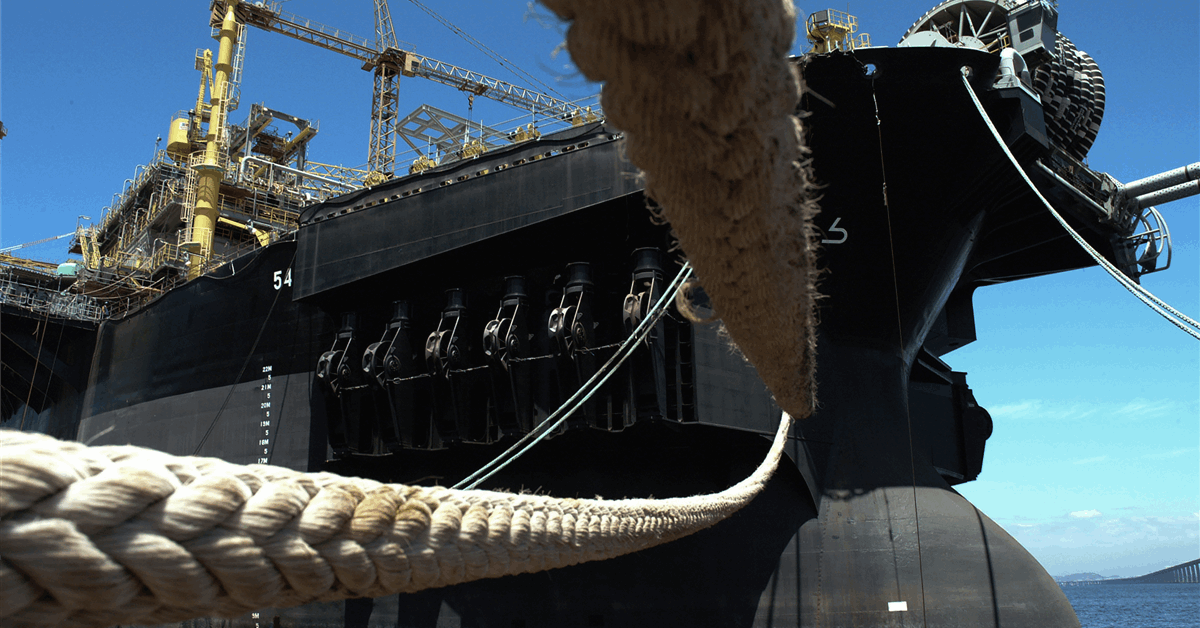

Ship classification organization American Bureau of Shipping (ABS) has granted approval in principle for a floating production, storage and offloading (FPSO) vessel for blue ammonia designed by MODEC Inc. and TOYO Engineering Corp.

Blue ammonia is ammonia produced using natural gas with emission mitigation technology such as carbon capture. The MODEC-TOYO FPSO is intended to use associated gas conventionally reinjected into the reservoir. For carbon dioxide (CO2) mitigation, the vessel would include a facility to capture and store emissions from the process of converting gas to ammonia, as well as CO2 from gas turbine generators, according to MODEC.

“The concept of producing blue ammonia offshore is achieved by combining MODEC’s expertise in overall layout, hull design and mooring technology, cultivated in Oil & Gas FPSO projects, with TOYO’s expertise in ammonia production process design and FPSO equipment design”, MODEC said in a press release Thursday.

The FPSO’s hull, which stores and offtakes the produced ammonia, was developed with help from Mitsubishi Shipbuilding Co. Ltd. TOYO meanwhile has partnered with Houston, Texas-based engineering firm KBR Inc. for its ammonia production technique.

“This blue ammonia is expected to serve as an alternative fuel and hydrogen carrier in the energy transition”, MODEC said.

“MODEC considers this AiP [approval in principle] as an initial step in the development of a floating solution for alternative energy production and will continue to strive to refine and mature this concept to address the key challenges for commercialization identified through this development, aiming to provide a safe and affordable alternative energy supply solution”.

The blue ammonia FPSO is positioned as the first concept design among floating alternative energy production systems envisioned in MODEC’s business plan for 2024-26. MODEC also aims to develop floating facilities for hydrogen and methanol, according to the plan published February 14, 2024.

Under the plan, MODEC envisions having the smallest carbon footprint among the world’s FPSO fleet operators by 2034.

“We will contribute to the minimization of CO2 emissions from FPSOs and the decarbonization of the global energy supply chain through developing new technologies for a sustainable future”, MODEC said Thursday.

Tokyo-based MODEC owns and operates floating production systems, as well as provides solutions for such facilities.

TOYO, based in Chiba, is an industrial engineering and construction company.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR