The U.S. Energy Information Administration (EIA) revealed its latest Brent spot price forecasts in its January short term energy outlook (STEO), which was published this week.

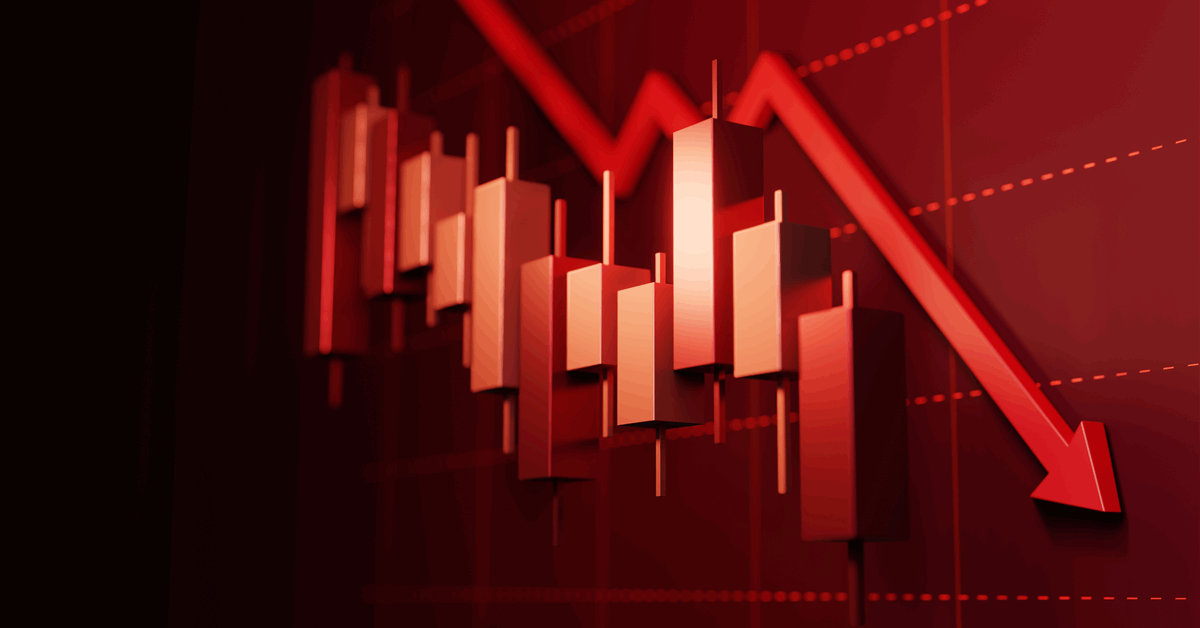

According to the STEO, the EIA sees the 2025 Brent spot price averaging $74.31 per barrel and the 2026 Brent spot price coming in at $66.46 per barrel. The EIA’s previous STEO projected that the 2025 Brent spot price would average $73.58 per barrel. That STEO did not offer a Brent spot price projection for 2026.

The EIA expects the Brent spot price to average $76.34 per barrel in the first quarter of this year, $75 per barrel in the second quarter, $74 per barrel in the third quarter, $72 per barrel in the fourth quarter, $68.97 per barrel in the first quarter of 2026, $67.33 per barrel in the second quarter, $65.68 per barrel in the third quarter, and $64 per barrel in the fourth quarter of 2026, the January STEO showed.

In its December STEO, the EIA forecast that the Brent spot price would average $74 per barrel in the first quarter of this year, $74.33 per barrel in the second quarter, $74 per barrel in the third quarter, and $72 per barrel in the fourth quarter.

The EIA highlighted in the STEO that its forecast was completed before the United States issued additional sanctions targeting Russia’s oil sector on January 10.

“For all of 2024, the Brent price averaged $81 per barrel and in 2023 averaged $82 per barrel,” the EIA noted in its latest STEO.

“Following some initial upward price pressure in early 2025, we expect that crude oil prices will generally decline from mid-2025 through the end of 2026 as growth in global oil production outpaces growth in oil demand,” it added.

“In our forecast, increases in oil prices in the coming months are largely a result of the recent extension of OPEC+ production cuts, which we expect will lead to global oil inventory withdrawals of 0.5 million barrels per day on average in the first quarter of 2025,” it continued.

“We expect that falling global oil inventories will increase crude oil prices $2 per barrel from their December average to an average of $76 per barrel in 1Q25,” it went on to state.

The EIA noted in its STEO that it expects that OPEC+ will begin to increase production by 2Q25. It added that it also expects that production growth from outside of OPEC+ will continue, “though at a slower pace than in 2023 and 2024”.

“This production growth, coupled with relatively weak growth in oil demand growth will cause global oil inventories to accumulate from mid-2025 through 2026,” the EIA warned in the STEO.

“Global inventories increase by an average of 0.3 million barrels per day in 2025 and by 0.7 million barrels per day in 2026,” it added.

“Increasing inventories put downward pressure on prices through the remainder of our forecast. As a result, we expect the average Brent crude oil price will fall to $72 per barrel in December 2025, before falling to an average of $66 per barrel in 2026,” it continued.

The EIA warned in its January STEO that significant uncertainty remains within its price forecast.

“While we assess that OPEC+ producers will likely continue to limit production mostly in line with recently announced targets through 2026, the potential for weakening commitment among OPEC+ producers to continue restraining production adds downside risk to oil prices,” the EIA said.

“Secondly, although no oil supplies have been directly affected thus far, tensions remain high around the Middle East, and future developments have the potential to influence oil prices,” it added.

“Lastly, our global oil consumption forecast shows growth that remains less than its pre-pandemic average, but changes in economic growth and other factors could significantly alter the trajectory compared with our forecast,” it went on to state.

Rigzone has contacted OPEC for comment on the EIA’s January STEO. At the time of writing, OPEC has not yet responded to Rigzone.

In a report sent to Rigzone by Standard Charted Bank Commodities Research Head Paul Horsnell late Tuesday, Standard Charted Bank projected that the ICE Brent nearby future crude oil price will average $82 per barrel in the first quarter of 2025, $84 per barrel in the second quarter, $89 per barrel in the third quarter, $93 per barrel in the fourth quarter, $91 per barrel in the first quarter of 2026, and $93 per barrel in the second quarter of next year.

“The strength in early-year crude oil prices has taken much of the market by surprise,” Standard Chartered Bank analysts, including Horsnell, stated in the report.

“However, we think the majority of traders have missed the main source of that surprise and think that it is only winter weather and sanctions of Russia that have detracted from the previous consensus of a 2025 supply glut,” they added.

“We think there are other deeper reasons for the strength in prompt markets: underlying non-weather-related demand is more robust than consensus expected; OPEC+ has been successful in keeping supply trimmed and close to target; and non-OPEC supply growth is already starting to disappoint relative to some of the wilder expectations for a surge in early 2025,” they went on to state.

In an oil and gas report sent to Rigzone by the Macquarie team on Wednesday, Macquarie strategists noted that “Brent has rallied over $6 per barrel to start the year”.

“Price action has largely created a curve rally as the market has priced in potential supply disruption, creating steep backwardation,” the strategists said in the report.

“With the expectation of tighter fundamentals, these supply side factors provided the catalyst for price to breach the 200D MA,” they added.

In the report, the strategists said “both WTI and Brent speculative (MM + Other) net length grew over the past week”.

“WTI net length increased by 37.9K while Brent rose by 22.3K. WTI spec net length gained as new long interest was over five greater than added shorts,” they highlighted.

To contact the author, email [email protected]