Royal Vopak said it has committed an additional $1.09 billion (EUR 1 billion) by 2030 to grow its gas and industrial footprint, “given the positive outlook and market demand for infrastructure”.

Majority of the Rotterdam, Netherlands-based company’s investments have been in gas infrastructure, as well as growth markets like India and China. The additional investments will be underpinned by customer commitments, it said.

The company’s total investments in gas and industrial infrastructure by 2030 are expected to be around $2.18 billion (EUR 2 billion), it noted.

Vopak said it aims to invest in attractive and accretive growth projects in gas, industrial and energy transition infrastructure that support a portfolio operating cash return of above 13 percent.

Further, the company said its ambition to invest $1.09 billion (EUR 1 billion) in energy transition infrastructure by 2030 remains unchanged. It plans to focus on infrastructure solutions for low-carbon fuels and sustainable feedstocks, ammonia as a hydrogen carrier, liquid carbon dioxide (CO2), and battery energy storage. Part of the company’s ambition to invest in energy transition infrastructure is to repurpose a portion of the existing oil capacity in the hub locations for low carbon fuels and feedstocks, it said.

FID on Thailand Tank Infrastructure Project

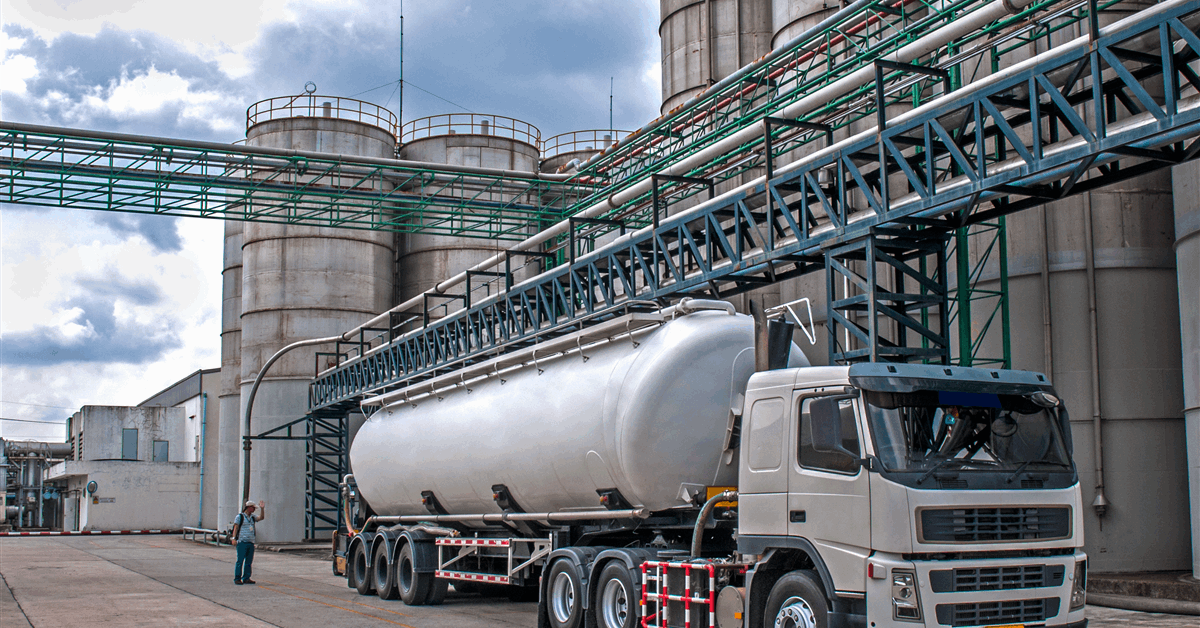

Meanwhile, Vopak said it has reached a positive final investment to construct 160,000 cubic-meter tank infrastructure in Map Ta Phut, Rayong, to support the import of U.S. ethane into Thailand.

Vopak’s joint venture entity Thai Tank Terminal signed a 15-year contract with PTT Global Chemical Public Company Limited (GC) for the storage and handling of ethane in Thailand, it said in a separate news release.

The tank infrastructure project is backed by a long-term contract and is expected to be completed in 2029, according to the release.

Ethane will serve as a long-term feedstock supply for petrochemical crackers, “enhancing cost competitiveness, feedstock security and reinforcing Thailand’s leadership position in the global chemical industry,” the company said.

As part of Vopak’s investment strategy in Thailand, the company said it plans to allocate approximately $141.4 million (EUR 130 million) over the next four years related to storage and other infrastructure in the Map Ta Phut region. The investments are not related to any specific project and are expected to provide an accretive operating cash return upon commissioning, the company noted.

Thai Tank Terminal is a joint venture between GC, Gulf Energy Development Public Company Limited, and Vopak Holding International B.V. It provides storage and logistics infrastructure for liquid chemicals and gases, providing terminal operations at Map Ta Phut, Thailand’s largest industrial port. Vopak’s shareholding in Thai Tank Terminal is 35 percent, according to the release.

PTT Global Chemical Public Company describes itself as the PTT Group’s chemical flagship operation and has combined olefins and aromatics, together with refining of crude oil and condensate. GC is Thailand’s largest integrated petrochemical and refining business and a leading corporation in the Asia-Pacific region, both in size and product variety, it said.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR