President-elect Donald Trump, set to be sworn in on Monday, is returning to the White House amid surging electricity demand, partly driven by planned data centers, new manufacturing facilities and electrification of the building and transportation sectors.

That reality — starkly different from the flat demand growth during Trump’s first term from 2017 to 2021 — will drive the incoming administration’s power-related policies, according to experts.

At the same time, there are more barriers to new power supply than probably during any previous era, such as state policies that make it hard to build infrastructure, according to Devin Hartman, director of energy and environmental policy at the R Street Institute, a market-oriented think tank. “You just cannot reconcile massive barriers to new supply with growing demand, and the situation that you inherit in the power sector is also the same set of conditions that constrain decarbonization,” he said.

Hartman contends there is significant overlap between Republican priorities for lowering energy costs and boosting reliability with Democratic desires for developing clean energy. Those goals, for example, can all be facilitated by new transmission, he said.

Trump moves quickly on nominations

At least three agencies — the Federal Energy Regulatory Commission and the departments of Energy and Interior — will play major roles in the Trump administration’s efforts to spur new power supplies and slash energy costs. The Environmental Protection Agency will also have a role in those efforts.

The incoming administration moved quickly with nominations to lead Energy, Interior and the EPA all announced in mid-November. The Senate is holding hearings this week on North Dakota Gov. Doug Burgum, R, Trump’s Interior secretary nominee and and prospective energy czar; former Rep. Lee Zeldin, R, nominated to be EPA administrator; and Liberty Energy CEO Chris Wright, the Energy secretary nominee. During a hearing on Wednesday, Wright said he would aim to increase U.S. power supplies to help lower electricity prices, if confirmed.

The nominees will likely be easily confirmed, John Lushetsky, senior vice president of ML Strategies, said during a Jan. 9 webinar hosted by the Mintz law firm. “With this accelerated pace, the Trump administration is in a much better position to be able to move out on many of these [energy-related] things that they campaigned on on day one,” he said.

Trump, for example, said during the campaign that he would cut electricity bills in half within 12 months of taking office.

Trump has also selected former FERC Chairman James Danly to be DOE deputy secretary.

Who leads FERC?

Trump is inheriting a FERC with a 3-2 Democratic majority, compared with an agency that lacked a quorum for months at the beginning of his first term.

“We’ll keep a quorum and keep doing business, but I think some Republicans view that as a bit of a loss, because they wanted to be able to shake things up on day one, and that’s just not possible,” Travis Fisher, director of energy and environmental policy studies at the Cato Institute, said.

Most FERC orders are unanimous, but there are often differences among the agency’s commissioners on major policy issues, Fisher noted. As a result, he said he doubts there will be action on big policy items until Republicans have a majority.

How long that takes likely depends on whether FERC Chairman Willie Phillips, a Democrat, decides to leave the agency before his term ends on June 30, 2026. Phillips hasn’t said what he plans to do.

“The Trump administration has been very public about wanting to take significant actions on energy, but if there is gridlock at FERC, that could slow down the incoming administration’s agenda.”

Steven Shparber

Attorney with Mintz, Levin, Cohn, Ferris, Glovsky and Popeo

Meanwhile, Trump will likely immediately name either Mark Christie or Lindsay See, FERC’s two Republican commissioners, to lead the agency until a permanent chairman is selected. Christie’s term expires June 30 and See’s term runs until June 30, 2028.

A new chairman will set FERC’s priorities, according to former Commissioner Allison Clements, who said the agency’s current commissioners appear to work well together.

“Each time a new commissioner or chair comes in, the dynamics shift across the agency,” said Clements, who this week joined data center-oriented consulting firm ASG as a partner. “The hope, in this moment of importance, will be that whoever becomes the chair that this level of collegiality and productivity continues.”

Changes to the agency’s makeup could affect the Trump administration’s success on energy policies, according to Steven Shparber, an attorney with Mintz, Levin, Cohn, Ferris, Glovsky and Popeo. “The Trump administration has been very public about wanting to take significant actions on energy, but if there is gridlock at FERC, that could slow down the incoming administration’s agenda,” he said.

