However, he noted, “CPUs are not being cannibalized by GPUs. Instead, they have become ‘chokepoints’ in AI infrastructure.” For instance, CPUs such as Granite Rapids are essential in GPU clusters, and for handling agentic AI workloads and orchestrating distributed inference.

How pricing might increase for enterprises

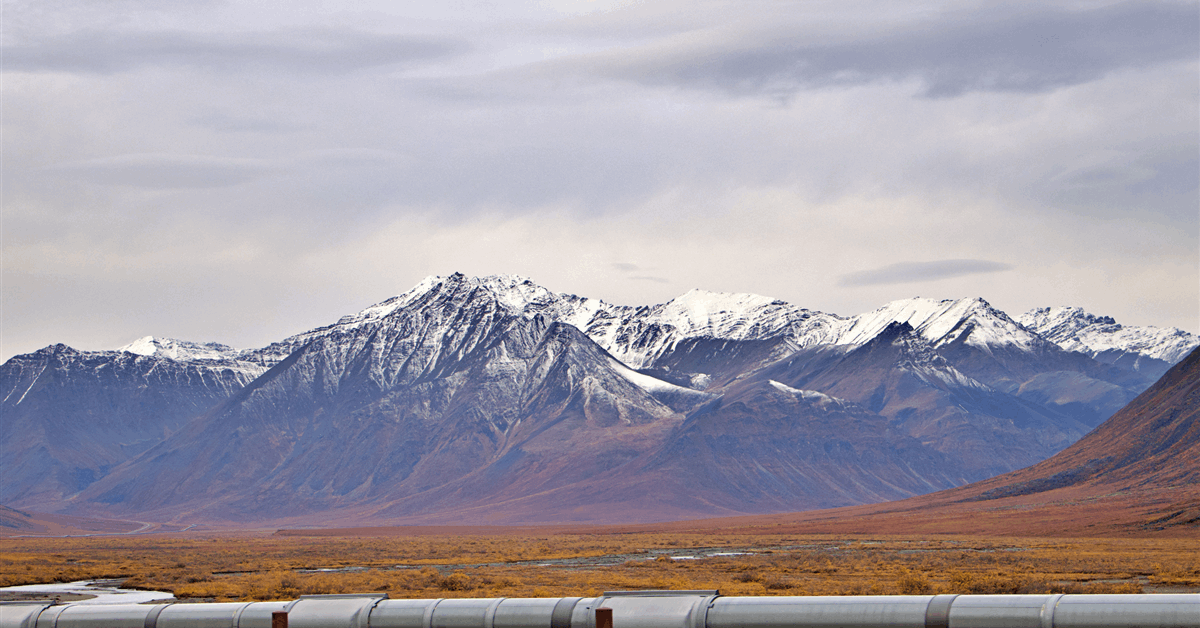

Ultimately, rapid demand for higher-end offerings resulted in foundry shortages of Intel 10/7 nodes, Bickley noted, which represent the bulk of the company’s production volume. He pointed out that it can take up to three quarters for new server wafers to move through the fab process, so Intel will be “under the gun” until at least Q2 2026, when it projects an increase in chip production.

Meanwhile, manufacturing capacity for Xeon is currently sold out for 2026, with varying lead times by distributor, while custom silicon programs are seeing lead times of 6 to 8 months, with some orders rolling into 2027, Bickley said.

In the data center, memory is the key bottleneck, with expected price increases of more than 65% year over year in 2026 and up to 25% for NAND Flash, he noted. Some specific products have already seen price inflation of over 1,000% since 2025, and new greenfield capacity for memory is not expected until 2027 or 2028.

Moor’s Sag was a little more optimistic, forecasting that, on the client side, “memory prices will probably stabilize this year until more capacity comes online in 2027.”

How enterprises can prepare

Supplier diversification is the best solution for enterprises right now, Sag noted. While it might make things more complex, it also allows data center operators to better absorb price shocks because they can rebalance against suppliers who have either planned better or have more resilient supply chains.