Aberdeen’s OEG Group has been acquired by Apollo in a deal that values the group for more than $1 billion (£770m).

The US-based fund manager acquired a majority stake in the offshore energy services group from private-equity backer, Oaktree Capital Management, and other investors.

Although the size of the stake acquired was not revealed, Apollo said the transaction meant the group achieved a “headline valuation” of over $1bn, with Los Angeles-based Oaktree retaining a small stake.

Apollo, which manages funds worth over $750bn, gave up after making a number of attempts buy Aberdeen’s energy services firm Wood Group in 2023.

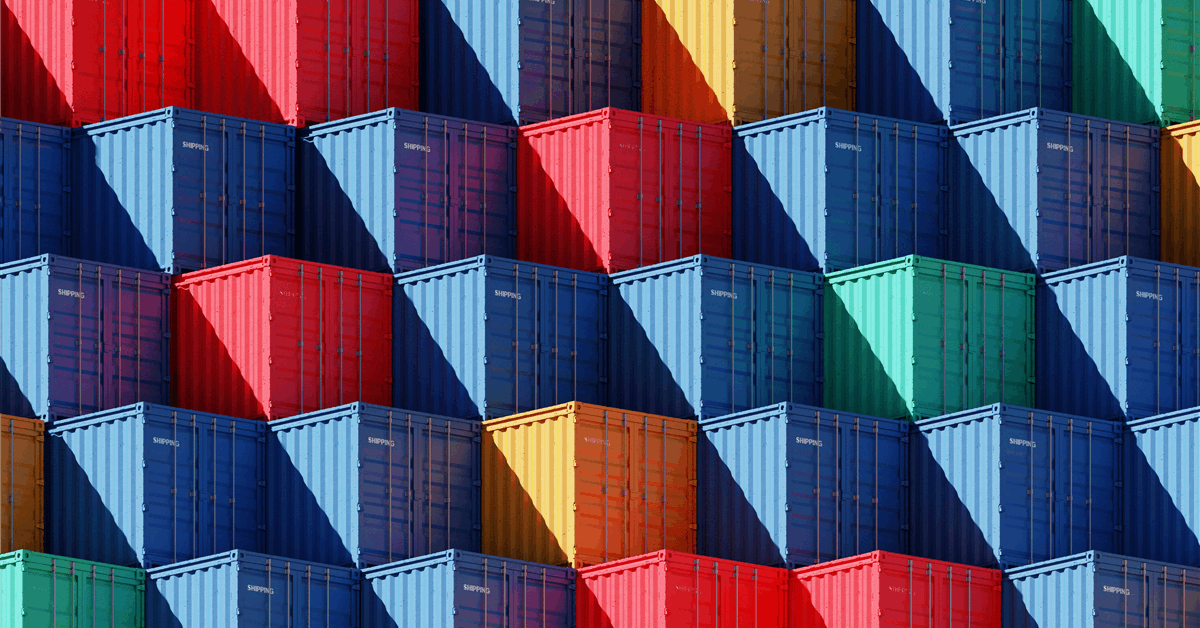

The firm, which has acquired OEG on behalf of fund investors, highlighted that OEG operates one of the world’s largest fleets of cargo carrying units (CCUs), with over 75,000 units handling cargo to and from offshore energy installations.

OEG launched its renewables division, largely targeting offshore wind, in 2021. At the end of 2024, OEG told Energy Voice it employs 1,300 people across 65 locations worldwide and was on track to deliver revenue in excess of £400 million this year for 2024, with the aim to achieve £800m turnover within the next five years.

Its heritage dates back to 1973, when it bought Ferguson Seacabs, which launched on the back of the first North Sea oil field, Argyll.

OEG chief executive John Heiton, CEO of OEG, said: “Since our company’s founding, we have worked hard to establish OEG as a global leader in delivering core services throughout the offshore energy value chain.

“As energy producers across Europe and around the globe continue to invest in the energy transition, we are committed to expanding and enhancing our capabilities as a key partner.

“We look forward to working with Apollo as we enter this new and exciting chapter for our business and remain focused on supporting our customers with the same quality service they have come to expect.”

Wilson Handler, partner at Apollo, said: “John and team have built OEG into a global leader and trusted provider of offshore equipment and services, with an integrated business model that has scaled across cycles.

“We see a tremendous opportunity to invest in the company’s future growth as secular tailwinds drive demand for services enabling efficient energy production and renewable power.

“Bringing to bear the scale of Apollo’s integrated platform and deep expertise in energy services, we look forward to working with the talented team at OEG to unlock value for its various stakeholders and loyal customer base via organic and inorganic channels.”

Francesco Giuliani, managing director and assistant portfolio manager in Oaktree’s Power Opportunities strategy, said: “We are proud of our partnership with the management team at OEG and the success achieved during Oaktree’s period of ownership.

“During that time, increased focus on the energy transition and global supply dynamics has made investment for core energy infrastructure even more important. We continue to have strong conviction in OEG’s growth trajectory and are thrilled to maintain a minority interest alongside Apollo funds.”

The transaction is expected to close in Q2 2025.