(Oh, I am the only one who’s been asking this question…? Hm. Well, if you have a minute, please enjoy this exploratory Data Analysis — featuring experimental design, statistics, and interactive visualization — applied a bit too earnestly to resolve an international debate.)

1. Introduction

1.1 Background and motivation

Chocolate is enjoyed around the world. From ancient practices harvesting organic cacao in the Amazon basin, to chocolatiers sculpting edible art in the mountains of Switzerland, and enormous factories in Hershey, Pennsylvania churning out 70 million kisses per day, the nuanced forms and flavors of chocolate have been integrated into many cultures and their customs. While quality can greatly vary across chocolate products, a well-known, shelf-stable, easily shareable form of chocolate are M&Ms. Readily found by convenience store check-out counters and in hotel vending machines, the brightly colored pellets are a popular treat whose packaging is re-branded to fit nearly any commercializable American holiday.

While living in Denmark in 2022, I heard a concerning claim: M&Ms manufactured in Europe taste different, and arguably “better,” than M&Ms produced in the United States. While I recognized that fancy European chocolate is indeed quite tasty and often superior to American chocolate, it was unclear to me if the same claim should hold for M&Ms. I learned that many Europeans perceive an “unpleasant” or “tangy” taste in American chocolate, which is largely attributed to butyric acid, a compound resulting from differences in how milk is treated before incorporation into milk chocolate.

But honestly, how much of a difference could this make for M&Ms? M&Ms!? I imagined M&Ms would retain a relatively processed/mass-produced/cheap candy flavor wherever they were manufactured. As the lone American visiting a diverse lab of international scientists pursuing cutting-edge research in biosustainability, I was inspired to break out my data science toolbox and investigate this M&M flavor phenomenon.

1.2 Previous work

To quote a European woman, who shall remain anonymous, after she tasted an American M&M while traveling in New York:

“They taste so gross. Like vomit. I don’t understand how people can eat this. I threw the rest of the bag away.”

Vomit? Really? In my experience, children raised in the United States had no qualms about eating M&Ms. Growing up, I was accustomed to bowls of M&Ms strategically placed in high traffic areas around my house to provide readily available sugar. Clearly American M&Ms are edible. But are they significantly different and/or inferior to their European equivalent?

In response to the anonymous European woman’s scathing report, myself and two other Americans visiting Denmark sampled M&Ms purchased locally in the Lyngby Storcenter Føtex. We hoped to experience the incredible improvement in M&M flavor that was apparently hidden from us throughout our youths. But curiously, we detected no obvious flavor improvements.

Unfortunately, neither preliminary study was able to conduct a side-by-side taste test with proper controls and randomized M&M sampling. Thus, we turn to science.

1.3 Study Goals

This study seeks to remedy the previous lack of thoroughness and investigate the following questions:

- Is there a global consensus that European M&Ms are in fact better than American M&Ms?

- Can Europeans actually detect a difference between M&Ms purchased in the US vs in Europe when they don’t know which one they are eating? Or is this a grand, coordinated lie amongst Europeans to make Americans feel embarrassed?

- Are Americans actually taste-blind to American vs European M&Ms? Or can they taste a difference but simply don’t describe this difference as “an improvement” in flavor?

- Can these alleged taste differences be perceived by citizens of other continents? If so, do they find one flavor obviously superior?

2. Methods

2.1 Experimental design and data collection

Participants were recruited by luring — er, inviting them to a social gathering (with the promise of free food) that was conveniently co-located with the testing site. Once a participant agreed to pause socializing and join the study, they were positioned at a testing station with a trained experimenter who guided them through the following steps:

- Participants sat at a table and received two cups: 1 empty and 1 full of water. With one cup in each hand, the participant was asked to close their eyes, and keep them closed through the remainder of the experiment.

- The experimenter randomly extracted one M&M with a spoon, delivered it to the participant’s empty cup, and the participant was asked to eat the M&M (eyes still closed).

- After eating each M&M, the experimenter collected the taste response by asking the participant to report if they thought the M&M tasted: Especially Good, Especially Bad, or Normal.

- Each participant received a total of 10 M&Ms (5 European, 5 American), one at a time, in a random sequence determined by random.org.

- Between eating each M&M, the participant was asked to take a sip of water to help “cleanse their palate.”

- Data collected: for each participant, the experimenter recorded the participant’s continent of origin (if this was ambiguous, the participant was asked to list the continent on which they have the strongest memories of eating candy as a child). For each of the 10 M&Ms delivered, the experimenter recorded the M&M origin (“Denmark” or “USA”), the M&M color, and the participant’s taste response. Experimenters were also encouraged to jot down any amusing phrases uttered by the participant during the test, recorded under notes (data available here).

2.2 Sourcing materials and recruiting participants

Two bags of M&Ms were purchased for this study. The American-sourced M&Ms (“USA M&M”) were acquired at the SFO airport and delivered by the author’s parents, who visited her in Denmark. The European-sourced M&Ms (“Denmark M&M”) were purchased at a local Føtex grocery store in Lyngby, a little north of Copenhagen.

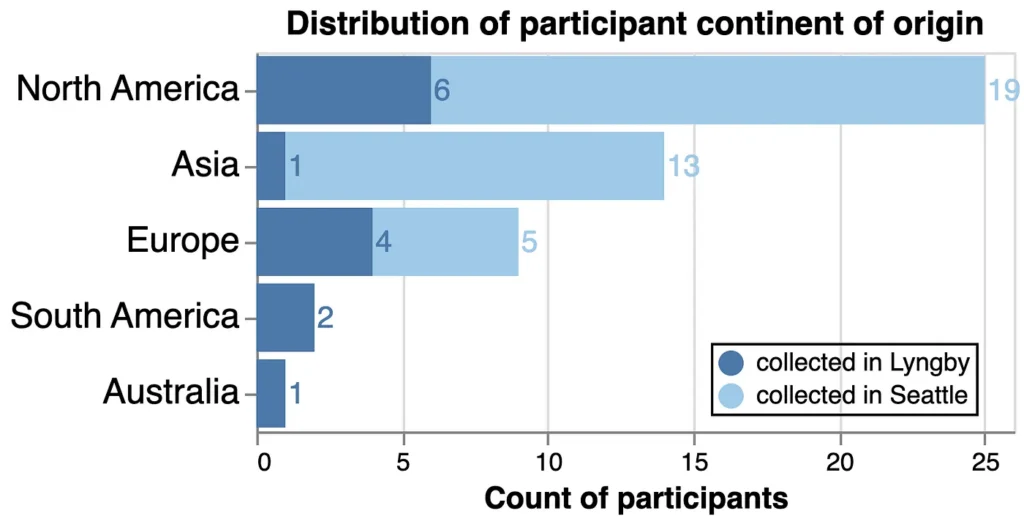

Experiments were conducted at two main time points. The first 14 participants were tested in Lyngby, Denmark in August 2022. They mostly consisted of friends and housemates the author met at the Novo Nordisk Foundation Center for Biosustainability at the Technical University of Denmark (DTU) who came to a “going away party” into which the experimental procedure was inserted. A few additional friends and family who visited Denmark were also tested during their travels (e.g. on the train).

The remaining 37 participants were tested in Seattle, WA, USA in October 2022, primarily during a “TGIF happy hour” hosted by graduate students in the computer science PhD program at the University of Washington. This second batch mostly consisted of students and staff of the Paul. G. Allen School of Computer Science & Engineering (UW CSE) who responded to the weekly Friday summoning to the Allen Center atrium for free snacks and drinks.

While this study set out to analyze global trends, unfortunately data was only collected from 51 participants the author was able to lure to the study sites and is not well-balanced nor representative of the 6 inhabited continents of Earth (Figure 1). We hope to improve our recruitment tactics in future work. For now, our analytical power with this dataset is limited to response trends for individuals from North America, Europe, and Asia, highly biased by subcommunities the author happened to engage with in late 2022.

2.3 Risks

While we did not acquire formal approval for experimentation with human test subjects, there were minor risks associated with this experiment: participants were warned that they may be subjected to increased levels of sugar and possible “unpleasant flavors” as a result of participating in this study. No other risks were anticipated.

After the experiment however, we unfortunately observed several cases of deflated pride when a participant learned their taste response was skewed more positively towards the M&M type they were not expecting. This pride deflation seemed most severe among European participants who learned their own or their fiancé’s preference skewed towards USA M&Ms, though this was not quantitatively measured and cannot be confirmed beyond anecdotal evidence.

3. Results & Discussion

3.1 Overall response to “USA M&Ms” vs “Denmark M&Ms”

3.1.1 Categorical response analysis — entire dataset

In our first analysis, we count the total number of “Bad”, “Normal”, and “Good” taste responses and report the percentage of each response received by each M&M type. M&Ms from Denmark more frequently received “Good” responses than USA M&Ms but also more frequently received “Bad” responses. M&Ms from the USA were most frequently reported to taste “Normal” (Figure 2). This may result from the elevated number of participants hailing from North America, where the USA M&M is the default and thus more “Normal,” while the Denmark M&M was more often perceived as better or worse than the baseline.

Figure 2. Qualitative taste response distribution across the whole dataset. The percentage of taste responses for “Bad”, “Normal” or “Good” was calculated for each type of M&M. Figure made with Altair.

Now let’s break out some Statistics, such as a chi-squared (X2) test to compare our observed distributions of categorical taste responses. Using the scipy.stats chi2_contingency function, we built contingency tables of the observed counts of “Good,” “Normal,” and “Bad” responses to each M&M type. Using the X2 test to evaluate the null hypothesis that there is no difference between the two M&Ms, we found the p-value for the test statistic to be 0.0185, which is significant at the common p-value cut off of 0.05, but not at 0.01. So a solid “maybe,” depending on whether you’d like this result to be significant or not.

3.1.2 Quantitative response analysis — entire dataset.

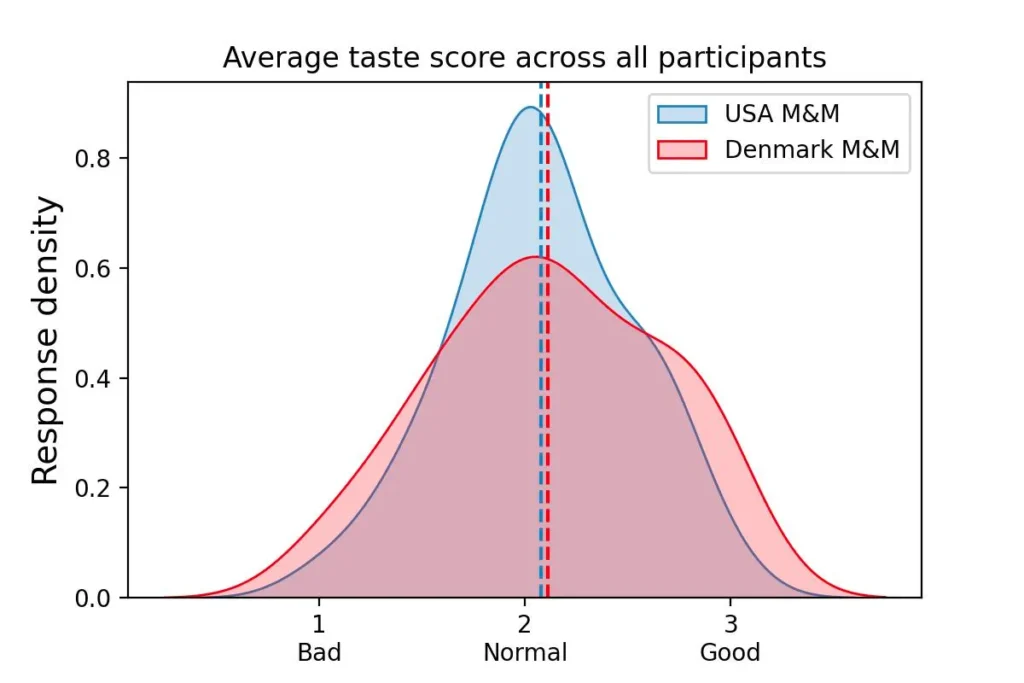

The X2 test helps evaluate if there is a difference in categorical responses, but next, we want to determine a relative taste ranking between the two M&M types. To do this, we converted taste responses to a quantitative distribution and calculated a taste score. Briefly, “Bad” = 1, “Normal” = 2, “Good” = 3. For each participant, we averaged the taste scores across the 5 M&Ms they tasted of each type, maintaining separate taste scores for each M&M type.

With the average taste score for each M&M type in hand, we turn to scipy.stats ttest_ind (“T-test”) to evaluate if the means of the USA and Denmark M&M taste scores are different (the null hypothesis being that the means are identical). If the means are significantly different, it would provide evidence that one M&M is perceived as significantly tastier than the other.

We found the average taste scores for USA M&Ms and Denmark M&Ms to be quite close (Figure 3), and not significantly different (T-test: p = 0.721). Thus, across all participants, we do not observe a difference between the perceived taste of the two M&M types (or if you enjoy parsing triple negatives: “we cannot reject the null hypothesis that there is not a difference”).

But does this change if we separate participants by continent of origin?

3.2 Continent-specific responses to “USA M&Ms” vs “Denmark M&Ms”

We repeated the above X2 and T-test analyses after grouping participants by their continents of origin. The Australia and South America groups were combined as a minimal attempt to preserve data privacy. Due to the relatively small sample size of even the combined Australia/South America group (n=3), we will refrain from analyzing trends for this group but include the data in several figures for completeness and enjoyment of the participants who may eventually read this.

3.2.1 Categorical response analysis — by continent

In Figure 4, we display both the taste response counts (upper panel, note the interactive legend) and the response percentages (lower panel) for each continent group. Both North America and Asia follow a similar trend to the whole population dataset: participants report Denmark M&Ms as “Good” more frequently than USA M&Ms, but also report Denmark M&Ms as “Bad” more frequently. USA M&Ms were most frequently reported as “Normal” (Figure 4).

On the contrary, European participants report USA M&Ms as “Bad” nearly 50% of the time and “Good” only 18% of the time, which is the most negative and least positive response pattern, respectively (when excluding the under-sampled Australia/South America group).

Figure 4. Qualitative taste response distribution by continent. Upper panel: counts of taste responses — click the legend to interactively filter! Lower panel: percentage of taste responses for each type of M&M. Figure made with Altair.

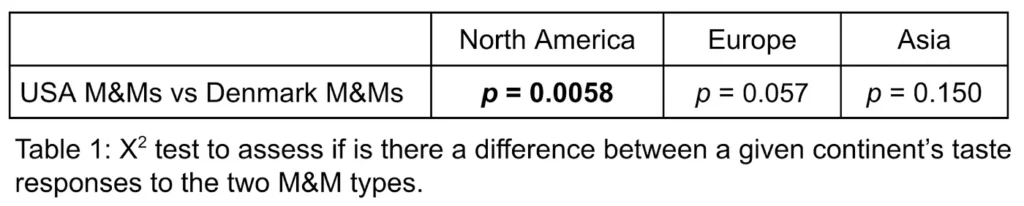

This appeared striking in bar chart form, however only North America had a significant X2 p-value (p = 0.0058) when evaluating each continent’s difference in taste response profile between the two M&M types. The European p-value is perhaps “approaching significance” in some circles, but we’re about to accumulate several more hypothesis tests and should be mindful of multiple hypothesis testing (Table 1). A false positive result here would be devastating.

When comparing the taste response profiles between two continents for the same M&M type, there are a couple interesting notes. First, we observed no major taste discrepancies between all pairs of continents when evaluating Denmark M&Ms — the world seems generally consistent in their range of feelings about M&Ms sourced from Europe (right column X2 p-values, Table 2). To visualize this comparison more easily, we reorganize the bars in Figure 4 to group them by M&M type (Figure 5).

