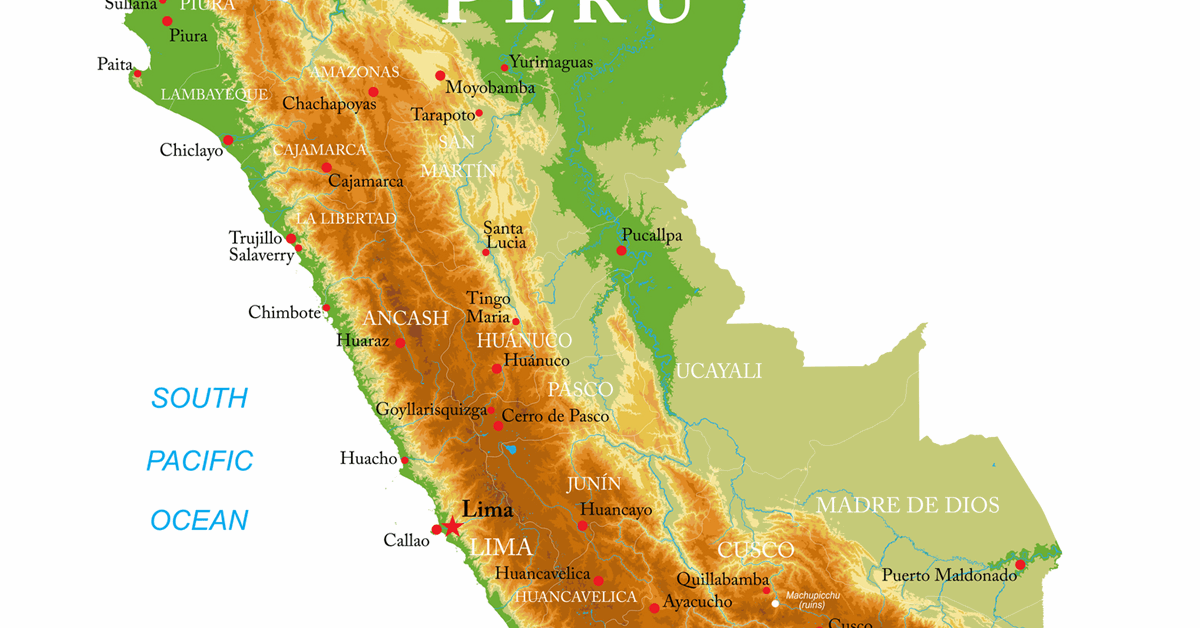

Peru-focused firm PetroTal is targeting to increase its production by around 24 percent in 2025.

PetroTal said in a news release that it has allotted a capital budget of $140 million, a year-over-year decrease of approximately 14 percent. The company’s flagship asset is its 100 percent working interest in the Bretana oil field in Peru’s Block 95, where oil production was initiated in June 2018.

Included in the company’s capital allocation is $55 million for drilling and workover activities, assuming a total of four development wells at the Bretana and Los Angeles oil fields; $60 million for field infrastructure at Bretana, including upgrades to fluid handling capacity and new drilling cellars to facilitate continued expansion of the Bretana field; and $36.5 million for investments in erosion control measures at Bretana.

The capital investments will support 2025 annual average production in the range of 21,000 to 23,000 barrels of oil per day (bopd), where the midpoint of 22,000 bopd implies growth of approximately 24 percent year over year, PetroTal said.

PetroTal’s new drilling rig, acquired in October 2024, is currently being imported to Peru. The company plans to move it to the Los Angeles field in the second quarter and commission it by mid-year. The company is planning to drill four development wells, with the last one to be completed in early 2026.

Major investments in field infrastructure include the expansion of fluid handling capacity at Bretana, where PetroTal is currently installing the fourth train of its central processing facility. This project will increase installed crude oil processing capacity to 32,000 bopd, the company said.

PetroTal President and CEO Manuel Pablo Zuniga-Pflucker said, “PetroTal is well positioned to build on the operational momentum that we established in 2024. We are firmly committed to a consistent return of capital policy, while maximizing the value of the Bretana oil field. We are one of very few companies in the oil and gas sector that can support a stable dividend while growing output by more than 20 percent year after year”.

“In addition to our active development programs at both the Bretana and Los Angeles fields, PetroTal is also expanding its exploration activities in the Ucayali Basin, where we recently secured an extension to our Block 107 license contract, and signed two new TEA’s adjacent to Block 131. Lastly, our budget also includes erosion protection measures for our key producing asset, a project that should be completed by the second quarter of 2026,” he added.

Further, PetroTal’s capital program includes approximately $4 million for exploration activities, mainly to fund ongoing permitting and road construction at Block 107. The company recently received an extension to the Fifth Exploration period of the Block 107 license contract, allowing ample time to pursue an exploration program at the Osheki-Kametza prospect, according to the release.

PetroTal said it also intends to commence exploration activities on the recently acquired TEA’s XCVII and XCVIII, in the vicinity of Block 131. A number of exploration prospects and leads have already been identified on existing 2D seismic coverage, it said.

PetroTal describes itself as having a management team that “has significant experience in developing and exploring for oil in Peru”. In early 2022, the company became the largest crude oil producer in the country.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR