BTC is Leading in Returns and Risk-Adjusted Returns

With the quiet Christmas and New Year period for institutional investors, it will be hard to find the inflows necessary to push Bitcoin back clearly above $100,000.

But this is a first-world problem. When we zoom out to the scale of the whole year, Bitcoin has performed well.

Among major assets, Bitcoin is an outlier in at least two dimensions.

And if one key metric holds up, Bitcoin might stay the leader in the coming year.

Let’s discuss.

The Ecoinometrics newsletter gives you insights from crypto and macro data to help you make better investment decisions.

We spend hours every day gathering data, creating metrics and bringing them to life with data visualizations that allow you to quickly get to the heart of things.

We then distill all that knowledge in each issue of the newsletter with less words and more charts so that you get insights, direct to the point, in five minutes or less.

Join more than 27,000 investors here:

Done? Thanks! That’s great! Now let’s dive in.

Bitcoin: an Outstanding Performance in 2024

The Takeaway

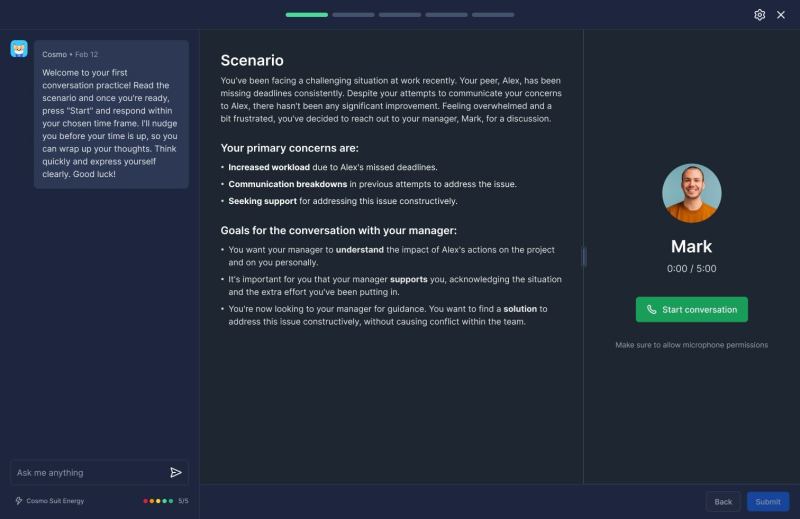

Despite December weakness from FOMC outflows and holiday de-risking, Bitcoin leads 2024’s performance charts in both absolute and risk-adjusted returns. It matches gold’s risk-adjusted metrics but delivers higher total gains through more volatile moves.

Key fundamentals remain supportive for 2025: rising global liquidity, successful ETF adoption, and favourable regulations.

While our models suggest some decline in risk-adjusted returns next month and ETF flows have temporarily weakened, these effects may be seasonal, warranting patience until regular market activity resumes in January.