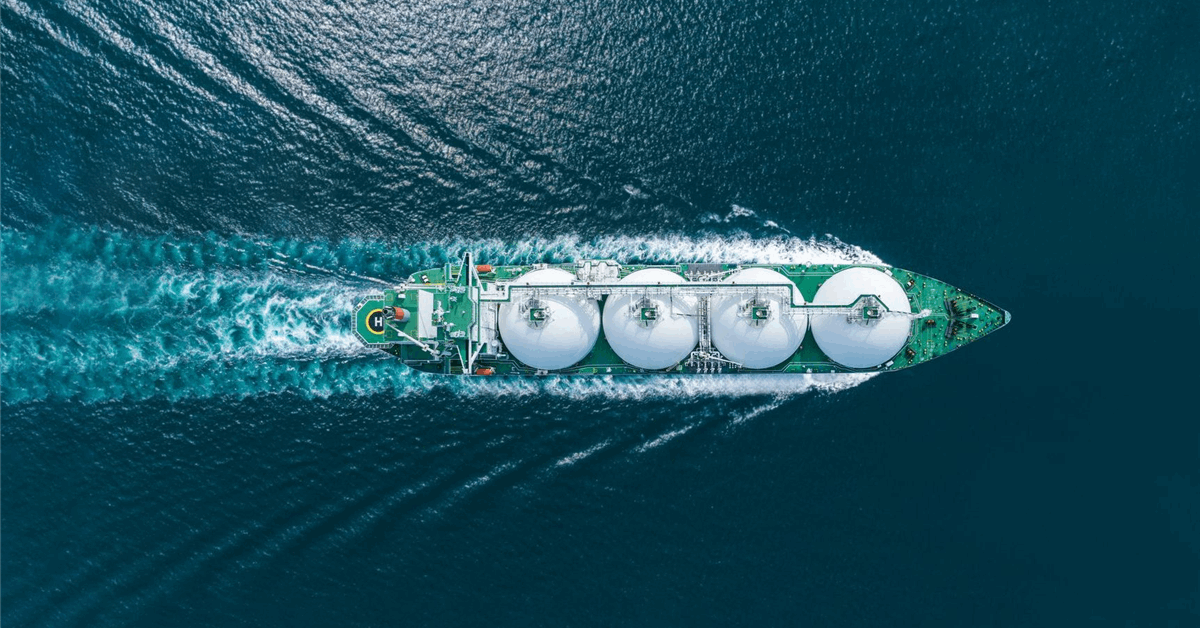

Hess Corp. grew its net oil production in Guyana by 52 percent to 195,000 barrels per day (bpd) in the fourth quarter of 2024 compared to the same three-month period in the prior year, according to quarterly results it released Wednesday.

The New York City-based company’s net production in the United States’ Bakken shale also rose seven percent year-on-year to 208,000 barrels of oil equivalent a day (boed).

Bakken and Guyana, specifically the Stabroek block, drove an increase in Hess’ proven reserves to 1.44 billion boe at the end of 2024 from 1.37 billion boe at the end of 2023, the oil and gas exploration and production company said.

Besides the onshore Bakken, the Gulf of Mexico also contributed to Hess’ U.S. production with 30,000 boed. In Southeast Asia, Hess derived 62,000 boed from the North Malay Basin and the Malaysia-Thailand Joint Development Area.

Hess’ net production in the October-December 2024 period totaled 495,000 boed, compared to 418,000 boed in the fourth quarter of 2023.

Higher production drove a 7.56 percent year-over-year increase in adjusted net earnings to $542 million, or $1.76 per share, for the fourth quarter of 2024.

That beat the Zacks Consensus Estimate, which averages projections by brokerage analysts, of $1.51 per share. Hess has now surpassed the Zacks estimate for the fourth consecutive quarter.

Lower realized selling prices and higher exploration expenses offset the effect of higher volumes.

Hess’ realized crude oil selling prices averaged $72.1 a barrel in the fourth quarter of 2024, including the effect of hedging. The corresponding figure in the fourth quarter of 2023 was $76.63 per barrel.

The average realized natural gas liquids selling price was $23.05 per barrel, up from $20.92 per barrel in the comparable period a year ago.

Hess sold natural gas at an average realized price of $4.1 per thousand cubic feet, compared with $4.51 in the fourth quarter of 2023.

“Cash operating costs, which include operating costs and expenses, production and severance taxes, and E&P [exploration and production] general and administrative expenses, were $12.95 per boe in the fourth quarter of 2024, compared with $13.29 per boe in the prior-year quarter”, Hess reported.

Net cash from operating activities totaled $1.31 billion, down from $1.34 billion for the fourth quarter of 2023. “Changes in operating assets and liabilities decreased cash flow from operating activities by $209 million during the fourth quarter of 2024 and increased cash flow from operating activities by $105 million during the prior-year quarter”, Hess said.

Hess ended 2024 with $1.2 billion in cash and cash equivalents, while debt and finance lease obligations stood at $5.3 billion.

In the first quarter of 2025 Hess expects to produce 465,000-475,000 boed, “reflecting planned maintenance and lower tax barrels at Guyana and the impact of winter weather in the Bakken”.

Hess and Chevron Corp. are progressing the completion of their delayed merger, under which Chevron will acquire the latter for $60 billion.

On January 17, 2025, the U.S. Federal Trade Commission finalized an agreement that settles antitrust concerns surrounding the combination.

While the competition agency concluded its statutory review of the merger, international arbitration is pending over a dispute with Hess’ partners in Stabroek — Exxon Mobil Corp. and China National Offshore Oil Corp. — over pre-emption rights or rights of first refusal.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR