American oilfield services firm Baker Hughes (NYSE:BKR) has beaten analyst profit estimates with an 8% increase in revenue and a 36% jump in adjusted net income in its full year results.

Baker Hughes achieved an adjusted profit of $0.70 per share in the fourth quarter, surpassing analyst expectations of $0.63.

The company’s industrial and energy technology (IET) segment experienced strong growth, with orders rising by 44% and revenue reaching $3.5 billion.

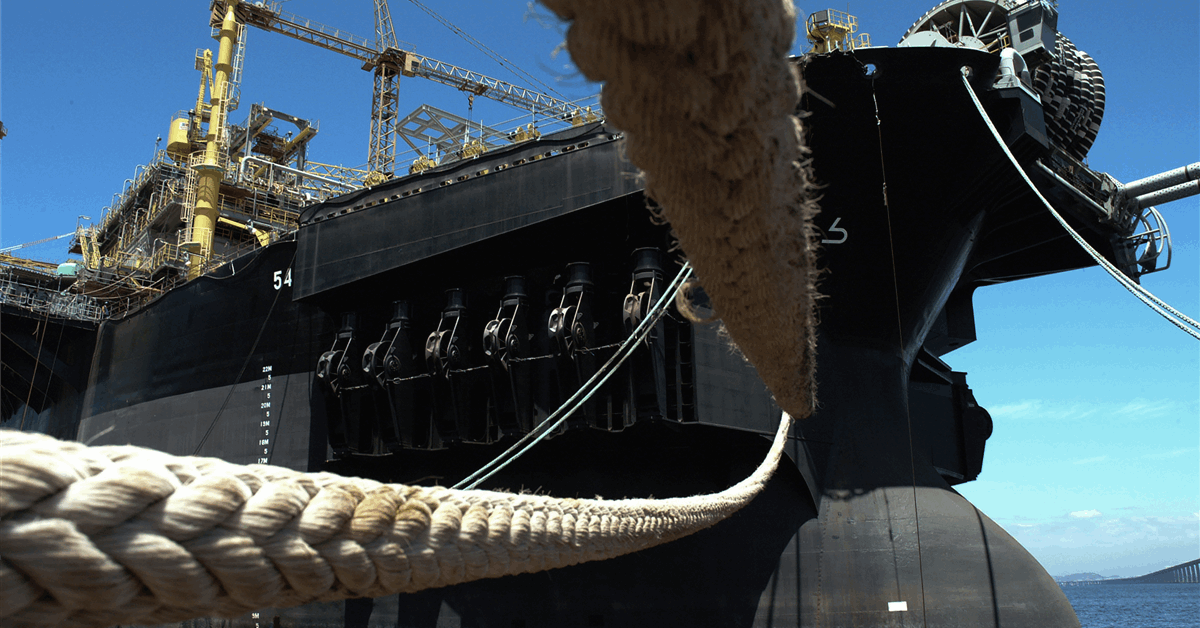

Baker Hughes attributed the surge to robust demand for compressors, turbines and other modular systems used in gas processing.

The IET segment also secured $3.8bn in orders in the fourth quarter of 2024, supported by strong liquefied natural gas (LNG) orders.

This week, Baker Hughes also secured a major contract with Venture Global LNG in the United states.

Overall, the company booked $13bn in orders in 2024, its second highest order year ever.

Baker Hughes chairman and chief executive officer Lorenzo Simonelli said the order performance “highlights the end-market diversity and versatility of our portfolio”.

“As reflected in our strong 2024 results and our exceptional margin improvement, Baker Hughes has evolved into a more profitable energy and industrial technology company,” he said.

“Company results are benefiting from strong execution, sharpened commercial focus and improved productivity gains.”

Despite strong growth in its IET segment, Baker Hughes saw revenue decline by 5% in North America in its oilfield services segment.

Meanwhile, international revenues, which includes the company’s North Sea and European operations, saw a slight decline, with a 1% decrease compared to the previous year.

Recommended for you

BP isn’t moving fast enough in the energy transition