The trade in fossil fuels across borders peaked in 2017 and is set to decline as nations seeking energy security accelerate investments in renewable and nuclear power, Carlyle Group Inc.’s Jeff Currie wrote in a research note Monday.

Conversations about peak oil supply and demand have for decades served as a backdrop to energy markets, and the transition from fossil fuels to renewables is top of mind this week as industry leaders descend on the so-called energy capital of the world, Houston, for the annual CERAWeek by S&P Global conference.

Currie doesn’t expect fossil fuels to disappear anytime soon, but he said the world is seeing “Peak Oil Trade.” Fossil fuels are convenient, but their transport is increasingly vulnerable — President Donald Trump’s trade wars being one recent example — and that will push countries to reduce oil and gas imports and invest in renewable sources of energy where possible, Currie said.

“The share of global energy consumption that came from fossil fuels that crossed borders peaked in 2017, and has since declined by 5%,” Currie wrote in the research piece outlining what he calls the “New Joule Order,” where security of energy supply is the paramount concern as demand continues to grow.

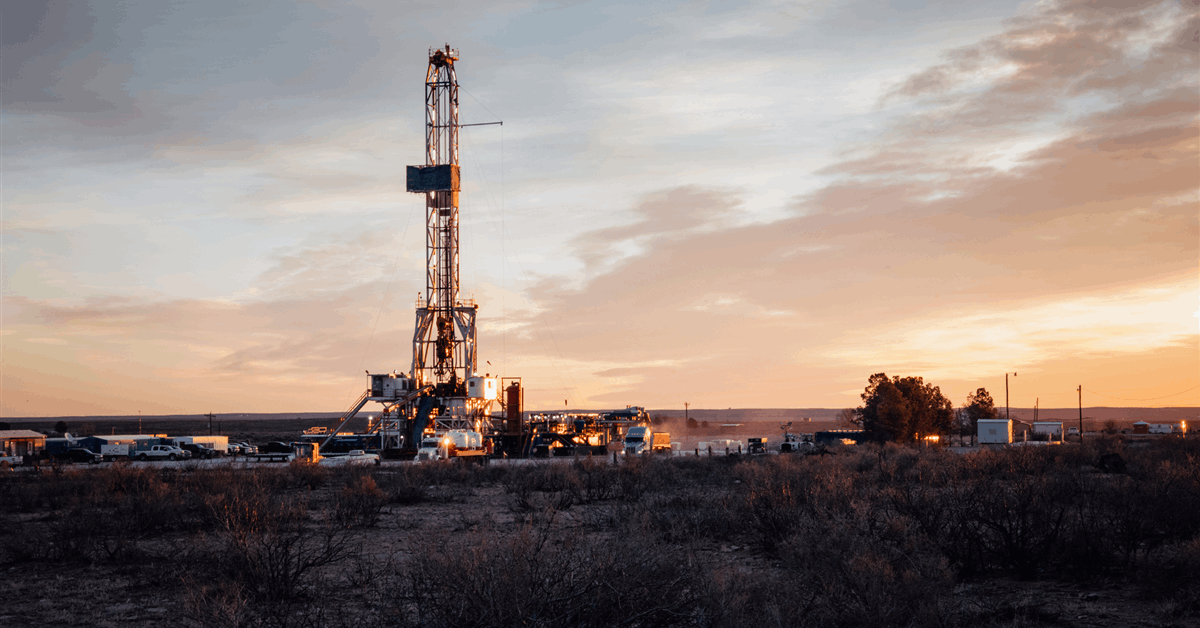

Looming large over global trade security is the US, who through technology advancements in oil extraction during the shale revolution became a net oil exporter and less reliant on foreign supply.

“The world’s protector of global trade no longer has an incentive to protect global trade,” Currie told Bloomberg in an interview Saturday.

While the oil and gas trade isn’t going away, fossil fuel imports are easier to block than wind and solar sources, Currie writes in the research note. As countries shift to more localized sources of energy, the subsequent reduction in trade will lead to slower oil and gas demand. But the US energy mix is likely to remain skewed toward fossil fuels given the country’s abundant domestic supply.

Another topic that will loom large over conversations this week in Houston is the energy demand spurred by artificial intelligence and the subsequent need to feed power-hungry data centers. Currie sees AI as the latest in a century-long, linear trend of electrification spurring energy demand, and even though AI is now “too big to ignore,” taking up a bigger share of the energy demand mix, it has done little to accelerate demand growth.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg