The Federal Energy Regulatory Commission will address regulatory issues around colocating large loads, such as data centers, at power plant sites, FERC Chairman Mark Christie said in an interview.

“Colocation is a huge issue that we need to get in front of,” Christie said. “There’s a strong consensus that we need to move forward.”

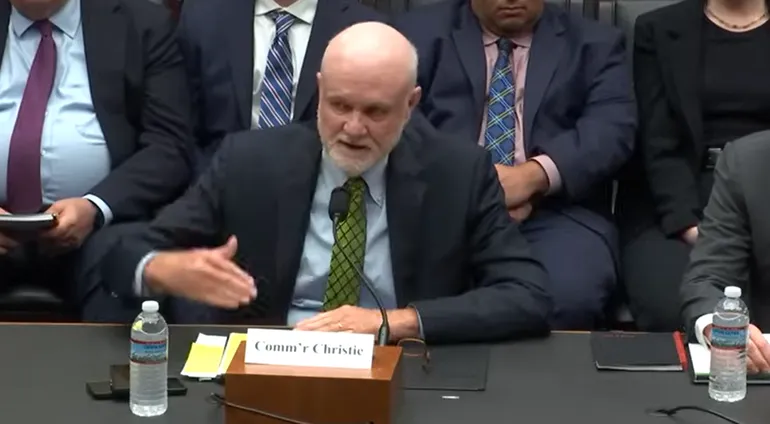

President Trump on Jan. 20 elevated Christie from FERC commissioner to chairman, a position that sets the agency’s agenda. Christie’s term on the commission ends June 30; when asked about a possible second term, he said there was “no news.”

Christie said his top priorities are protecting consumers from excessive electricity costs, ensuring grid reliability and strengthening ties between FERC and states.

Colocation, especially when it occurs at existing power plants, potentially affects two of those priorities: consumer costs and reliability. Companies exploring serving data centers next to nuclear and gas-fired power plants include Constellation Energy, PSEG Power and Vistra.

In November, Christie joined FERC Commissioner Lindsay See in a 2-1 vote to reject an amended interconnection service agreement that would have facilitated expanded power sales from a Susquehanna nuclear power plant in Pennsylvania that is majority owned by Talen Energy to to a colocated Amazon data center. Talen on Jan. 15 asked the U.S. Court of Appeals for the Fifth Circuit to overturn FERC’s decision.

In a concurrence to the decision, Christie cited concerns the PJM Interconnection’s market monitor raised that the Amazon data center could remove a significant amount of electricity from the grid operator’s market. It could also increase energy and capacity prices, according to the market monitor. In the interview, Christie said he stood by the concerns he raised in his concurrence.

FERC will address colocation using information it gathered at a technical conference the agency held in early November, Christie said, noting it is too soon to say when or how the agency will take up the issue.

“We have to get it so we don’t cost-shift to residential consumers who are struggling right now to pay their monthly bills,” Christie said. “We’ve got to make sure there’s no cost-shifting.”

Protecting consumers

Christie said his experience as a state regulator is part of what’s driving his focus on protecting consumers. Before joining FERC in January 2021, Christie served for 17 years at the Virginia State Corporation Commission as a judge — or what most states call a commissioner — and chairman.

“When you raise somebody’s retail rate, it’s going to go in their monthly bills,” Christie said. “These are the people you run into in the grocery store, when you walk around … These are your neighbors.”

FERC lacks a consumer advocate representing residential ratepayer interests, Christie noted. “I wish we did have one, but we don’t,” he said. “We still have to remember the public interest … the people who are not in the room, and the people who are not represented, and people who don’t have the lawyers, and people who don’t have the lobbyists pushing various regulatory initiatives.”

Electricity is an essential, non-discretionary service, Christie said, and his philosophy of utility regulation is “reliable power at the least cost.”

During his tenure at the Virginia SCC, Christie said he dissented twice out of roughly 17,000 orders that he participated in. In both dissents, Christie said he opposed allowing utilities to recover half of their charitable giving from ratepayers.

FERC has little role in overseeing generation and the distribution system, which fall under state jurisdiction, according to Christie. The agency affects customers’ electric bills through transmission, however, he said.

As a FERC commissioner, Christie has repeatedly called on the agency to revisit the incentives it gives to utilities and other companies to build power lines. Christie contends the incentives shift risks and costs onto consumers. He wants to eliminate incentives such as “construction work in progress,” which allows a utility to recover its expenses while it is building a project instead of waiting to recoup those expenses via a rate case after it is placed into service.

He has also wants to see changes in how FERC approves “formula rates,” an annual process that allows transmission owners to update their transmission rates outside a typical rate case. FERC acts on the presumption that transmission owners’ spending was prudent, leaving it up to ratepayer advocates and others to show it wasn’t.

Christie said he is “certainly going to try to act” on those issues as chairman. In August, he proposed providing incentives only for projects that had been thoroughly reviewed by states.

Grid reliability and capacity markets

Gid reliability is also a major concern for Christie, especially amid “mind-boggling” load growth forecasts driven by data centers.

On Jan. 23, Christie noted that PJM that week had set a winter peak load record of 145 GW, The generation mix serving the load was gas at 43.7%, nuclear at 22.2%, coal at 21.6%, wind at 2.4%, hydroelectric at 3.6%, oil at 4.4% and solar at 0.4%.

The Midcontinent Independent System Operator’s load peaked during the same cold snap at 108.2 GW, with a generation mix of gas at 37.1%, coal at 30.1%, wind at 17.7%, nuclear at 11.3% and solar at effectively zero, according to Christie.

“In both PJM and MISO, dispatchable generation kept the lights on and heat pumps running during this freezing weather,” Christie said on X, formerly Twitter. “We need to stop the premature retirements of dispatchable generation and build more, otherwise we freeze in the dark. That is reality.”

Reports from the North American Electric Reliability Corp. and grid operators like PJM show that baseload power plants are retiring without adequate replacements, Christie said in the interview.

While FERC has no direct authority over generation, the agency regulates capacity markets run by PJM, MISO, ISO New England and the New York Independent System Operator, Christie noted.

Through its market oversight, FERC has “a big impact on what gets built and what gets retired,” Christie said. “We’re not just a bystander saying, ‘Hey, look what’s happening.’ We are a big actor here.”

Currently, PJM is at the center of capacity market reforms. “We’re seeing numerous problems in the PJM capacity market,” Christie said, pointing to several pending market reform proposals and complaints.

Christie said he “expressed a long-time skepticism about whether this [capacity] construct is the best way to get resource adequacy” in a May 2023 Energy Law Journal article.

Strengthening FERC-state connections

Christie said he plans to continue a collaboration between FERC and the National Association of Regulatory Utility Commissioners that started during former FERC Chairman Richard Glick’s tenure.

“It is a structured way of constant communication” that it lets federal and state commissioners learn about the challenges their colleagues are facing, Christie said. “I am very, very adamant that we need to keep in constant dialogue with the states. The states are on the front lines.”

State utility regulators understand their states better than anyone, according to Christie. “I didn’t know more than the regulators from California, Minnesota, Indiana, any other state, and I didn’t become a genius when I came to FERC,” Christie said. “The regulators live it in those states, and so we need to listen to them … that’s what’s important about going to those NARUC meetings.”