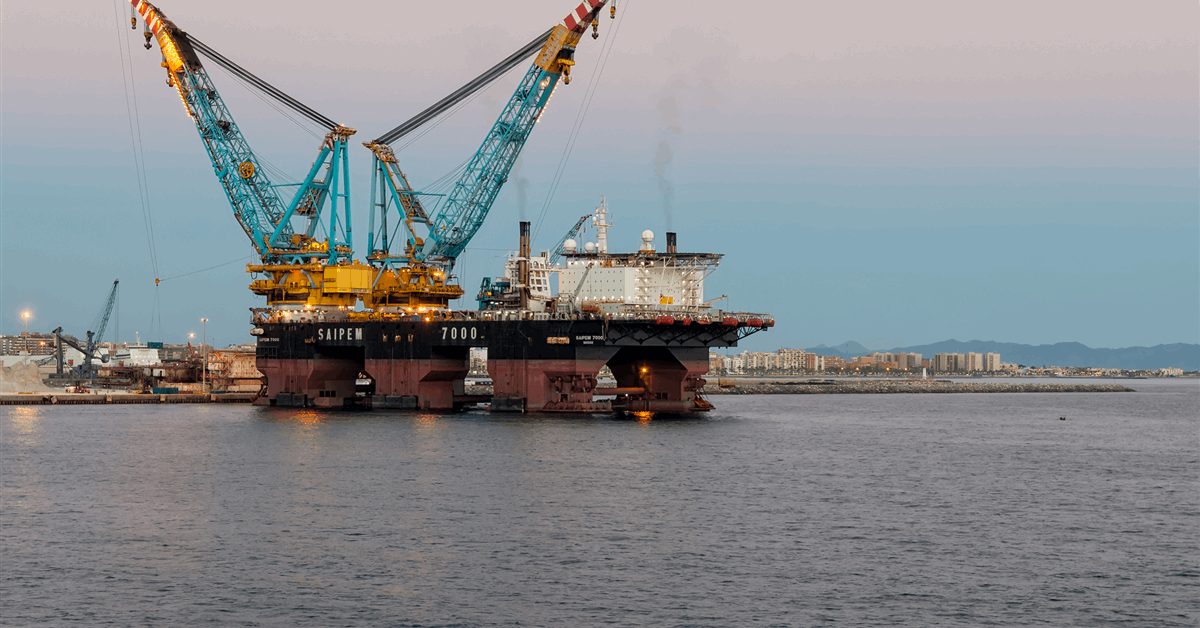

Saipem SpA on Tuesday reported EUR 306 million ($321.08 million) in net profit and EUR 14.55 billion in revenue for 2024, up 70.9 percent and 22.5 percent respectively compared to 2023.

The revenue increase was driven by higher volumes in Saipem’s asset-based services and energy carriers, as well as the deployment of new rigs in its offshore drilling business, according to results published online by the Italian state-backed energy engineering company.

Revenue from asset-based services rose 32.8 percent to EUR 8.06 billion thanks to higher volumes in Asia-Pacific, Europe, the Middle East and Sub-Saharan Africa. In the fourth quarter Saipem won oil and gas contracts from BP PLC in Indonesia, Shell PLC in Nigeria and TotalEnergies SE in Suriname, as well as a carbon storage contract from the Northern Endurance Partnership in the United Kingdom.

The energy carriers segment generated EUR 5.57 billion in revenue for 2024, up 10.1 percent “as an effect of the higher volumes in the Middle East, in Sub-Saharan Africa and in Italy”, Saipem said.

Offshore drilling posted EUR 918 million in revenue, up 23.6 percent “thanks to the contribution of the drilling vessel Deep Value Driller and the jack-ups Perro Negro 12 and Perro Negro 13, entered into operation during the financial year 2024”, Saipem said. “The improvement was partly offset by the lower contribution of the jack-ups Perro Negro 9 and Perro Negro 10, which were inactive for most of the year”.

Offshore drilling saw a reduced margin “due to the higher costs incurred to prepare the new vessels entering operations during 2024, as well as the temporary suspension of activities requested by the Client Saudi Aramco on some vessels”, Saipem said.

Order intake and backlog reached record highs of EUR 18.8 billion and EUR 34.26 billion respectively.

Earnings before interest, taxes, depreciation and amortization (EBITDA) totaled EUR 1.33 billion, up 43.5 percent from 2023. EBIT grew 38.7 percent to EUR 606 million. Free cash flow landed at EUR 757 million.

For the fourth quarter (Q4) Saipem reported EUR 100 million in net profit, the same as the corresponding three-month period in 2023. Q4 revenue climbed 25.9 percent year-on-year to EUR 4.42 billion. Q4 EBITDA increased 48.3 percent year-over-year to EUR 424 million. Q4 EBIT increased 42.1 percent year-on-year to EUR 189 million.

Saipem ended the year with negative working capital, registering -EUR 1.51 billion in net current assets. “In addition, with the aim of achieving an investment grade credit rating, Saipem commits to reduce gross debt (pre-IFRS 16) by approximately EUR 650 million by repaying all maturities due in the 2025-2027 period”, it said.

The board upgraded the company’s shareholder remuneration policy to at least 40 percent of free cash flow post-repayment of lease liabilities. For 2024, Saipem plans to distribute EUR 333 million in dividends.

Saipem unveiled a four-year plan that targets EUR 15 billion in revenue for 2028. The 2025-28 plan aims to maintain at least EUR 1 billion in available cash. It did not specify whether the targets account for its planned acquisition of Subsea7 SA.

On Sunday it said it has struck an agreement in principle on the key terms of a potential merger with Luxembourg-registered Subsea7, which would result in a company called Saipem7.

Saipem and Subsea7 plan to enter into a merger agreement mid-2025. The transaction is expected to close in the second half of 2026.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR