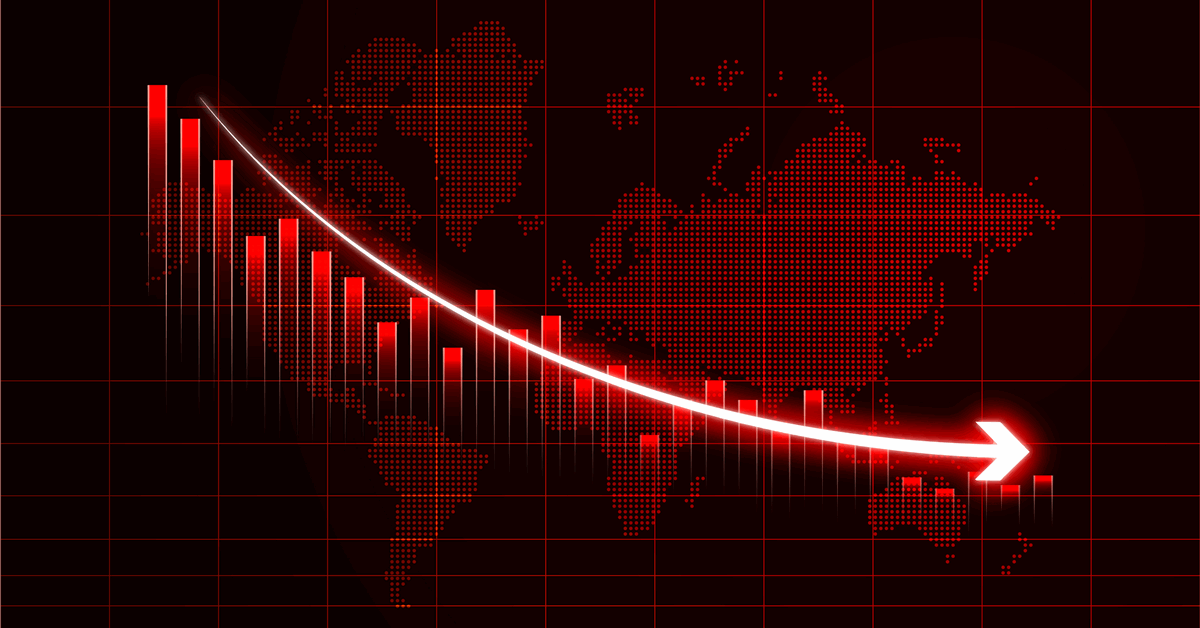

Oil fell to its lowest closing price of the year as traders continued exiting the market in the weeks following President Donald Trump’s inauguration.

West Texas Intermediate slid 2.3% to settle at $71.03 a barrel Wednesday as Trump’s positions on everything from war in the Middle East to tariffs on energy weigh on sentiment. Investors pulling out of crude and fuel markets triggered a $17 billion net outflow in the week ending Jan. 31, JPMorgan Chase & Co. analyst Tracey Allen wrote in a note to clients.

“Traders are pulling bets on the direction of crude right now,” said Joe DeLaura, a former trader and global energy strategist with Rabobank. “We see crude continuing lower until the next geopolitical outburst juices prices again.”

Wednesday’s drop followed a report that the Trump administration will unveil plans to end Russia’s war against Ukraine by next week, a move that would ease the risk of energy supply disruptions. Also weighing on prices: Beijing on Tuesday issued a swift but restrained retaliation to Trump’s levies, escalating the trade standoff between the world’s two biggest economies.

“Yesterday’s rebound on Trump’s ‘maximum pressure’ plan for Iran has proven to be short-lived,” City Index and Forex.com analyst Fawad Razaqzada wrote in a note. “The negative effect of a US-China trade war on demand, as well as rising global supplies, is what is holding back prices.”

Although investors are reading Trump’s moves as generally bearish for oil, his positions on the Israel-Gaza conflict and Iran sanctions may continue whipsawing the market.

The president on Tuesday signed a directive ordering Treasury Secretary Scott Bessent to use sanctions and tougher enforcement of existing measures to increase pressure on Tehran. He also proposed the US take over the Gaza Strip, eliciting scorn from Arab nations including OPEC+ leader Saudi Arabia.

Oil Prices:

- WTI for March delivery fell 2.3% to $71.03 a barrel in New York.

- Brent for April settlement slid 2.1% to $74.61 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR

Bloomberg