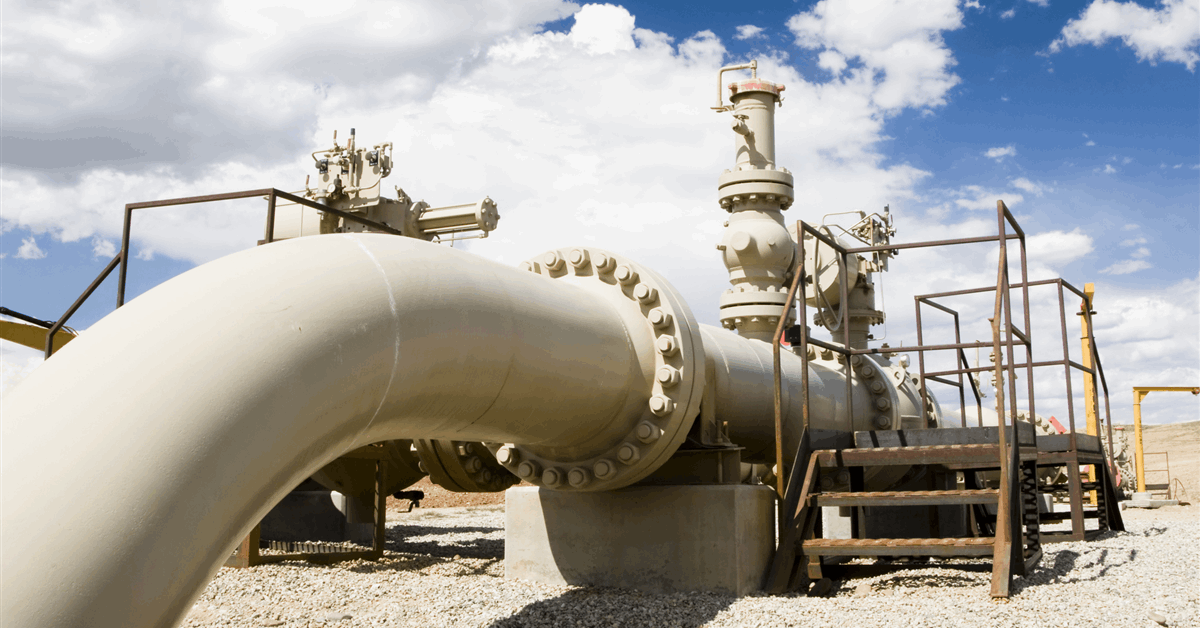

ArcLight Capital Partners LLC said Monday it had completed the acquisition of Phillips 66’s DCP GCX Pipeline LLC, which owns a 25 percent non-operating stake in the Gulf Coast Express Pipeline (GCX), for $865 million.

“Going forward, GCX will be jointly owned by subsidiaries of Kinder Morgan Inc. (NYSE: KMI) and ArcLight”, infrastructure investor ArcLight said in a press release. Houston, Texas-based Kinder Morgan remains as operator.

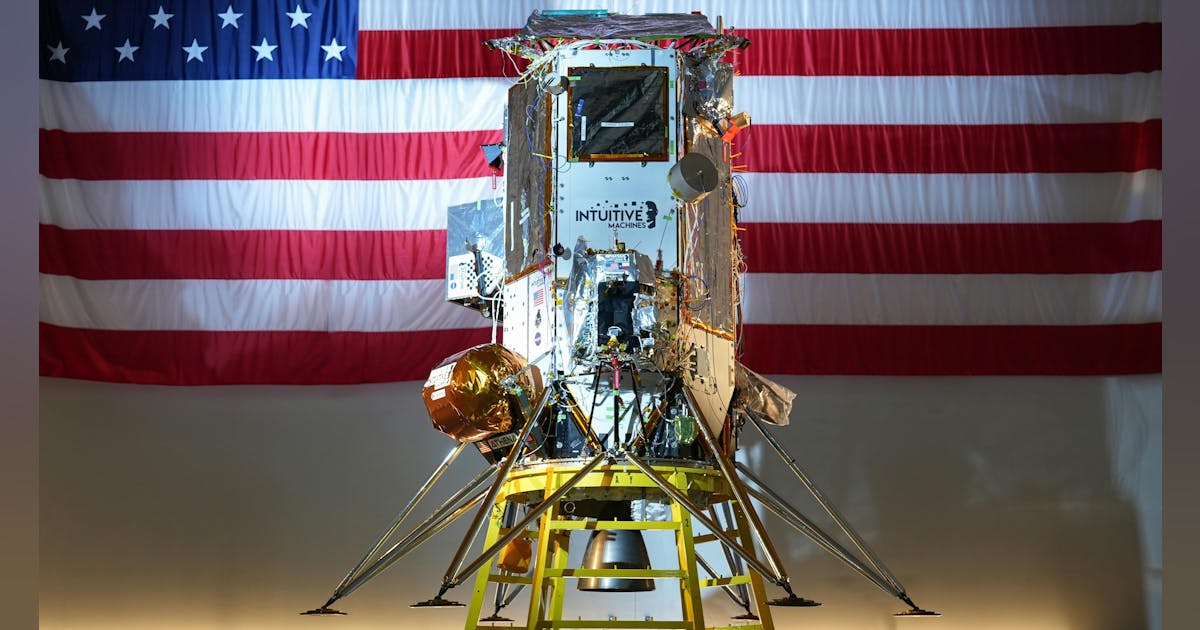

“GCX is a premier, 500-mile natural gas pipeline with approximately 2 Bcf/d [billion cubic feet a day] of capacity that is underpinned by a high-quality array of shippers under long-term committed contracts”, Boston, Massachusetts-based ArcLight said.

“GCX provides critical residue gas takeaway service from the Permian Basin to key U.S. Gulf Coast end-markets, including key growing demand regions such as the growing liquefied natural gas export market in South Texas”.

ArcLight founder Dan Revers said, “As the U.S. seeks to meet the rapidly growing power demand needs associated with AI and data center infrastructure, we believe more natural gas-related infrastructure, both power and midstream assets, will be needed to meet this objective”.

“This acquisition builds on our history dating back to 2001 of investing in critical gas infrastructure, ability to be a value-added partner, and expands our strategic partnership with Kinder Morgan”, Revers added.

Lucius Taylor, partner at ArcLight, commented, “As one of the largest, lowest cost transmission assets in the region, we believe GCX is well positioned to capitalize on the dual tailwinds of growing Permian production and long-term LNG, power, and industrial demand growth”.

Barclays Capital Inc. acted as ArcLight’s financial advisor in the transaction, announced December 16, 2024. Latham & Watkins LLP served as legal counsel.

For downstream oil and gas player Phillips 66, the transaction was part of a $3 billion divestment package to support its shareholder return target and other long-term priorities. The GCX sale exceeded the Houston-based company’s divestment plan.

“We intend to continue to optimize the portfolio and rationalize non-core assets going forward”, chief executive Mark Lashier said December about the agreement with ArcLight. “The evolution of our portfolio underscores our position as a leading integrated downstream energy provider, enhancing shareholder value and positioning the company for the future”.

Phillips 66 said, “Proceeds from the sale will support the strategic priorities of Phillips 66, including returns to shareholders and debt reduction”.

“The sales price represents an implied Enterprise Value/EBITDA multiple of 10.6x based on expected 2025 EBITDA [earnings before interests, taxes, depreciation and amortization]”, it said.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR