If you’re going to mine bitcoin, you’re going to need a Bitcoin mining ASIC.

In this blog post, we profile some of the best Bitcoin mining ASICs available as we turn the corner into 2025.

Bitcoin mining can be a great way to gain bitcoin exposure, BUT it’s also highly competitive and can be risky. Hashing with the right Bitcoin mining ASIC can make all the difference.

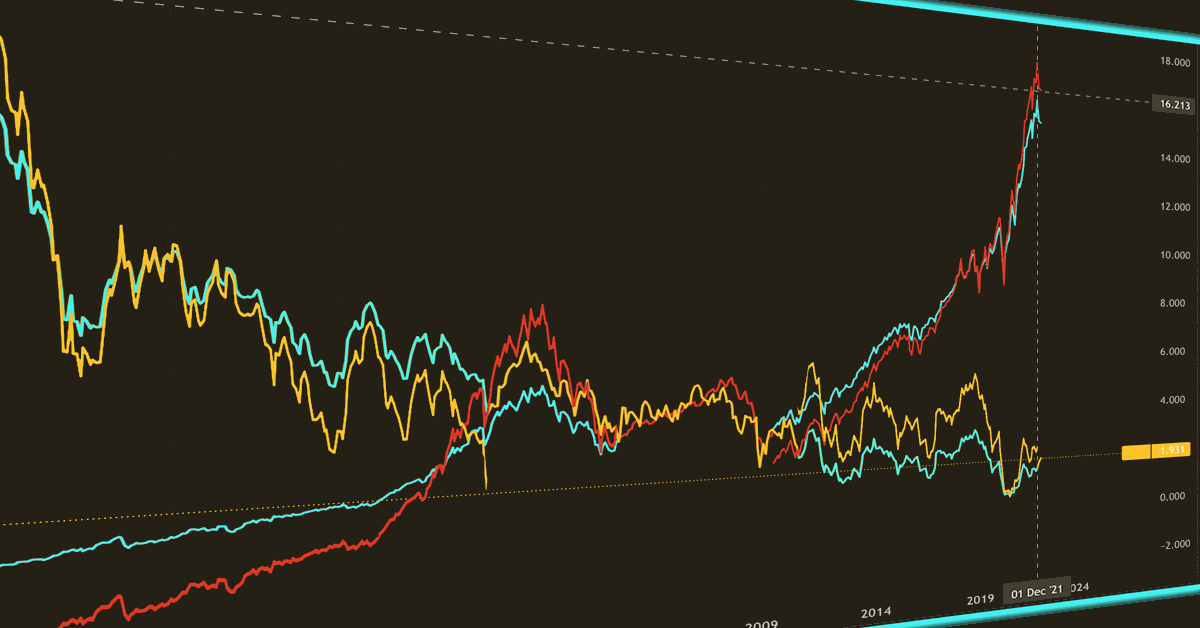

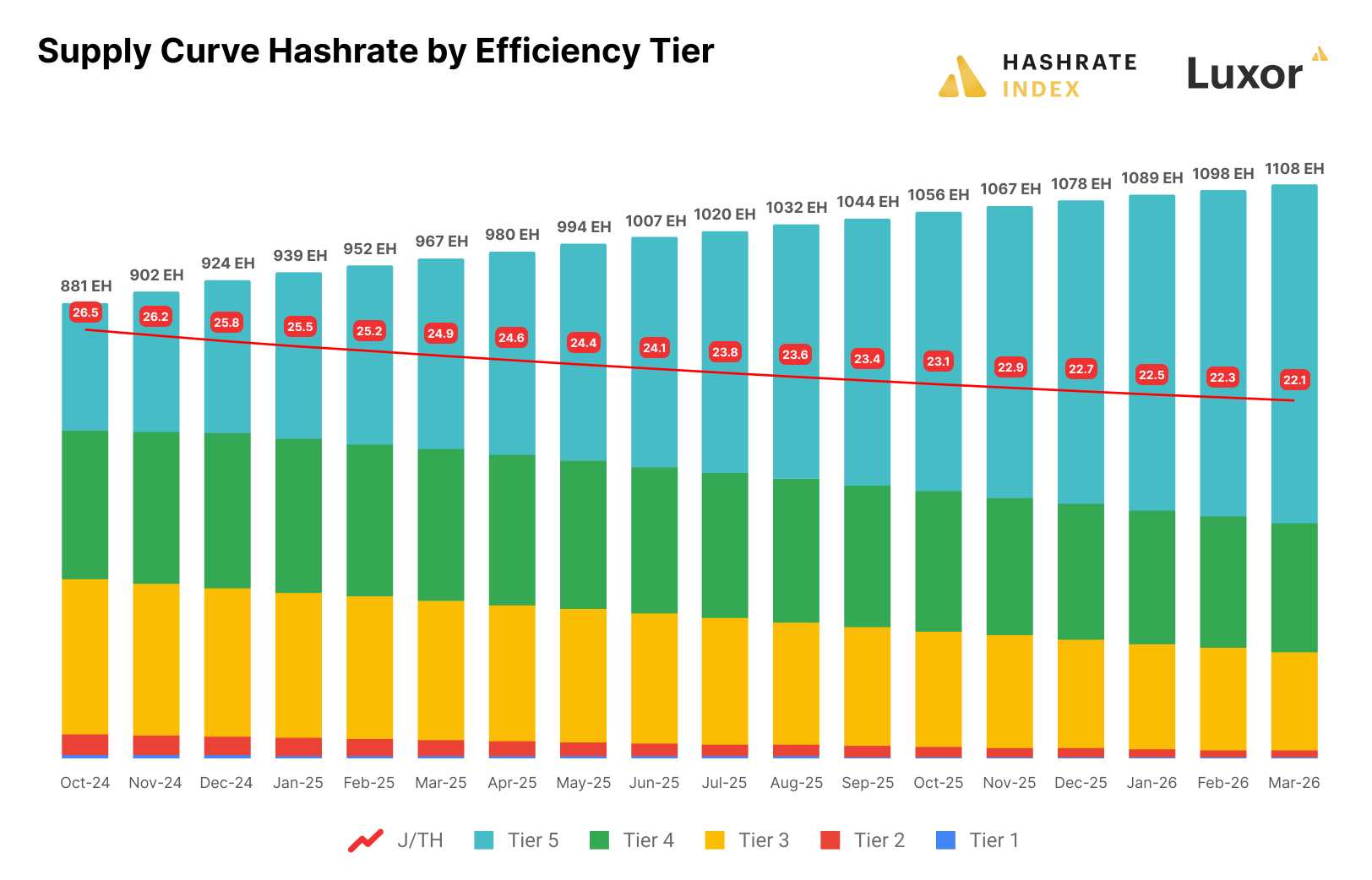

As shown in our most recent quarterly hashprice forecast model report — exclusively available for Hashrate Index Premium members — handling future increases in network difficulty will be crucial for mining operations as Bitcoin adoption continues around the world.

As we enter a new year of mining, we expect machines optimized for potential upgrades or better efficiency and specs to remain profitable for longer.

Here are the models we cover for this year’s best Bitcoin mining ASICs:

- Bitmain Antminer S21 Pro

- MicroBT Whatsminer M60S

- Bitmain Antminer S19j Pro

- MicroBT Whatsminer M30S++

- Canaan Avalon A1566

- Bitmain Antminer S21 XP Hydro

- Bitmain Antminer S19k Pro

- MicroBT Whatsminer M66S Immersion

- Canaan Avalon A1566 Immersion

- Bitdeer Sealminer A2

The contents of this article does not constitute financial advice. If readers are interested in buying and operating Bitcoin mining machines, they should do their own research and consult a trusted advisor.

If you would like to learn more about any of these Bitcoin mining machines, including their specifications and associated payback periods, you can visit our ASIC directory.

The Antminer S21 Pro is one of the most powerful air-cooled Bitcoin mining ASIC on the market today.

Overview

The S21 Pro boasts a hashrate of 234 TH/s with an efficiency of 15 J/TH, consuming around 3510 watts. It was introduced in March 2024. Since this model is still fairly new, supply is largely concentrated among large-scale professional mining companies.

At current cost conditions and mining economics, this model entails a daily profitability profile of $7.80 (assuming an electricity cost of 6 cents per kWh).

Firmware

Firmware is specialized software that Bitcoin miners can use to improve a Bitcoin mining ASIC’s performance. Firmware essentially enables a miner to “jail break” their machines, unlocking custom configurations between hashrate production, energy efficiency, and power consumption.

The Antminer S21 Pro comes with stock firmware, but there are also third-party firmware options that can enhance the miner’s performance.

Please note: using third-party firmware can void a machine’s warranty.

Luxor’s Antminer firmware, LuxOS, supports the S21 Pro. You can learn more about it here.

How to buy

Large-scale miners can buy the Antminer S21 Pro directly from its manufacturer, Bitmain. Other miners can source them from Luxor’s ASIC Shop at a current price of $23.87/TH.

The Whatsminer M60S is another one of the most powerful air-cooled Bitcoin mining ASIC on the market today.

Overview

The M60S boasts a hashrate of 170-186 TH/s with an efficiency of 18.5 J/TH, consuming around 3441 watts. It was introduced in October 2023.

At current cost conditions and mining economics, this model entails a daily profitability profile of $5.22 (assuming an electricity cost of 6 cents per kWh).

Firmware

The M60S comes with stock firmware, however it doesn’t have third-party firmware available because of its hashboard design. Bitcoin mining firmware specialists are working hard to crack this nut though, so stay tuned.

How to buy

Large-scale miners can buy the Antminer M60S directly from its manufacturer, MicroBT at a current price of $18.30/TH. These miners can also be sourced from Luxor’s ASIC Shop.

The Antminer S19j Pro has replaced its predecessor, the Antminer S9, as the mining industry’s humble and reliable hasher.

Overview

The S19j Pro boasts a hashrate of 100 TH/s with an efficiency of 29.5 J/TH, consuming around 2950 watts. It was introduced in June 2021. This model is from the previous generation of ASICs, however used machines have recently been in high demand because of its favourable cost coupled with an improving hashprice environment, resulting in some of the best payback periods around at the moment.

At current cost conditions and mining economics, this model entails a daily profitability profile of $1.22 (assuming an electricity cost of 6 cents per kWh).

Firmware

The Antminer S19j Pro comes with stock firmware, but there are also third-party firmware options that can enhance the miner’s performance.

Luxor’s Antminer firmware, LuxOS, supports the S19j Pro.

How to buy

Since these miners are old-gen, they can only be sourced from secondary markets such as Luxor’s Request-for-Quote Marketplace.

Another older generation ASIC, the Whatsminer M30S++ is a coveted Bitcoin mining ASIC from MicroBT.

Overview

The M30S++ boasts hashrate of 100-112 TH/s with an efficiency of 134J/TH, consuming around 3400 watts. It was introduced in October 2020. This model is from the previous generation of ASICs, however has benefited from recent improvements in hashprice.

At current cost conditions and mining economics, this model entails a daily profitability profile of $1.13 (assuming an electricity cost of 6 cents per kWh).

Firmware

The M30S++ comes with stock firmware, however it doesn’t have third-party firmware available because of its hashboard design.

How to buy

Since these miners are old-gen, they can only be sourced from secondary markets such as Luxor’s Request-for-Quote Marketplace.

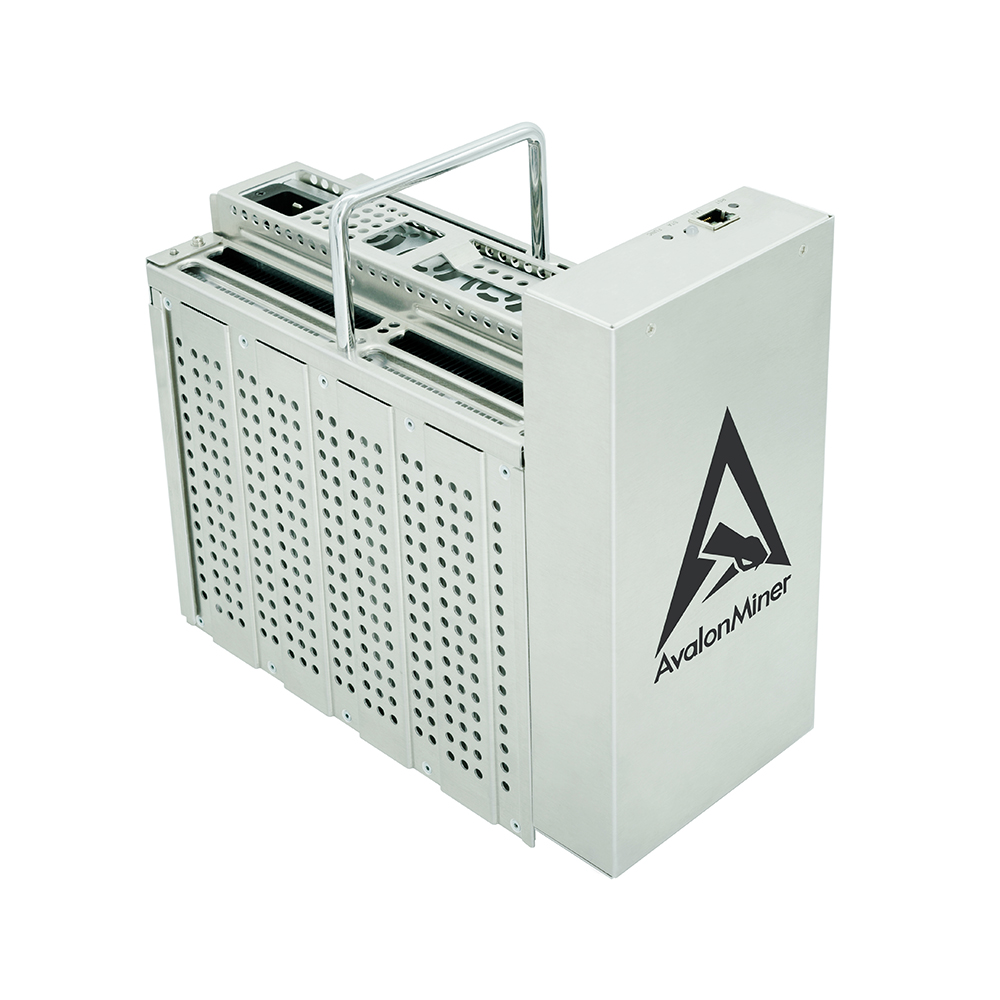

Canaan’s Avalonminer A15 series of air-cooled Bitcoin mining ASICs is a fierce competitor in the mining market.

Overview

The Avalon A1566 boasts a hashrate of 185 TH/s with an efficiency of 19.9 J/TH, consuming around 3681 watts. It was introduced in Q4 2024. Since this model is still fairly new, supply is largely concentrated among large-scale professional mining companies.

At current cost conditions and mining economics, this model entails a daily profitability profile of $4.82 (assuming an electricity cost of 6 cents per kWh).

Firmware

The A1566 comes with stock firmware, however it doesn’t have third-party firmware available.

How to buy

Large-scale miners can buy the A1566 directly from its manufacturer, Canaan. Other miners can source them from Luxor’s ASIC Shop at a current price of $19.51/TH.

The Antminer S21 XP Hydro is the most powerful Bitcoin mining ASIC currently available.

Overview

The S21 XP Hydro boasts a hashrate of 473 TH/s with an efficiency of 12 J/TH, consuming around 5676 watts. It was introduced in June 2024. Since this model is still fairly new, supply is largely concentrated among large-scale professional mining companies.

At current cost conditions and mining economics, this model entails a daily profitability profile of $17.70 (assuming an electricity cost of 6 cents per kWh).

Firmware

Luxor’s Antminer firmware, LuxOS, does not support the S21 XP Hydro (yet).

How to buy

Large-scale miners can buy the Antminer S21 XP Hydro directly from its manufacturer, Bitmain.

The Antminer S19k Pro is highly similar to its sibling, the Antminer S19j Pro, as another humble hasher for the mining industry.

Overview

The S19k Pro boasts hashrate of 120 TH/s with an efficiency of 23 J/TH, consuming around 2760 watts. It was introduced in September 2023. This model is from the previous generation of ASICs, however has benefited from recent improvements in hashprice.

At current cost conditions and mining economics, this model entails a daily profitability profile of $2.59 (assuming an electricity cost of 6 cents per kWh).

Firmware

The Antminer S19k Pro comes with stock firmware, but there are also third-party firmware options that can enhance the miner’s performance.

Luxor’s Antminer firmware, LuxOS, supports the S19k Pro.

How to buy

Since these miners are old-gen, they can only be sourced from secondary markets such as Luxor’s Request-for-Quote Marketplace. Miners can also source them from Luxor’s ASIC Shop at a current price of $10.76/TH.

The immersion-cooled Whatsminer M66S is one of MicroBT’s most powerful Bitcoin mining ASIC on the market today.

Overview

The M66S Immersion boasts a hashrate of 298 TH/s with an efficiency of 18.5 J/TH, consuming around 5513 watts. It was introduced in October 2023. Since this model is fairly complex to operate, supply is largely concentrated among large-scale professional mining companies.

At current cost conditions and mining economics, this model entails a daily profitability profile of $8.43 (assuming an electricity cost of 6 cents per kWh).

Firmware

The M66S Immersion comes with stock firmware, however it doesn’t have third-party firmware available because of its hashboard design.

How to buy

Large-scale miners can buy the M66S Immersion directly from its manufacturer, MicroBT.

The immersion-cooled Avalon A1566 is one of Canaan’s most powerful Bitcoin mining ASIC on the market today.

Overview

The A1566 Immersion boasts a hashrate of 249 TH/s with an efficiency of 19 J/TH, consuming around 4500 watts. It was introduced in June 2024. Since this model is fairly complex to operate, supply is largely concentrated among large-scale professional mining companies.

At current cost conditions and mining economics, this model entails a daily profitability profile of $7.22 (assuming an electricity cost of 6 cents per kWh).

Firmware

The A1566 Immersion comes with stock firmware, however it doesn’t have third-party firmware available.

How to buy

Large-scale miners can buy the A1566 Immersion directly from its manufacturer, Canaan.

The Sealminer A2 is a highly anticipated Bitcoin mining ASIC designed and manufactured by the publicly traded Bitcoin mining company Bitdeer (NASDAQ: BTDR). This machine is about to enter the mining market as a new player in town.

Overview

The Sealminer A2 boasts a hashrate of 226 TH/s with an efficiency of 16.5 J/TH, consuming around 3729 watts. It was introduced in November 2024. Since this model is still fairly new and proprietary, supply is highly limited among Bitdeer and its customer base.

At current cost conditions and mining economics, this model entails a daily profitability profile of $7.05 (assuming an electricity cost of 6 cents per kWh).

Firmware

The Sealminer A2 comes with stock firmware, however it doesn’t have third-party firmware available.

How to buy

Large-scale miners can buy the Sealminer A2 directly from its manufacturer, Bitdeer.

Mining Bitcoin in 2025

The bitcoin mining ASICs we highlight in this blog post are the best options available today. Wether you’re new to Bitcoin mining, a veteran, a hobbyist miner, or a professional, these miners will provide you with the hashes you want to secure the blockchain and earn bitcoin in return.

All that said, be sure to do your research and choose a machine that’s right for you. If you are looking to purchase, check out Luxor’s ASIC Shop for the best prices and seamless shipping.

Happy hashing!