Reduced North Sea investment as a result of UK government policy could lead to millions of tonnes of additional CO2 emissions from imports, according to a report.

Edinburgh-based financial analyst firm Gneiss Energy modelled the potential impact of UK government policies relating to the country’s offshore oil and gas sector.

Since taking office last year, the UK Labour government has increased the windfall tax on North Sea oil and gas firms and pledged not to issue new exploration licences.

These policies, combined with a recent court ruling focused on downstream emissions, have raised concerns about the impact on future investment in the North Sea.

Without new projects and further investment, domestic UK gas production in the maturing North Sea basin is likely to significantly decrease over the next decade, leading to a greater reliance on imports.

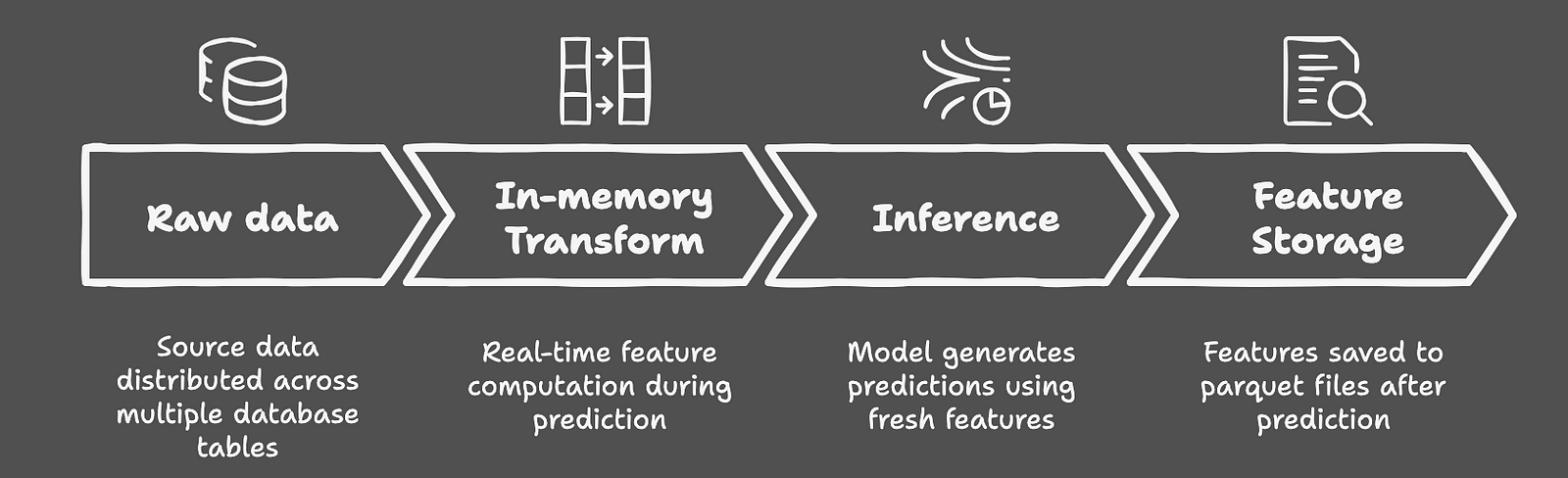

According to the North Sea Transition Authority (NSTA), the carbon intensity of UK gas production is almost four times lower than liquefied natural gas (LNG) imports.

UK gas and LNG emissions

The Gneiss Energy report estimated the emissions impact of reduced UK production on whilst in tandem increasing imports of liquefied natural gas (LNG) into the 2030s.

It modelled scenarios ranging from total reliance on UK domestic production to a ‘sunset’ scenario which assumes a 50% reduction in gas supplies from the UK continental shelf (UKCS).

In the sunset scenario, UK gas demand is met with increased supply balanced between Norway and LNG imports from countries like the United States, Qatar and Algeria.

Gneiss estimates this would lead to 13% higher pre-consumption CO2 emissions compared to the current UK energy mix.

© Supplied by National Grid Grain

© Supplied by National Grid GrainBy contrast, if the UK were to achieve 100% domestic gas supply it would lead to a 36% reduction in associated emissions.

While Gneiss notes that sourcing 100% of UK demand from domestic production is an “unlikely proposition”, it demonstrates a “strong emissions-focused argument for increased UK production”.

“This is especially true for the handful of large, undeveloped UK gas fields with attractive emissions profiles and significant capital investment requirements,” the report states.

UK policy leading to reliance on imports

Gneiss Energy managing director of Edinburgh and London Jon Fitzpatrick said full reliance on LNG imports would lead to an additional 8.5 million tonnes of CO2 emissions.

“We all want to get to a future where we do not need gas in the energy mix; however, all current analysis shows that gas will form a large part of the UK’s energy landscape for a number of years to come,” he said.

© Supplied by Gneiss Energy

© Supplied by Gneiss Energy“By impeding investment in new projects, UK policymakers are virtually guaranteeing a reliance on increased imports of emissions-intense LNG from sources that are often of worse environmental pedigree than our domestic assets.

“Not only does imported LNG bring higher CO2, it increases the UK’s reliance on overseas supply, including fracked gas from the USA alongside supplies from Qatar.”

Fitzpatrick said the UK should look to emulate the policies of its North Sea neighbour Norway, echoing trade bodies like Offshore Energies UK.

“The irony is that Norway, whose gas fields are in many cases located adjacent to our own, continues to invest significantly in exploration and production of the very gas which we now pay to import, and one of the reasons that Norwegian gas has a lower impact than ours is that they are investing in the electrification of gas fields – something we could do too,” he said.

“At a time of climate crisis and increasing global uncertainty, it would make far more sense from an economic, environmental, social and strategic perspective to support and ramp up UK domestic gas production than relying on imported gas from overseas.”

Energy Voice has contacted the Department for Energy Security and Net Zero for comment.

Recommended for you

Australian trio progress UK North Sea projects despite ‘challenging environment’