Figure 5. Qualitative taste response distribution by M&M type, reported as percentages. (Same data as Figure 4 but re-arranged). Figure made with Altair.

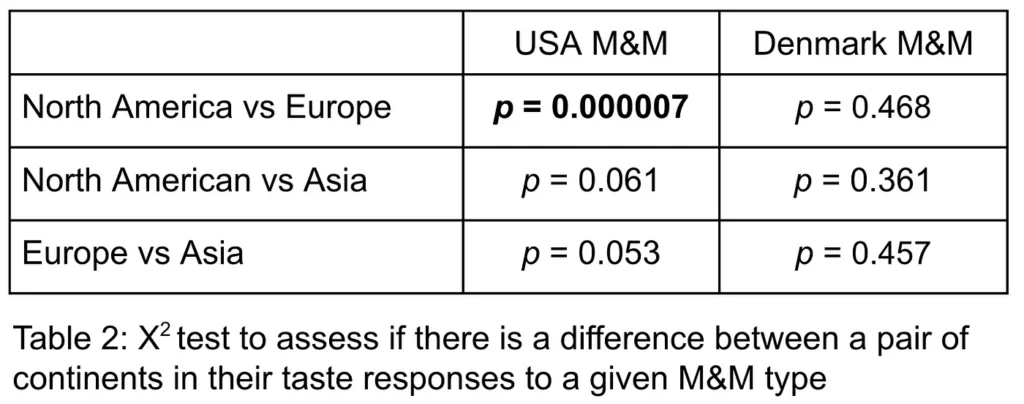

However, when comparing continents to each other in response to USA M&Ms, we see larger discrepancies. We found one pairing to be significantly different: European and North American participants evaluated USA M&Ms very differently (p = 0.000007) (Table 2). It seems very unlikely that this observed difference is by random chance (left column, Table 2).

3.2.2 Quantitative response analysis — by continent

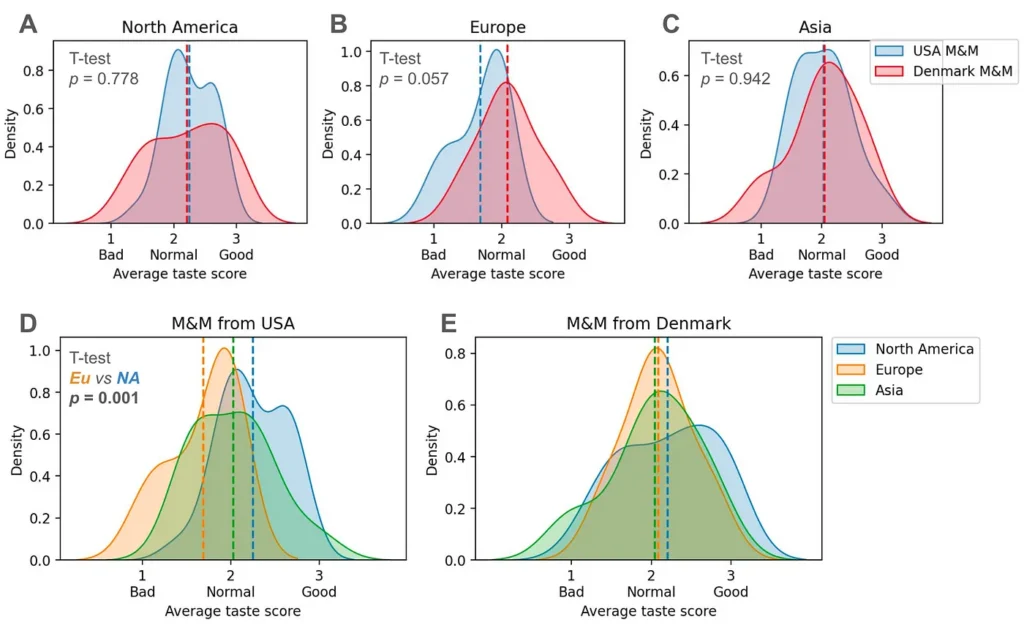

We again convert the categorical profiles to quantitative distributions to assess continents’ relative preference of M&M types. For North America, we see that the taste score means of the two M&M types are actually quite similar, but there is a higher density around “Normal” scores for USA M&Ms (Figure 6A). The European distributions maintain a bit more of a separation in their means (though not quite significantly so), with USA M&Ms scoring lower (Figure 6B). The taste score distributions of Asian participants is most similar (Figure 6C).

Reorienting to compare the quantitative means between continents’ taste scores for the same M&M type, only the comparison between North American and European participants on USA M&Ms is significantly different based on a T-test (p = 0.001) (Figure 6D), though now we really are in danger of multiple hypothesis testing! Be cautious if you are taking this analysis at all seriously.

At this point, I feel myself considering that maybe Europeans are not just making this up. I’m not saying it’s as dramatic as some of them claim, but perhaps a difference does indeed exist… To some degree, North American participants also perceive a difference, but the evaluation of Europe-sourced M&Ms is not consistently positive or negative.

3.3 M&M taste alignment chart

In our analyses thus far, we did not account for the baseline differences in M&M appreciation between participants. For example, say Person 1 scored all Denmark M&Ms as “Good” and all USA M&Ms as “Normal”, while Person 2 scored all Denmark M&Ms as “Normal” and all USA M&Ms as “Bad.” They would have the same relative preference for Denmark M&Ms over USA M&Ms, but Person 2 perhaps just does not enjoy M&Ms as much as Person 1, and the relative preference signal is muddled by averaging the raw scores.

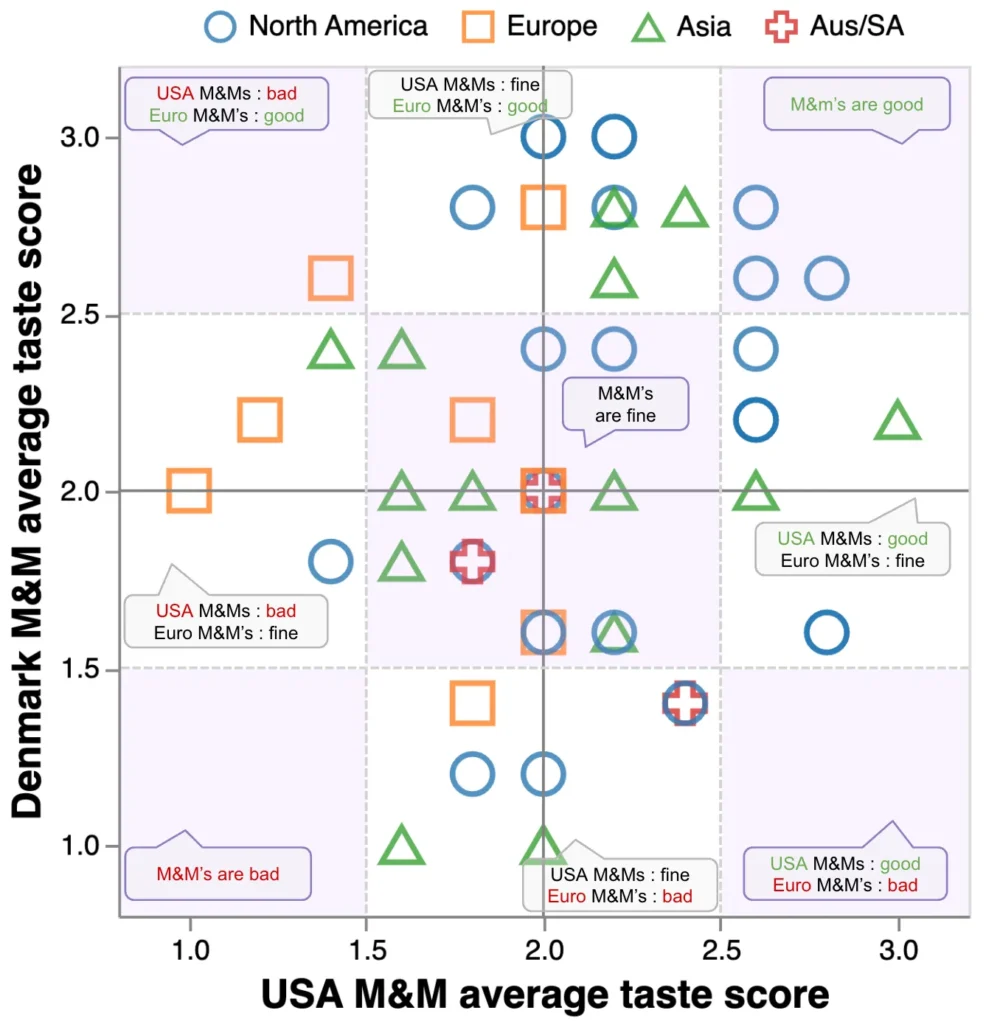

Inspired by the Lawful/Chaotic x Good/Evil alignment chart used in tabletop role playing games like Dungeons & Dragons©™, in Figure 7, we establish an M&M alignment chart to help determine the distribution of participants across M&M enjoyment classes.

Notably, the upper right quadrant where both M&M types are perceived as “Good” to “Normal” is mostly occupied by North American participants and a few Asian participants. All European participants land in the left half of the figure where USA M&Ms are “Normal” to “Bad”, but Europeans are somewhat split between the upper and lower halves, where perceptions of Denmark M&Ms range from “Good” to “Bad.”

An interactive version of Figure 7 is provided below for the reader to explore the counts of various M&M alignment regions.

Figure 7 (interactive): click and brush your mouse over the scatter plot to see the counts of continents in different M&M enjoyment regions. Figure made with Altair.

3.4 Participant taste response ratio

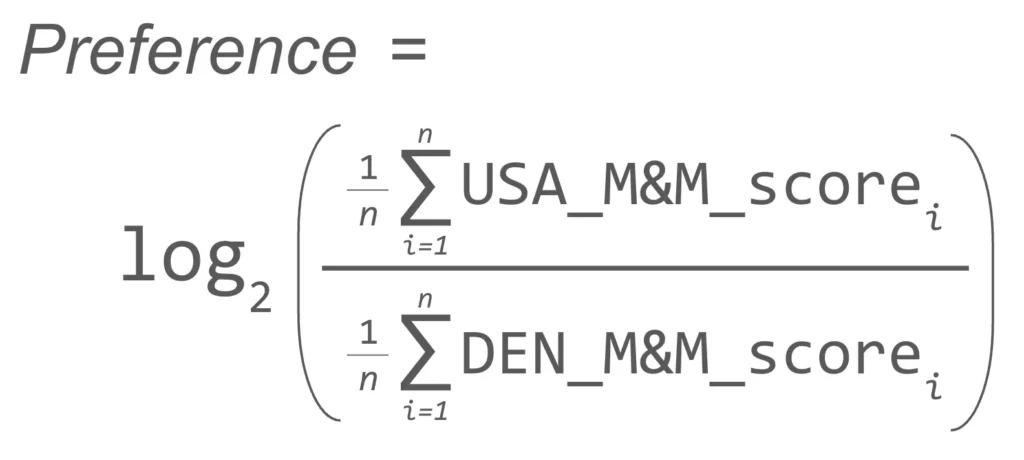

Next, to factor out baseline M&M enjoyment and focus on participants’ relative preference between the two M&M types, we took the log ratio of each person’s USA M&M taste score average divided by their Denmark M&M taste score average.

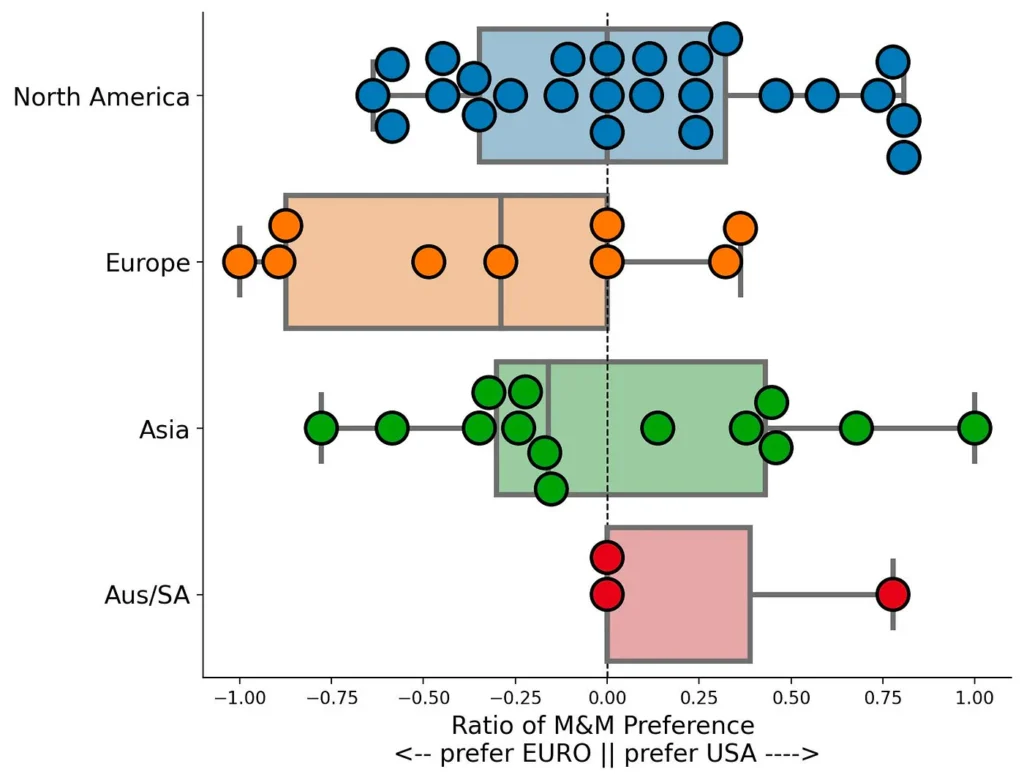

As such, positive scores indicate a preference towards USA M&Ms while negative scores indicate a preference towards Denmark M&Ms.

On average, European participants had the strongest preference towards Denmark M&Ms, with Asians also exhibiting a slight preference towards Denmark M&Ms (Figure 8). To the two Europeans who exhibited deflated pride upon learning their slight preference towards USA M&Ms, fear not: you did not think USA M&Ms were “Good,” but simply ranked them as less bad than Denmark M&Ms (see participant_id 4 and 17 in the interactive version of Figure 7). If you assert that M&Ms are a bad American invention not worth replicating and return to consuming artisanal European chocolate, your honor can likely be restored.

North American participants are pretty split in their preference ratios: some fall quite neutrally around 0, others strongly prefer the familiar USA M&M, while a handful moderately prefer Denmark M&Ms. Anecdotally, North Americans who learned their preference skewed towards European M&Ms displayed signals of inflated pride, as if their results signaled posh refinement.

Overall, a T-test comparing the distributions of M&M preference ratios shows a possibly significant difference in the means between European and North American participants (p = 0.049), but come on, this is like the 20th p-value I’ve reported — this one is probably too close to call.

3.5 Taste inconsistency and “Perfect Classifiers”

For each participant, we assessed their taste score consistency by averaging the standard deviations of their responses to each M&M type, and plotting that against their preference ratio (Figure 9).

Figure 9. Participant taste consistency by preference ratio. The x-axis is a participant’s relative M&M preference ratio. The y-axis is the average of the standard deviation of their USA M&M scores and the standard deviation of their Denmark M&M scores. A value of 0 on the y-axis indicates perfect consistency in responses, while higher values indicate more inconsistent responses. Figure made with Altair.