Demand growth drives FERC agenda

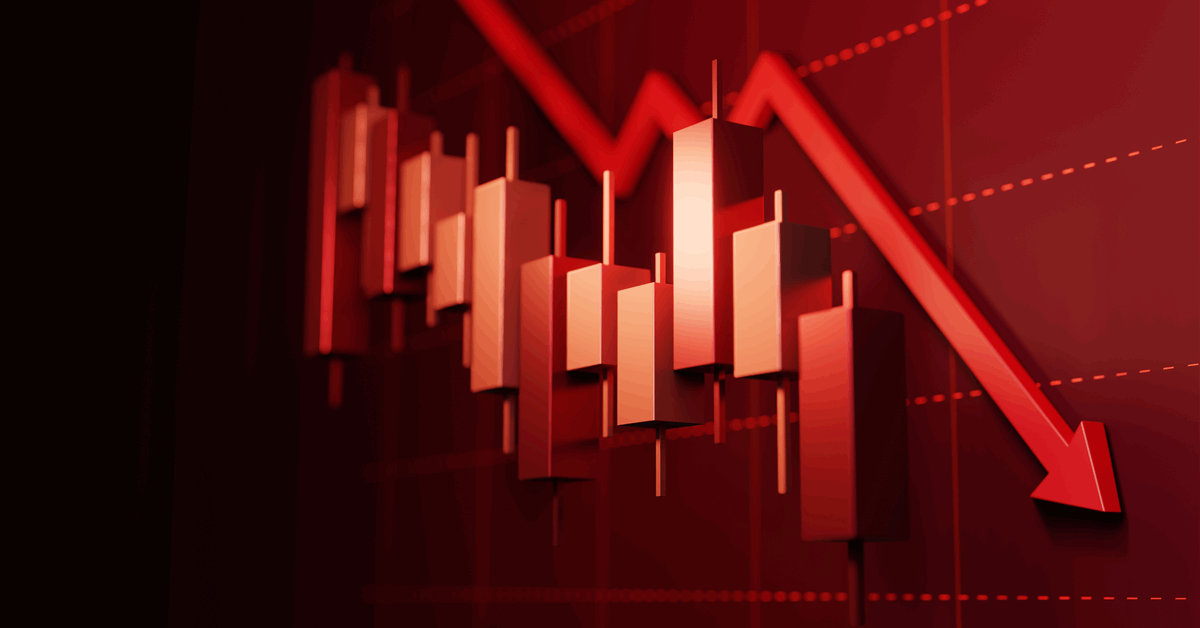

FERC’s agenda will be driven by the overarching issue of once-in-a-generation demand growth, according to Shparber. “This [demand growth] chart is candidly freaking out a lot of people, not just at FERC, but also on the Hill, and also people in the energy industry,” he said during the Jan. 9 Mintz webinar. The chart showed flat U.S. electric demand since about 2000, and then a sharp upturn in North American Electric Reliability Corp. forecasts starting in December 2023.

Noting it can take years to bring power supplies online, FERC will likely consider ways to spur cost-effective and reliable near-term resource additions, according to Clements. That may include taking additional steps on interconnection queue reform, finding ways to use surplus interconnection capacity and addressing co-locating load, such as data centers, at power plants, she said.

It can also include looking at ways to make the existing grid more efficient by using grid-enhancing technologies, decreasing inefficiencies at the seams between grid operators and increasing transparency so that market participants have opportunities to compete effectively, Clements said.

FERC will likely continue to support transmission development and competitive wholesale markets, according to John Moore, director of the Sustainable FERC Project, housed at the Natural Resources Defense Council. “The facts on the ground tell us we’re going to probably need more transmission, and these regional markets make a big difference in helping to ensure reliability and resource adequacy,” he said.

Hartman said he expects FERC will move ahead with regulations for dynamic line ratings — “a great candidate for a low cost way to quickly put downward pressure on rates” — and efforts to spur interregional transmission as well as implementing its Order 1920 on transmission planning and cost allocation.

Managing new loads

Another issue FERC could tackle is analyzing best practices for processing new load requests from data centers and manufacturing plants onto the grid, according to Josh Price, a director at consulting firm Capstone. There is a lack of uniformity and oversight on the process for interconnecting load to the grid across utilities, making it unclear exactly how much will be added, when and where, he said.

FERC could hold a technical conference on the issue or convene a meeting with the National Association of Regulatory Utility Commissioners to discuss jurisdictional issues, according to Price.

“You just cannot reconcile massive barriers to new [energy] supply with growing demand, and the situation that you inherit in the power sector is also the same set of conditions that constrain decarbonization.”

Devin Hartman

Director of Energy and Environmental Policy, R Street Institute

The load interconnection process has become the “Wild West” like generation interconnection processes have been where speculative projects overwhelmed interconnection queues, according to Clements.

“People are signing up commercially unrealistic, economically unrealistic, load filing requests,” Clements said. “Or they’re signing up five speculative requests when they only want to build one, and we’ve seen this movie before on the interconnection side.”

There may be a need to impose some sort of policy requirement, like financial readiness or commercial readiness, on the load filing side to make it clearer what projects are likely to move forward, Clements said.

Siting large loads is primarily a state-jurisdictional issue, according to Shparber. “So FERC will likely continue coordinating with states to get better visibility into the magnitude and location of where load is growing the most so that FERC-jurisdictional transmission planning processes can be optimized,” he said. “This sounds simple and straightforward, but it is a very important and complicated undertaking.”

Will FERC lose staff?

The Trump administration may face conflicting goals of trying to downsize the federal government with the need to tackle pressing issues, such as getting more power supplies onto the system to help reduce energy prices.

Project 2025, a presidential transition effort organized by the Heritage Foundation, included the Mandate for Leadership, a road map to “deconstruct the Administrative State.”

Besides calls for changes to power markets, the Project 2025 road map urges the incoming Trump administration to readopt the first Trump administration’s Schedule F classification for career federal employees involved in policymaking. The personnel classification would allow the president to fire those employees and replace them with selected people. In response to an October 2020 Trump executive order establishing Schedule F, FERC estimated that more than half of its positions met Schedule F criteria, according to a 2022 Government Accountability Office report.

It’s unlikely the Trump administration will conduct a political witch hunt or fire a specific number of people at FERC, according to Fisher, who contributed to the Project 2025 road map’s chapter on the agency. “I think that would be a bad move, especially in a highly specialized agency like FERC,” he said.

Given how important FERC is to the U.S. economy, it’s unlikely the agency will undergo staffing cuts, according to Hartman. However, some staff are exploring new jobs, he said.

DOE reorg, pause on loans on tap

Through the bipartisan infrastructure law and the Inflation Reduction Act, DOE has steered billions of dollars to clean energy and transmission projects during the Biden administration.

It is unclear exactly how that funding through DOE’s Loan Programs Office and other offices will be affected, Lushetsky said. However, given his technical, engineering and business background, DOE Secretary nominee Wright may be “very pragmatic,” he said, noting Liberty Energy invested in Fervo, a geothermal company, and Wright is on the board of Oklo, a company developing small modular nuclear reactors.

It will be challenging to withdraw IRA funding for projects that have been awarded funds and especially for projects with contracts, Lushetsky said, noting that funding has gone roughly six to one to Republican districts.

In August, 18 House Republicans urged Speaker Mike Johnson, R-La., to protect the IRA while other members have talked about administering a scalpel to the law instead of a sledgehammer, Lushetsky said.

Under Trump, DOE may, where statutorily possible, shift outstanding funding around to support priorities such as nuclear power and geothermal energy, according to Kennedy Nickerson, a vice president at Capstone.

Nickerson expects the new administration will temporarily pause the LPO program to review pending loan applications.

The LPO was reviewing 182 applications for about $279 billion in loans for advanced nuclear, renewable energy, transmission and other technologies as of Dec. 31. The LPO has about $397 billion in remaining loan authority, mostly for its Energy Infrastructure Reinvestment program, according to the office.

DOE may also be reorganized, with the Grid Deployment Office likely being axed, according to the Cato Institute’s Fisher.

EPA power plant rules face rollback

Trump didn’t leave a strong legacy on energy and environmental policy from his first term, with many decisions being overturned in court or efforts starting so late they were easily reversed by Biden, according to R Street’s Hartman.

“I am very curious to see if you have a much more pragmatic EPA agenda,” he said.

Generally, experts expect the Trump administration will roll back the EPA’s greenhouse gas regulations for power plants and other rules affecting generators. However, the process could take three years to complete, according to ML Strategies’ Lushetsky.