UK Oil & Gas (UKOG) has struck deals with Portland Port to drive the development of its South Dorset hydrogen project.

UKOG’s subsidiary UK Energy Storage (UKEn) executed two memorandums of understanding (MoU) with the port, the first covering imports of green hydrogen carrier fluids and compressed hydrogen into the port and sending gas to the storage site.

The second covers generating green hydrogen via electrolysis within Portland Port by using excess wind power and using the hydrogen to generate power to cover South Dorset’s initial power needs.

UKOG added that it has identified and opened preliminary dialogue with potential suppliers of both liquid and gaseous green hydrogen.

According to UKEn, the potential to source green hydrogen supplies, along with converting excess wind power to hydrogen for storage, will strengthen its case for the award of government revenue support.

UKOG chief executive Stephen Sanderson commented: “The addition of a potential material source of green hydrogen, directly linked to UKEn’s South Dorset storage site, would both enhance our project’s national significance and the prospects of UKEn securing revenue support in the government’s forthcoming Hydrogen Storage procurement process.

“The revenue support case would likely be further strengthened by the future potential for UKEn’s proposed at scale hydrogen battery allied to planned offshore Dorset wind power.”

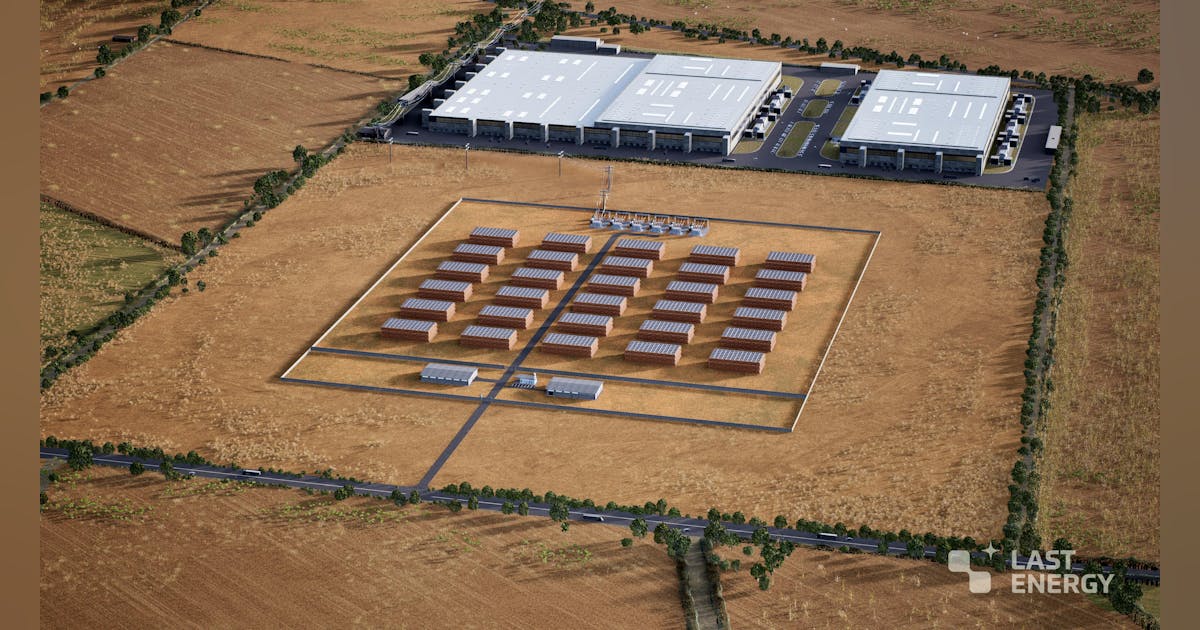

The UKOG boss added that the development of “one of the UK’s largest future green energy and hydrogen hubs” makes sense for the region as it stands to be “the UK’s largest hydrogen demand area by 2040.”

The South Dorset project will consist of 24 salt caverns around 4,265 feet below ground. It will have the capacity to store around a billion cubic meters (bcm) of hydrogen, equivalent to 30.2TWh per year.

In addition, the site is located near the Solent Cluster, with the planned H2Connect hydrogen trunk pipeline connecting it to the UK hydrogen transmission pipeline system and hydrogen clusters in the South, East Coast and Northwest.

UKEn previously struck an agreement with Portland Port to lease two sites at the former Royal Navy port in 2022.

The group recently brought in £400,000 of funding for the project. In addition, Japanese conglomerate Sumitomo and Germany’s RWE have voiced their support for the project.

Developing the South Dorset site comes with an estimated £800m price tag.UKOG expects to see construction underway by 2030, with the first caverns operational between 2030 and 2032.

Recommended for you

Climate groups back North Sea clean power overhaul