Most participants were somewhat inconsistent in their ratings, ranking the same M&M type differently across the 5 samples. This would be expected if the taste difference between European-sourced and American-sourced M&Ms is not actually all that perceptible. Most inconsistent were participants who gave the same M&M type “Good”, “Normal”, and “Bad” responses (e.g., points high on the y-axis, with wider standard deviations of taste scores), indicating lower taste perception abilities.

Intriguingly, four participants — one from each continent group — were perfectly consistent: they reported the same taste response for each of the 5 M&Ms from each M&M type, resulting in an average standard deviation of 0.0 (bottom of Figure 9). Excluding the one of the four who simply rated all 10 M&Ms as “Normal”, the other three appeared to be “Perfect Classifiers” — either rating all M&Ms of one type “Good” and the other “Normal”, or rating all M&Ms of one type “Normal” and the other “Bad.” Perhaps these folks are “super tasters.”

3.6 M&M color

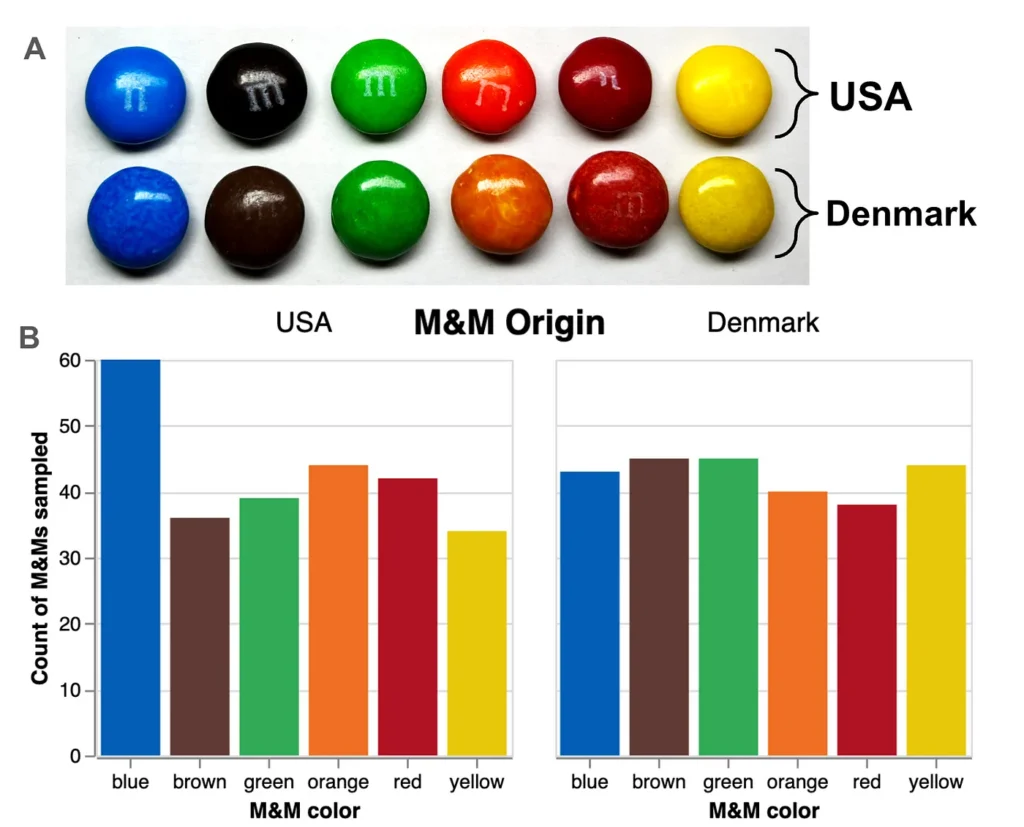

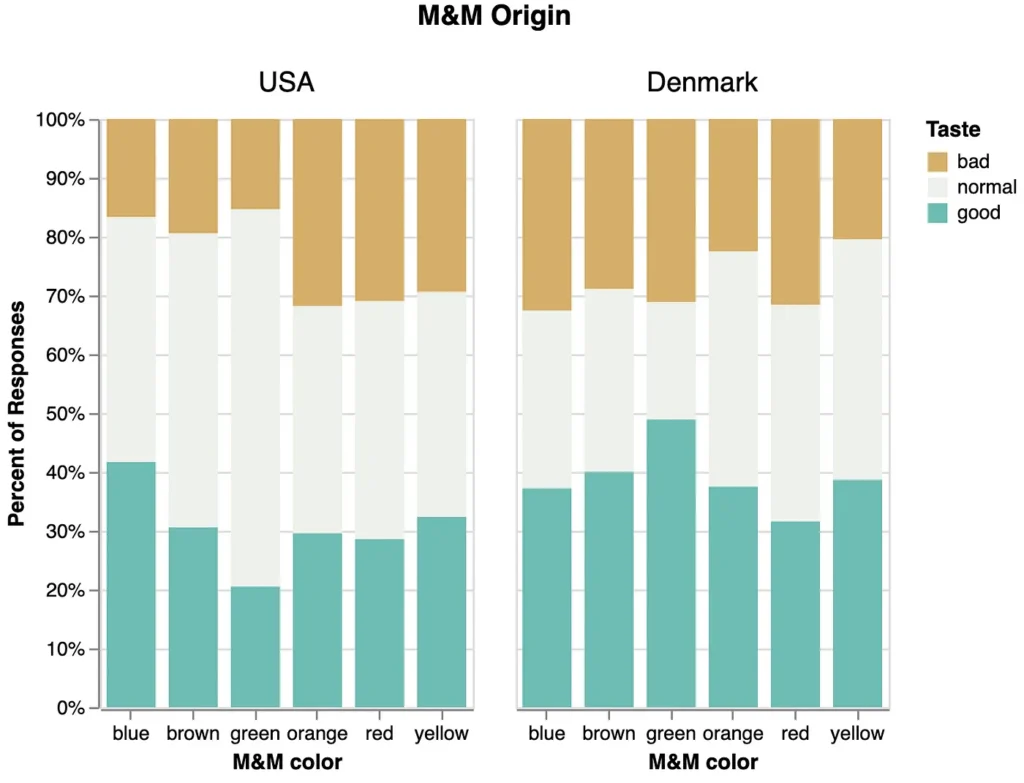

Another possible explanation for the inconsistency in individual taste responses is that there exists a perceptible taste difference based on the M&M color. Visually, the USA M&Ms were noticeably more smooth and vibrant than the Denmark M&Ms, which were somewhat more “splotchy” in appearance (Figure 10A). M&M color was recorded during the experiment, and although balanced sampling was not formally built into the experimental design, colors seemed to be sampled roughly evenly, with the exception of Blue USA M&Ms, which were oversampled (Figure 10B).

We briefly visualized possible differences in taste responses based on color (Figure 11), however we do not believe there are enough data to support firm conclusions. After all, on average each participant would likely only taste 5 of the 6 M&M colors once, and 1 color not at all. We leave further M&M color investigations to future work.

3.7 Colorful commentary

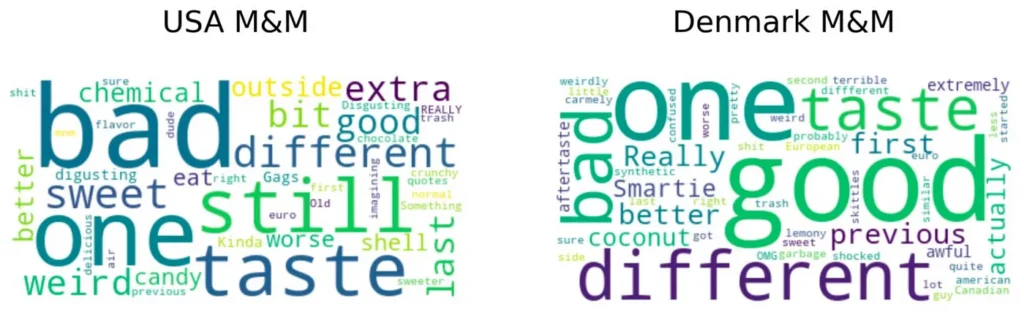

We assured each participant that there was no “right “answer” in this experiment and that all feelings are valid. While some participants took this to heart and occasionally spent over a minute deeply savoring each M&M and evaluating it as if they were a sommelier, many participants seemed to view the experiment as a competition (which occasionally led to deflated or inflated pride). Experimenters wrote down quotes and notes in conjunction with M&M responses, some of which were a bit “colorful.” We provide a hastily rendered word cloud for each M&M type for entertainment purposes (Figure 12) though we caution against reading too far into them without diligent sentiment analysis.

4. Conclusion

Overall, there does not appear to be a “global consensus” that European M&Ms are better than American M&Ms. However, European participants tended to more strongly express negative reactions to USA M&Ms while North American participants seemed relatively split on whether they preferred M&Ms sourced from the USA vs from Europe. The preference trends of Asian participants often fell somewhere between the North Americans and Europeans.

Therefore, I’ll admit that it’s probable that Europeans are not engaged in a grand coordinated lie about M&Ms. The skew of most European participants towards Denmark M&Ms is compelling, especially since I was the experimenter who personally collected much of the taste response data. If they found a way to cheat, it was done well enough to exceed my own passive perception such that I didn’t notice. However, based on this study, it would appear that a strongly negative “vomit flavor” is not universally perceived and does not become apparent to non-Europeans when tasting both M&Ms types side by side.

We hope this study has been illuminating! We would look forward to extensions of this work with improved participant sampling, additional M&M types sourced from other continents, and deeper investigations into possible taste differences due to color.

Thank you to everyone who participated and ate M&Ms in the name of science!

Figures and analysis can be found on github: https://github.com/erinhwilson/mnm-taste-test

Article by Erin H. Wilson, Ph.D.[1,2,3] who decided the time between defending her dissertation and starting her next job would be best spent on this highly valuable analysis. Hopefully it is clear that this article is intended to be comedic— I do not actually harbor any negative feelings towards Europeans who don’t like American M&Ms, but enjoyed the chance to be sassy and poke fun at our lively debates with overly-enthusiastic data analysis.

Shout out to Matt, Galen, Ameya, and Gian-Marco for assisting in data collection!

[1] Former Ph.D. student in the Paul G. Allen School of Computer Science and Engineering at the University of Washington

[2] Former visiting Ph.D. student at the Novo Nordisk Foundation Center for Biosustainability at the Technical University of Denmark

[3] Future data scientist at LanzaTech