Aramco is launching its first bond sale of the year, following two debt issuances last year as the world’s largest oil company aims to increase borrowing levels and support investment and dividend payments.

The government-owned oil producer plans to sell dollar-denominated bonds on international markets, according to a statement to the Saudi stock exchange. Aramco is marketing debt with maturities ranging from three to 30 years, said a person with knowledge of the matter who asked not to be identified.

Aramco is a key contributor to Saudi state finances, with large dividend payments supplementing royalties linked to crude sales. As oil prices have dipped and OPEC+ policy limited Saudi production, cash flows lagged payouts before a rebound in the third quarter. Aramco’s $17 billion in debt sales over the last two years helped support payouts.

Saudi Arabia’s budget remains heavily dependent on oil revenue as the kingdom pursues an ambitious modernization drive. Crude prices remain well below levels needed to balance the state budget, forcing the government to project spending shortfalls for the coming years.

Initial pricing thoughts range from about 100 basis points over US Treasuries for the three-year tranche to about 165 basis points for the longer maturity. The market expects the bond sale will raise about $2 billion.

Aramco has turned to debt to augment its cash flow and plans to invest more than $50 billion this year in oil and natural gas production, while maintaining its high base dividend of $21 billion. In November, the company reported a surprise jump in third-quarter profit as rising production outweighed lower crude prices. Earnings are set to slip for the full year, estimates compiled by Bloomberg show.

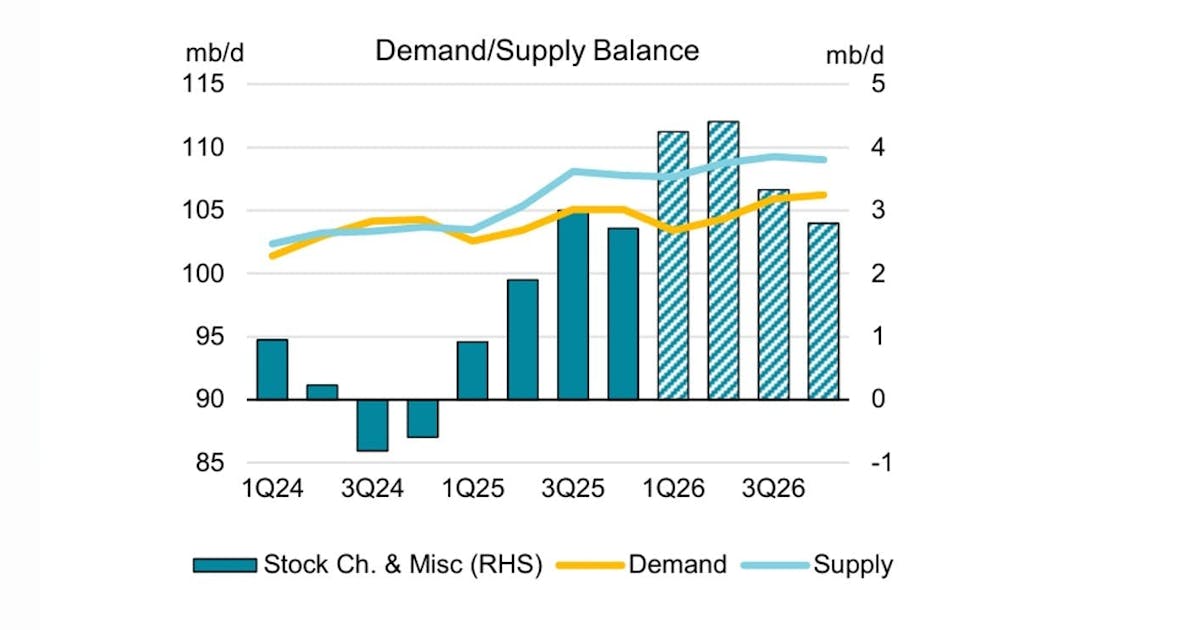

While Brent crude has risen this year amid geopolitical tensions, including US attacks on or threats of action against fellow OPEC producers Venezuela and Iran, the global benchmark lost almost 20% last year.

Brent was trading below $66 a barrel on Monday, while Saudi Arabia needs levels above $90 a barrel to balance its budget under current spending plans.

Aramco’s gearing — a measure of indebtedness — remains low relative to industry peers, and the company plans to gradually raise it, Chief Financial Officer Ziad Al-Murshed said on conference calls this year. Aramco has also signaled that further debt sales are planned.

Lenders appointed as active joint bookrunners for the sale are Citigroup Inc., Goldman Sachs Group Inc., HSBC Holdings Plc, JPMorgan Chase & Co. and Morgan Stanley.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.