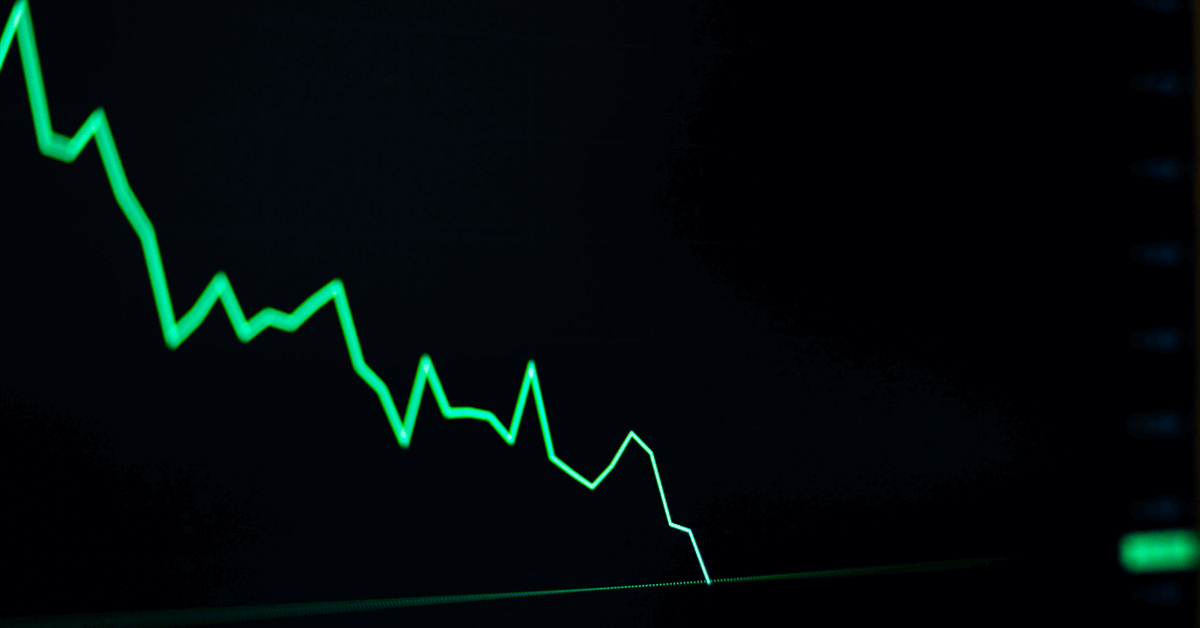

Oil dropped 2.1% to settle near $59 a barrel, weighed down by swelling crude inventories and signs of progress in Russia-Ukraine peace talks.

Ukrainian President Volodymyr Zelenskiy will join trilateral meetings with the US and Russia Friday, stoking hopes of a breakthrough to end Moscow’s war in Ukraine. An end to sanctions on Russia would add to an already oversupplied global market.

In the US, crude inventories rose 3.6 million barrels while gasoline stocks reached their highest level since 2021 and exports fell by more than a half-million barrels a day. In Kazakhstan, repairs at a key Black Sea oil-loading facility are nearing completion while a backlog of cargoes at the Caspian Pipeline Consortium terminal is easing.

Supplies are also returning to the global market from Venezuela, while Indian refiner Reliance Industries Ltd. has once again purchased Russian crude, with deliveries scheduled to February and March.

Offering something of a floor to prices, the International Energy Agency, which advises major economies, nudged up its estimate for oil demand growth on Wednesday. That will offer some relief for producers, but the agency still maintained its view for a major glut this year.

“The geopolitical temperature has eased a few degrees,” said Ole Sloth Hansen, a strategist at Saxo Bank A/S in Copenhagen. But with a range of supply threats unresolved, and colder weather set to bolster US demand, prices will likely “hold firm.”

Oil Prices

- WTI for March delivery fell 2.1% to settle at $59.36 a barrel in New York.

- Brent for March settlement fell 1.8% to settle at $64.06.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.