans for Goliat include a connection to the Equinor-operated gas liquefaction facility on Melkøya island.

“The recent discoveries reinforce Vår Energi’s position as a leading exploration company on the Norwegian continental shelf and continue to strengthen our ability to sustain high-value production of 350,000-400,000 boe per day beyond 2030”, said Vår Energi chief operating officer Torger Rød.

New Equinor Discovery

The NOD announced a separate discovery on Monday in the Equinor-operated production license 124 B in the Norwegian Sea.

Preliminary estimates for the Othello South prospect or wildcat well 6507/8-12 S, four kilometers (2.49 miles) north of Equinor’s producing Heidrun field, indicate 0.95-12.6 MMboe of recoverable resources, the NOD said.

“The licensees will assess the discovery with a view toward further developing the northern part of the Heidrun field”, it said.

The discovery is the first exploration well drilled in license 124 B, carved out of production license 124 in 2024, according to the NOD.

Equinor operates 124 B with a 25.69 percent stake. ConocoPhillips has 27.91 percent. Norway’s state-owned Petoro AS owns 36.4 percent. Vår Energi holds 10 percent.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR