New York Governor Kathy Hochul has signed a law that retroactively penalizes the biggest emitters in the fossil fuel sector to help the state fund climate adaptation measures.

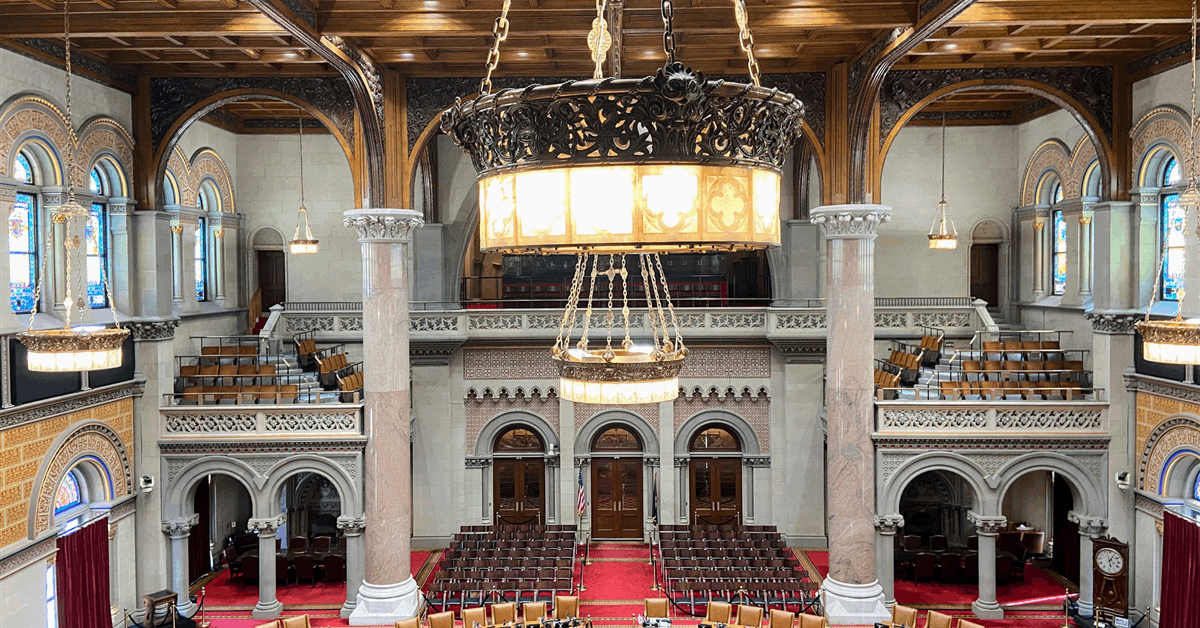

Voted 92-49 by the assembly June 8, the Climate Change Superfund Act applies to the biggest fossil fuel emitters from 2000 to 2018.

The fund charges a total of $75 billion to the “largest one hundred fossil fuel producing companies”, or $3 billion annually over the next 25 years, according to the text of the legislation published on the assembly’s website. The bill number is S02129B or A03351-B, two identical pieces of legislation with different sponsors.

“This landmark legislation shifts the cost of climate adaptation from everyday New Yorkers to the fossil fuel companies most responsible for the pollution”, the governor’s office said in an online statement.

Welcoming the new law, Sierra Club Atlantic chapter conservation director Roger Downs said, “New Yorkers are desperate for climate solutions because they have directly experienced how increasingly severe storms, floods, droughts, heatwaves, and public health emergencies are hurting our communities and undermining the affordability of everything”.

A spokesperson for lobby group the American Petroleum Institute said in a statement to Rigzone, “This type of legislation represents nothing more than a punitive new fee on American energy, and we are evaluating our options moving forward”.

The legislative text states, “Based on decades of research it is now possible to determine with great accuracy the share of greenhouse gases released into the atmosphere by specific fossil fuel companies over the last 70 years or more, making it possible to assign liability to and require compensation from companies commensurate with their emissions during a given time period”.

“The obligation to pay under the program is based on the fossil fuel companies’ historic contribution to the buildup of greenhouse gases that is largely responsible for climate change”, the legislation says.

“The program operates under a standard of strict liability; companies are required to pay into the fund because the use of their products caused the pollution. No finding of wrongdoing is required”.

The fund will be spent on the construction or upgrade of infrastructure such as coastal wetlands and storm water drainage systems; the provision of energy-efficient cooling systems in public and private buildings; programs addressing climate-driven public health challenges; and responses to extreme weather events.

At least 35 percent of spending is allotted to disadvantaged communities.

“The cost to the state of climate adaptation investments through 2050 will easily reach several hundred billion dollars, based on an array of estimates for projects impacting different regions across the state, far more than the $75 billion being assessed on the fossil fuel industry”, the legislation says.

The charge on fossil fuel firms is “sufficiently limited so as to not impose a punitive negative impact on an industry in which just the three largest domestic oil and gas producers made a combined $85.6 billion in profits in 2023”, it says.

“Recent science has determined that the largest one hundred fossil fuel producing companies are responsible for more than 70 percent of global greenhouse emissions since 1988, and therefore bear a much higher share of responsibility for climate damage to New York State than is represented by the $75 billion being assessed them”, the legislation adds.

“With respect to each responsible party, the cost recovery demand shall be equal to an amount that bears the same ratio to seventy-five billion dollars as the responsible party’s applicable share of covered greenhouse emissions bears to the aggregate applicable shares of covered greenhouse gas emissions of all responsible parties”, it says.

New York has yet to create implementing rules including the methodology to determine parties to be charged.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR