There are more energy projects awaiting final investment decisions (FIDs) in the UK now than there have been in decades, a trade body boss has warned.

While this represents a great deal of potential investment across oil and gas as well as carbon capture and storage (CCS), offshore wind and other clean energy schemes, it means development is also pent up with little to feed the UK supply chain until the commitment is made to unleash the cash.

Speaking at the annual Share Fair event, Dave Whitehouse, chief executive of the trade body Offshore Energies UK pointed to the firm’s latest research into supply chain sentiment, released ahead of the annual event in Aberdeen, which found almost all companies in the UK offshore energy supply chain are instead looking elsewhere around the world for work rather than in the UK.

© Supplied by OEUK

© Supplied by OEUK“Almost 90% of our supply chain members are seeing that their growth opportunities lie overseas,” he said.

“I think it’s good to explore their expertise. But the truth is we need to change that. We need to unlock more projects here in the UK, and that means more oil and gas projects alongside our wind, floating wind, carbon storage and hydrogen projects.”

He added: “What our members are saying is, actually a significant number of them are seeing less activity.

“But the truth is, when you when you look across the UK, you are seeing more projects which are in that pre-final investment decision than probably I’ve seen in my career. The opportunity now is, how do you unlock those? How do you how do we get those projects unlocked? How do we create the certainty that those projects start to move forward?”

‘Don’t get too excited’

OEUK has hosted Share Fair for over 20 years. Designed to forge relationships with North Sea oil and gas operators with the local supply chain, the focus has shifted dramatically in recent years.

BP had a big stand at the show where its partner Hydrasun, delivered the latest update on a pivotal green energy project. The Aberdeen Hydrogen Hub, a joint venture between BP and Aberdeen City Council, has recently done a deal to bring in a 2.5MW electrolyser.

In more traditional vein, there was also the likes of Ineos presenting an update on progress in the Pegasus Area Licenses. The gas field lies around 66 miles north-east of Flamborough Head on the North Yorkshire coast.

A presentation by Celtic Sea Power also attracted attention from the audience of contractors keen to bid for work in floating offshore wind.

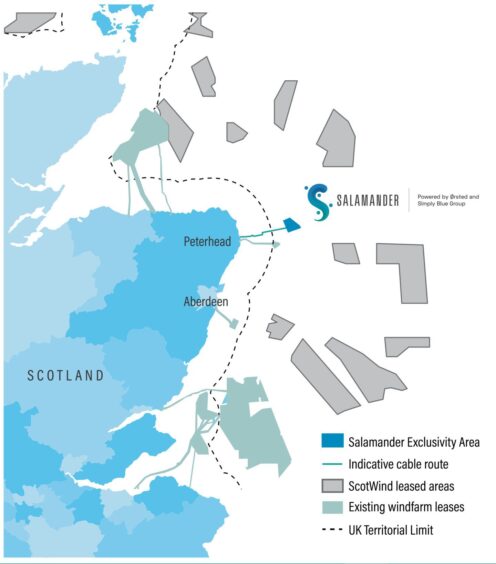

The company, owned by Cornwall Council, is supporting the development of 12GW of offshore wind off the coast of Wales and South West England and building supply chain involvement.

Celtic Sea Power business development manager Phil Johnston started his presentation by managing expectations.

He said: “I’ll explain the time frame as best I can. I wouldn’t get too excited. It’s going to be a long haul, but, you know, it’s a major, major market that’s opening up.”

The first to get a start in the region was a 32MW project being developed by Swedish firm Hexicon which won support from the UK government in the contracts for difference (CfD) funding round, AR4.

Others in the Celtic Sea hoping to land strike prices in this year’s AR7 round, which will enable developers to commit to investment, include Simply Blue and TotalEnergie’s 100MW Erebus project, Flotation Energy and Cobra’s 100 MW White Cross project and Floventis Energy’s 200MW Llyr project.

The latter recently changed hands after Dutch FPSO moorings giant SBM sold the Floventis portfolio to a small firm based in Fife, Cierco Energy.

“I don’t think it is any great secret the road to test demos is an easy one,” Johnston said.

© Supplied by Michal Wachucik/ OEU

© Supplied by Michal Wachucik/ OEUPresentations at Share Fair are slick and well executed. Delegates can tune into presentations running across three stages using silent disco-style headphones. Meanwhile there are desks set up for meetings between developers and suppliers arranged not unlike speed dates.

OEUK supply chain and people director Katy Heidenreich confirmed the event attracted 550 delegates to discuss what is happening over the next 12 to 18 months.

Unlocking investment

The next year may be thin on the ground but over the next five years, the prize could be huge.

OEUK estimates that the private sector is set to invest up to £110 billion in UK energy projects. This is largely split between oil and gas and offshore wind, with the extra £10bn aimed at CCS and hydrogen.

However in order for this magnitude of investment to be achieved several things have to come into place and most of these are currently sitting on UK government desks in the Treasury and the Department for Energy Security and Net Zero (DESNZ).

These include the outcome of DESNZ’s building the North Sea’s energy future consultation to address the UK’s fiscal regime, which the industry accuses of being a jobs killer.

This is in addition to the government’s expected guidance for oil and gas firms on environmental impact assessments regarding scope 3 emissions on which the fate of the multi-billion pound Rosebank and Jackdaw oil and gas fields await.

As well, it is also expected Chancellor Rachel Reeves could yet pull a rabbit out of the hat for Acorn, a track-2 CCS project, around her Spring statement on 26 March.

© Supplied by OEUK

© Supplied by OEUKHeidenreich said: “We are so incredibly fortunate that we still have a huge amount of resource under our North Sea.

“The Climate Change Committee have shown that between now and 2050 we are going to need around 13 billion barrels of oil.

“So 75% of our energy needs today are met by oil and gas, and we can meet around half of that from our own UK oil and gas resources, and we need to make the most of that.

“That is such a brilliant opportunity, not just for us to help with energy security and national security at home, but also, it’s the profits from that that help companies invest in new energies of the future.

“That’s the opportunity, and that’s what we need to make sure, working together with the government in partnership, with a competitive fiscal regime – the future of the North Sea consultation will set out the regulatory framework. The updated environmental impact assessment guidance will make sure projects are within the guidance that see those projects flow.

“Get the fiscal regime right. We get the regulatory framework right, and the opportunity is ours for the taking.”