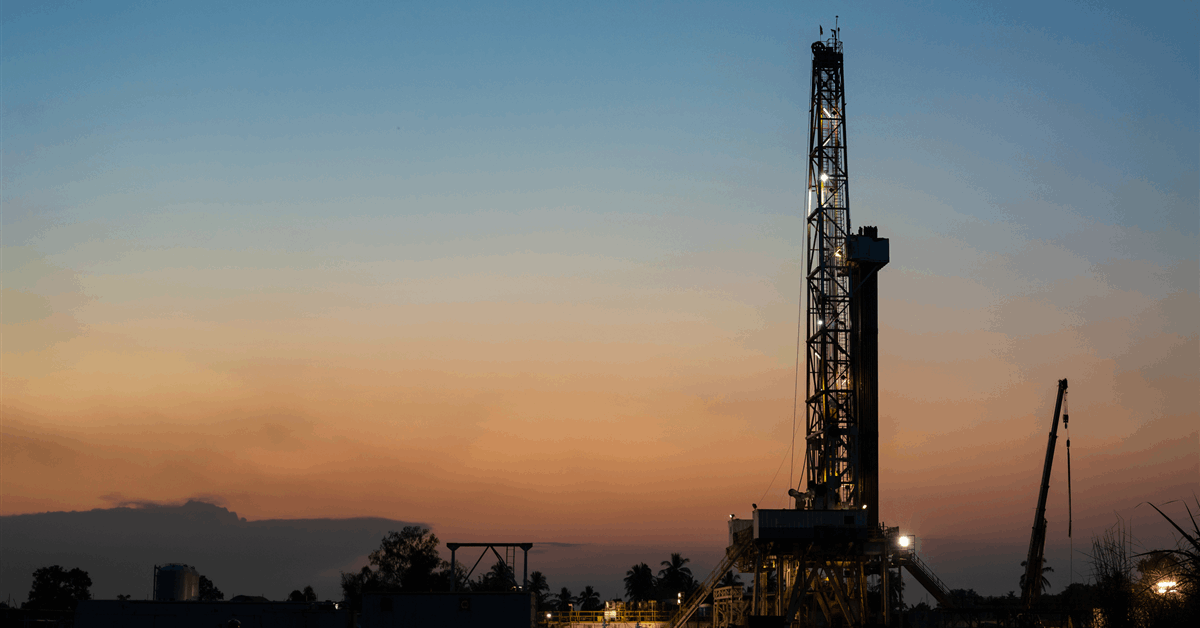

Vancouver, British Columbia-based Black Gold Exploration Corp. said drilling activities have started on the Fritz 2-30 oil and gas well in Clay County, Indiana.

Earlier this month, BGX acquired a 10 percent working interest in the well and an option to participate in any offset developmental wells in a 210-acre area of mutual interest from the operator, Adler Energy LLC.

Black Gold said in a new release that the prospect “offsets the Fritz 1 well”. The Fritz well was drilled around 17 years ago and discovered both oil and gas pay horizons, but never produced due to a variety of factors, including a drop in oil prices at the time, the company stated.

The Fritz 2-30 well is in a known productive oil zone known as the Terra Haute Reef Bank, in southwestern Indiana, according to the company.

“We believe that the drilling in this region is the Company’s most significant short-term milestone to date and we are delighted to have the opportunity to participate in the Well, which not only gives us the potential for early cash flow but is also aligned with our longer-term plan to expand our footprint in the Illinois Basin,” Black Gold CEO Francisco Gulisano said.

The Illinois Basin has a history of producing 10 to 12 million barrels of oil annually, the company said.

Adler Energy completed a 3D seismic evaluation of 8 square miles of the area, including the Fritz 2-30, showing both shallow and deeper stacked pay horizons. The Well plans to test a minimum of ten potential oil pay zones, according to the release.

“Based on the 3D seismic and other data we have compiled, our experienced technical team could not be more excited about the Fritz 2-30 well and we are very happy to be working with BGX in discovering what we believe is tremendous untapped value,” Adler Energy President John Miller said.

“Given the history of the Fritz wells, we are looking to take advantage of overlooked opportunities to hopefully not only jump start our cash flows but also unlock value in one of the oldest and most productive oil basins in North American history,” Gulisano said.

In January, Black Gold entered into a purchase and sale agreement with LGX Energy Holdings, parent company of Adler Energy, to participate in the development of the Fritz 2-30 well. Black Gold said in an earlier statement it expects to commit an initial investment of $105,000 for the well and estimates incurring additional costs of approximately $50,000 towards commissioning the well.

Black Gold Exploration Corp holds a 95 percent interest in the El Carmen hydrocarbon project in the Chubut province of Argentina, about 7 kilometers from the Atlantic coast, according to the company’s website.

The San Jorge Basin ranks second of the five producing basins in Argentina and has proven oil reserves of about 5.65 billion cubic feet (160 million cubic meters), the company said.

Black Gold notes that only 35 percent of the basin has been estimated to be fully explored, and that its current oil reserves can potentially be nearly doubled. The immediate area of El Carmen is a prolific oil and gas producer with highly developed infrastructure, the company said.

The company said it seeks to option El Carmen to an established oil exploration company, preferably one operating in Argentina.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR