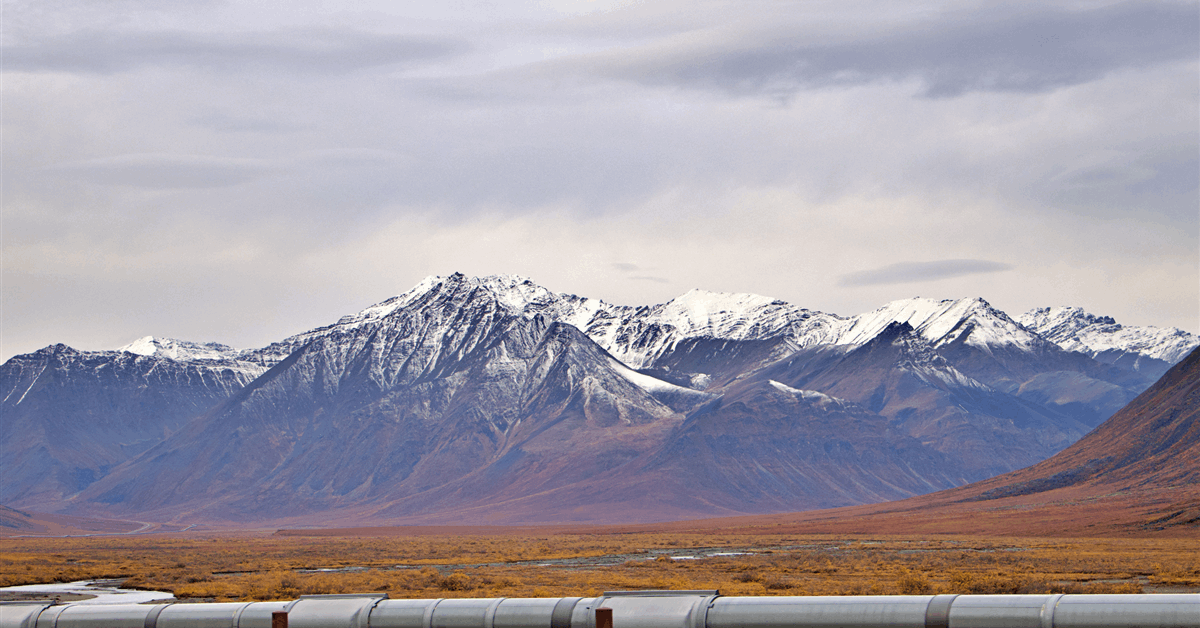

Glenfarne Group LLC said Thursday it had signed several preliminary agreements to source natural gas for and sell output from Alaska LNG, designed to also supply the domestic market, as well as conditionally awarded build contracts.

Alaska LNG holds an Energy Department permit to export 20 million metric tons per annum (MMtpa) of LNG, or 2.55 billion cubic feet a day of natural gas equivalent according to Alaska LNG, to both FTA and non-FTA countries. The project secured the authorization November 2014 for the portion for countries with a free trade agreement (FTA) with the United States and August 2020 for the non-FTA portion.

On December 11, 2025 the Federal Permitting Improvement Steering Council announced the completion of permit renewal for the project, which would process gas from the North Slope for both the domestic and overseas markets, following a review of environmental opinions.

On Thursday Glenfarne said it has executed “gas sales precedent agreements” with Exxon Mobil Corp and Hilcorp Energy Co for the supply of gas from phase 1 of Alaska LNG. The Houston, Texas-based developer did not disclose any prospective contract volume. Glenfarne has a previous gas sales precedent agreement with Pantheon Resources PLC.

“These agreements, which include pricing, contract length and other fundamental commercial terms, are a monumental step in achieving the decades-long objective of bringing the benefits of Alaska’s incredible North Slope reserves to Alaskans and to global markets”, said Adam Prestidge, Glenfarne president for Alaska LNG.

Thursday’s statement also said Glenfarne had signed a letter of intent with Alaskan utility ENSTAR Natural Gas Co for a 30-year supply of LNG from the project. The volume under negotiation was not disclosed.

Earlier this month it announced a letter of intent with Donlin Gold LLC of Novagold Resources Inc for a power plant for the Donlin gold mine that would be fed by Alaska LNG. The document also provides for “a potential natural gas sales agreement for up to 50 million cubic feet of natural gas per day” and a pipeline connected to the local mine, Glenfarne said in a press release January 10.

On December 5, 2025 Glenfarne said it had finalized a partnership with POSCO International Corp that includes the execution of heads of agreement for a 20-year offtake of one MMtpa and a pre-FID investment from the Incheon, South Korea-based company. POSCO has also agreed to supply steel for Alaska LNG’s 807-mile, 42-inch pipeline.

The other earlier preliminary offtake agreements for Alaska LNG involve buyers in Japan, South Korea, Taiwan and Thailand, according to Glenfarne.

Thursday’s update also said Glenfarne has provisionally selected Sydney, Australia-based Worley Ltd for engineering, procurement and construction management services for Alaska LNG. Worley at the end of 2025 completed “engineering work sufficient for a final investment decision [FID]”, the statement said.

Glenfarne also announced conditional awards for pipeline construction to Wisconsin-based Precision Pipeline LLC; Texas-based Price Gregory International; joint bidders ASRC Energy Services LLC and Michels Pipeline Inc, based in Alaska and Wisconsin respectively; joint bidders Associated Pipe Line Contractors Inc of Texas, Cruz Construction Inc of Alaska and Doyon Energy Services LLC of Alaska; joint bidders Barnard Pipeline Inc of Montana and SICIM SpA of Italy; joint bidders U.S. Pipeline of Texas and VINCI Construction of France.

For pipe supply, Glenfarne said it had penned preliminary agreements for about two-thirds of the pipeline with Germany’s Europipe Gmbh and Greece’s Corinth Pipeworks SA.

Last year Baker Hughes agreed to a partnership with Glenfarne that would see it supply refrigerant compressors and power generation equipment for Alaska LNG. Under the collaboration, Baker Hughes has also committed to investing in Alaska LNG.

The project is planned to proceed in two phases. Phase 1 aims to deliver gas to the domestic market via a pipeline to the Anchorage region.

“Glenfarne is targeting mechanical completion of the pipeline in 2028 and delivery of first gas in 2029”, Glenfarne said Thursday.

Phase 2 would install additional infrastructure to enable overseas exports.

Glenfarne took over Alaska LNG in March 2025 as lead developer, with the state government’s Alaska Gasline Development Corp retaining 25 percent.

To contact the author, email [email protected]